9 Last Mile Delivery Trends You Won’t Want to Miss

According to the U.S. Census Bureau quarterly reports, both total retail eCommerce sales and eCommerce as a percentage of total sales rose steadily from 2022 through 2023. In the most recent report for Q3 2023, retail eCommerce sales increased 2.3% from quarter to quarter, reaching a total of $284.1 billion and accounting for 15.6% of total sales.

While eCommerce sales saw a massive spike due to the COVID-19 pandemic, the post-pandemic return to normal saw record-breaking year-over-year growth for offline stores. Thanks to inflation, eCommerce growth has slowed as customers found they had less to spend and so prioritized the experience of shopping at physical locations.

While it’s not looking like eCommerce will overtake physical retail just yet, eCommerce has cemented itself as a vital offering for retailers thanks to its cost-effective means of order fulfillment. Any company looking to get the most out of their eCommerce offerings will need to optimize order fulfillment — especially last mile delivery.

Table of Contents

- What is Last Mile Delivery?

- Final Mile Logistics Challenges

- 9 of the Latest & Greatest Last Mile Delivery Trends

- Factors to Consider When Choosing a Last-Mile Delivery Partner

- Closing Thoughts

What is Last Mile Delivery?

Last mile delivery, also known as final mile delivery or final mile logistics, refers to the transportation of goods from a warehouse or distribution center to their final destination — typically, the customer’s doorstep.

Final Mile Logistics Challenges

Last mile delivery is an integral component of the order fulfillment process but is often the most challenging to coordinate for a number of reasons. First and foremost, last mile delivery is expensive. Between fuel, vehicle and labor costs — as well as associated fulfillment and technology costs — the price of last mile delivery really adds up.

And that’s before you factor in the competition from the Amazons of the world, which promise “free” same-day or next-day delivery. We put scare quotes around “free” because, as everyone knows, there’s no such thing as a free lunch — the customer may never see the expense, but someone has to pay for shipping, so retailers usually end up eating the cost. For these and other reasons, final mile logistics accounts for 53% of the total cost of shipping and 41% of total supply chain costs.

Once you get past the financial challenges of last mile delivery, there are logistical challenges to consider. Unfortunately, last mile distribution is affected by a number of variables, many of which are outside retailers’ control — for example, the customer’s location relative to the warehouse or distribution center, the number of deliveries along a carrier’s route, traffic while in transit, customer availability and so on. Oftentimes, final mile delivery requires coordination of time-definite delivery windows for installation, or signoff in the case of controlled substance fulfillment. Other challenges, such as inventory shortages, discrepancies in order tracking and routing errors can be attributed to process inefficiencies and an overall lack of transparency.

Final mile logistics has become a proving ground for many retailers. According to one survey, 59% of consumers say that they buy more and more frequently from retailers that offer fast, easy and transparent delivery. Based on that same survey, 48% of consumers ages 18–26 have voiced their displeasure about a delivery experience on social media. If there’s one thing that’s clear, it’s that the last mile delivery experience can easily make or break a retailer’s reputation.

“The final mile delivery when it comes to end consumer delivery is really supplying that end consumer with the experience they’re looking for,” said Louis DeJianne, UPS’ director of marketing for consumer goods, apparel and retail. “When that package is delivered, that package being delivered is still an extension of your brand.”

In light of this, many retailers have found creative and innovative ways to reduce costs, eliminate inefficiencies, provide greater transparency and optimize the entire last mile distribution process. Without further ado, let’s take a look at some of those last mile delivery trends.

9 of the Latest & Greatest Last Mile Delivery Trends

1. The Gig Economy & Crowdsourcing

Venture capitalist startups such as Uber, Airbnb and TaskRabbit have changed the labor market as we know it, contributing to the rise of the gig economy — and they’re coming for last mile delivery, next. From Amazon Flex to Postmates to Roadie, a growing number of business units and companies have cropped up that provide crowdsourced delivery services.

“Crowdsourced delivery was not possible 10 or 15 years ago,” said Ingrid Bekkers, VP Marketing at Deliv, a crowdsourced same-day delivery startup. “There has been a profound technology shift for drivers. Today, everyone has a GPS computer in their pocket. With that, you can mobilize a disparate workforce of delivery drivers by a whole host of factors, chief among them is where they are.”

And it’s easy to understand the appeal: A crowdsourced delivery model can drastically reduce retailers’ out-of-pocket shipping costs, customers have the flexibility to schedule deliveries based on their availability and GPS and/or telematics devices allow for real-time traceability.

That said, crowdsourcing last mile delivery isn’t without its challenges. Though it’s really taken off in urban centers, where couriers on bicycles have an easier time navigating narrow, congested streets than traditional delivery vehicles, it has yet to see that same rate of adoption in rural areas. Additionally, there’s the concern that retailers have less oversight with crowdsourcing than they would with traditional delivery methods, meaning there’s greater potential for inefficiency.

2. Smart Technology for Tracking

Transparency and traceability are major concerns for retailers and consumers alike, but letting customers know the current status of their order and whether a package is in route to its final destination are just table stakes. What if you could tell customers the exact location of an item in transit with pinpoint accuracy? Even better — what if you could tell customers the exact environmental conditions their package is being delivered in?

With smart technology, you can. From using GPS and RFID tags to track the movement of shipments in real time to embedding IoT-enabled sensors in packages in order to monitor their temperature and humidity, smart technology has enabled retailers to provide their customer base with the transparency and traceability they desire. And smart technology isn’t limited strictly to consumers tracking in-progress shipments — retailers can even leverage it to monitor weather patterns and plot delivery routes in order to ensure that packages arrive at their final destination on time and in pristine condition.

3. Robotic Delivery

Of the various expenses associated with last mile delivery, labor is the highest, accounting for an estimated 60% of costs. And when it comes to labor, cost isn’t the only limiting factor — there’s also the matter of availability and scheduling to consider. For these and other reasons, a growing segment of retailers are starting to experiment with robotic delivery in the form of self-driving vehicles, drones and autonomous delivery bots.

Though this technology is still largely untested and unproven, it appears to be the way of the future, especially in a post-COVID-19 world. Just ask Amazon, which recently invested $530 million in the self-driving car company, Aurora. According to one Amazon spokesperson, “Autonomous technology has the potential to help make the jobs of our employees and partners safer and more productive, whether it’s in a fulfillment center or on the road, and we’re excited about the possibilities.” And as we all know, where Amazon goes, others will follow.

4. Rapid Order Fulfillment

Speaking of Amazon, the eCommerce behemoth is often credited for kickstarting the rapid order fulfillment revolution with its two-day (now one-day or same-day) Prime delivery. Although most businesses can’t afford to shell out the same amount of coin as Amazon to support this level of rapid order fulfillment — the company reportedly spends billions on shipping — it’s imperative that you make every effort to winnow down your last mile delivery window in order to meet rising customer expectations. One efficient way to do this is to partner with a third-party logistics (3PL) provider that leverages a warehouse management system to optimize the order fulfillment process.

Pick and pack fulfillment — also referred to as pick, pack and ship — is one of the approaches that can streamline eCommerce fulfillment. Workers, or pickers, pick items from warehouse shelves and package them in individual boxes or envelopes to be directly shipped to customers. By skipping the distribution center, companies are further able to lower costs and reduce shipping times. Companies should consider a wide variety of pick and pack options, including kitting and assembly and subscription box services.

5. Urban Warehouses

The acceleration of eCommerce and growing demand for rapid order fulfillment has also prompted a shift in the way retailers approach warehousing. Following in the footsteps of major players like Walmart, Target and IKEA, a growing number of businesses are exploring the possibility of urban warehousing. The idea is simple: The closer a fulfillment center is to the end consumer, the easier it is to reduce delivery lead time. Given the fact that the vast majority of consumers live in or around major metropolitan areas, building a warehouse within city limits can be a practical way to expedite final mile logistics and fulfill same-day orders. Another major benefit of urban warehousing is that it provides retailers with closer access to pools of labor. Like consumers, many warehouse employees live in or around city centers; rather than require those workers to drive out to suburban areas, urban warehouses bring work closer to home. This is even better for workers who do not own their own car and would otherwise be dependent on public transit.

Urban warehouses are currently a hot commodity in short supply, however, a growing number of real estate developers are turning their attention to this expanding market. Innovo Property Group is one such firm, having recently broken ground on a one million square foot, two-story Class A logistics and distribution facility in the Bronx.

“What’s interesting is that because of the confluence of factors — the demographic trend to live in cities, the smartphone, shorter delivery time frame requirements, and the advent of a shared services new economy, which focus on capacity utilization to drive down costs — has created a need for a total new sector in real estate, which is the urban warehouse,” said Andrew Chung, founder of Innovo. “In addition to addressing shorter delivery times, [these facilities] can also accommodate multiple needs for the retailer.”

As the saying goes, “If you build it, they will come.” That’s certainly the hope of industrial developers and, given the last mile delivery opportunities that urban warehouses present, it’s likely to come true. That said, new developments aren’t the only answer to the demand for urban warehousing: Major retailers are starting to explore the option of transitioning vacant storefronts in shopping malls into fulfillment centers.

6. Insourcing Deliveries

Rather than outsource last mile delivery, some retailers have instead opted to handle everything internally, relying on their own fleet of vehicles or a hybrid fleet to fulfill orders. Although outsourcing remains the order of the day, some retailers have even chosen to co-op with competitors in their region to share assets and reduce final mile logistics costs. This trend has inspired some 3PL providers to develop their own local delivery services to compete with insourcing, with vehicles and technicians on-hand for local deliveries.

7. Hybrid Fleet Management Systems

As mentioned, some retailers have adopted a hybrid fleet model — that is, a combination of a trucking company’ own fleet, paired with contractors, third-party providers and freelance drivers — in order to scale fleet size in accordance with changes in demand. A hybrid fleet model offers greater flexibility and affordability than the traditional model. If aligned correctly with your fleet operator, there are even more opportunities to create value-added synergies within your supply chain, including optimizing deliveries within your entire network, mitigating deadhead miles with empty trucks and even introducing the potential to broker your truck capacity in certain lanes.

A hybrid fleet strategy requires a fleet management system capable of enabling efficient transportation execution. Similar to traditional fleet management systems, which enable businesses to gain insight and analytics into vehicle and technician performance, a hybrid fleet management system provides you with a centralized dashboard from which you can optimize routing, monitor vehicle location, receive delivery updates and weather alerts, access historical reports and more, all in real time. With a hybrid fleet management system, you get the best of both worlds in terms of both scalability and control, making it one of the leading trends for last mile delivery today.

8. Last-Mile/Carrier Upselling

Sometimes, it can seem like no one knows us better than our internet browsers. Last-minute upselling is a growing trend on eCommerce sites that leverages predictive technology to pitch additional items to the customer, akin to placing all the candy and tabloids in the checkout line at the pharmacy.

Similarly, carrier upselling has delivery drivers stocking these grab-bag items in their vehicles, in the event they can make one more sale literally on the customer’s doorstep. This tactic hinges on consumers’ urge to impulse buy, or the fact that they often forget the essentials needed to complement their latest purchase, such as batteries or condiments (for food delivery).

9. Predictive Shipping

By analyzing seasonal trends and using predictive algorithms, many eCommerce retailers are shipping stock to local warehouses in preparation for spikes in customer demand. This places products closer to the consumer so there are fewer miles to travel when the customer places their order. Predictive shipping reduces both the delivery time and the cost of shipping.

Factors to Consider When Choosing a Last-Mile Delivery Partner

For firms looking to outsource last-mile delivery, consider the following before choosing a logistics partner:

- Security

The increase in package theft has mirrored the rise of eCommerce; in 2022, 14% of Americans reported a stolen package (down from 43% in 2020). If the intended recipient can’t apprehend the thief, they often blame the retailer or the delivery service for failing to take appropriate last-mile security measures.

To placate the customer, most retailers will replace the purchase at no additional cost, thus absorbing the loss of the stolen package (and the customer’s business). Going forward, the onus is often on the customer to beef up their doorstep security with lockbox solutions such as Box Sentinel and Doorbox.

There are a few ways retailers can nip this problem in the bud without resorting to extremes. Offering delivery windows at check-out lets the customer choose when they would like to receive a package, avoiding the risk of leaving an unattended parcel on their doorstep when no one’s home.

Retailers can also partner with brick-and-mortar stores in a buy online, pick up in-store arrangement. The customer simply chooses the location closest to them at check-out and retrieves the package at their convenience.

- Capabilities

Consumers want to know their favorite retailers and carriers have invested in the latest tracking and security measures for their purchases. This means real-time tracking capabilities, direct communication with delivery drivers, white glove (i.e. in-home) delivery for heavy or fragile items, streamlined reverse logistics and API integrations with existing tech at local retail stores and distribution centers.

With heightened awareness of carbon emissions, consumers increasingly want to know how carriers are offsetting their environmental footprint. Fleet electrification and streamlined or eco-friendly packaging policies are two tangible moves retailers and distributors can make to demonstrate their commitment to sustainability.

Closing Thoughts

As we look to the future, we expect the continued growth of the eCommerce market and, with it, continued high expectations for fast and efficient last mile delivery.

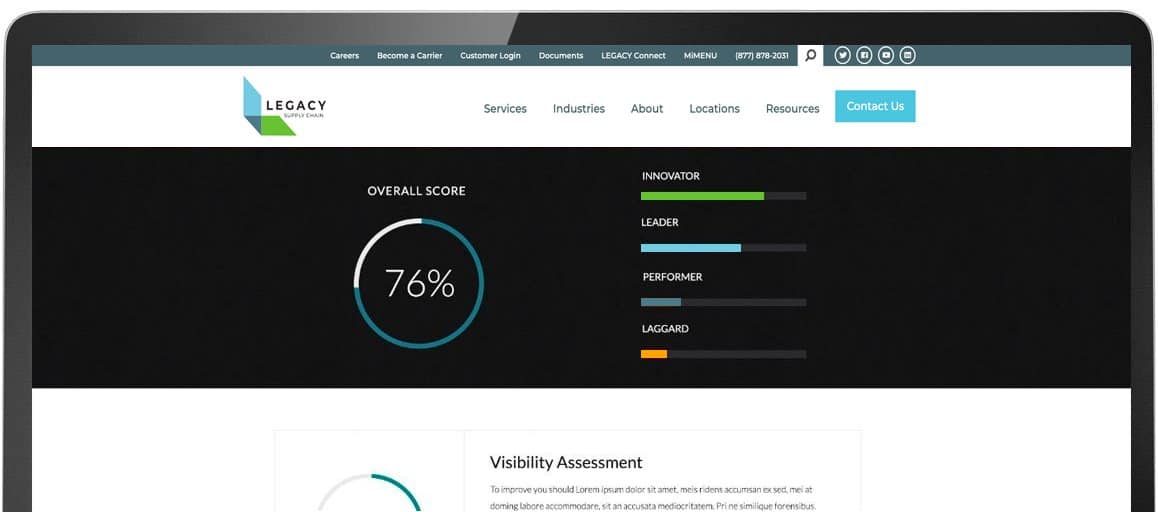

To find out how to incorporate these and other final mile logistics trends into your eCommerce fulfillment strategy, talk to the experts at Legacy Supply Chain. With a broad, scalable infrastructure and omni-channel expertise built upon 30 years of experience, we can offer a customizable, high-touch 3PL service most larger providers can’t. From our dedicated Customer Success and Solutions teams to our transparent fulfillment process, we pride ourselves on our compassionate efficiency.

Contact us today, and let us help you develop a winning last mile delivery strategy.

In our whitepaper, Fighting Against Excess, learn how to trim warehousing costs for higher profit margins and better supply chain performance. This whitepaper covers tactics such as cross-docking and reverse logistics, along with 3PL expertise and Lean practices can significantly drive ROI.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.

Popular Posts

Search Posts

-

6 Cornerstones to a Successful 3PL-Customer Relationship

Hiring a third-party logistics (3PL) provider is a strategic approach for businesses to increase their capacity without expanding their...

+ Read more -

Canadian Rail Strike? – What We Know So Far

On May 1st, CN (Canadian National Railway) and CPKC (Canadian Pacific Kansas City) rail workers voted overwhelmingly to authorize a strike...

+ Read more -

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more