Issue 6: Experts Express Concern Over Vaccine Distribution Logistics

Welcome back to the Legacy Monthly Shipment, where leading supply chain professionals share their insights and opinions on the latest industry trends, topics and news.

As the economy shows some signs of recovery and we head into peak season, the supply chain news cycle shows no signs of slowing down. To that end, let’s dig right in.

Today’s Shipment:

- As the LMI continues to climb, transportation capacity continues to fall.

- Supply chain experts express concern over COVID-19 vaccine distribution.

- Study shows that eCommerce sites leave large greenhouse gas footprints.

- The Port of LA takes a meaningful step toward achieving Gene Seroka’s vision.

- U.S. weekly intermodal volumes are on the rise.

INDEX

Logistics Managers’ Index Reaches Two-Year High for August

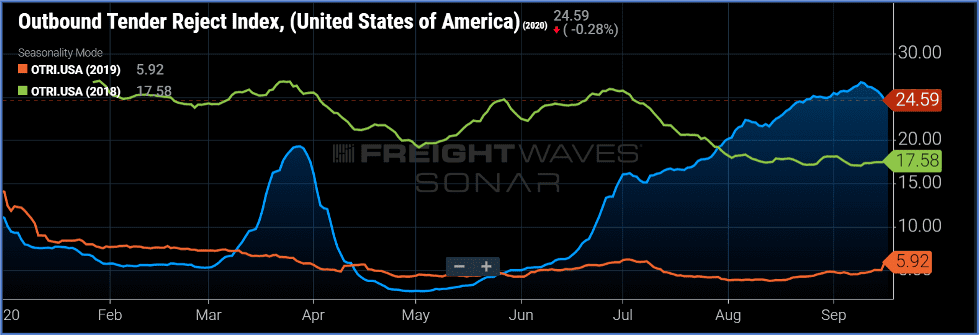

Hardly a month goes by without us featuring at least one story about low warehouse and transportation capacity availability, and this month’s newsletter promises to be no different. According to the August 2020 Logistics Managers’ Index (LMI) Report, transportation capacity has tightened to 31.5%, which is the second fastest rate of contraction observed in the LMI’s four-year history. This is consistent with FreightWaves’ Outbound Tender Reject Index, which showed that outbound tender rejection rates peaked on September 9 at 26.68% and have since trended down to 24.59% — still a remarkably high level.

The August 2020 report also indicates an overall LMI of 66% — three percentage points up from July and the highest reading since November 2018.

Consistent with the LMI Report’s findings, the Legacy team is seeing increased demand for truck capacity across North America; Southern California is the hottest market as carriers work to absorb high import volumes coming into the country. Cross-border northbound from Mexico is also seeing capacity shortages due to a rebound of the auto industry and other manufacturing verticals following the COVID-19 slowdown. Northbound Canada capacity is tight with fewer Canadian drivers entering the U.S. market due to COVID-19 restrictions. U.S. demand remains strong as consumers buy and companies work to rebuild inventory and prep for the holiday season. Finally, hurricanes in the Southeast and wildfires along the West Coast have had an impact on the efficiency of regional capacity, further straining the national carrier network.

Lead time is absolutely imperative for shippers in order to offset tightening capacity and high tender rejection rates. We recommend shippers build as much lead time into their lines of supply and demand as possible in order to allow more flexibility in shipment and delivery times.

REPORT

Global Supply Chain Braces for Braces for COVID-19 Vaccine

Even though a COVID-19 vaccine is unlikely to be widely available until well into 2021, freight companies have already started to express concerns over its distribution, citing shrinking capacity on container ships and cargo aircraft and lack of visibility into when a vaccine will arrive.

“We’re not prepared,” said Neel Jones Shah, global head of air carrier relationships for freight forwarder Flexport. “Let’s all be honest here, vaccine supply chains are exponentially more complex than [the] PPE supply chain. You can’t ruin PPE by leaving it on the tarmac for a couple of days. You will destroy vaccines.” Given that the global supply chain is still recovering from the disruption caused by earlier waves of the pandemic, Shah’s apprehension is valid — and that’s without factoring in refrigeration requirements, forecasting and transparency issues and accessibility concerns.

Though it’s still unclear when we can expect a vaccine to arrive, one thing is certain: Distributing it will require global coordination and cooperation. Many logistics providers are already hard at work building giant cold-storage facilities, or “freezer farms,” to facilitate proper refrigeration of the vaccine, which must be stored at minus 20 degrees Celsius to minus 70 degrees Celsius, depending on the drug maker, while in transit. Others are looking for creative ways to navigate capacity constraints, such as a combination of air and expedited ocean shipping, in order to expediently deliver the vaccine to hospitals and other medical facilities; this will provide especially crucial should distribution coincide with peak holiday shipping season.

Tight protocols and visibility tools will need to be implemented to ensure chain of custody security across all nodes and amongst all service providers in the supply chain. Complete inventory management accuracy — down to individual unit levels — will be a must-have for storage and distribution providers.

STUDY

Environmental Effects of Online Shopping Begin to Come to Light

COVID-19 has changed almost everything about how we go about our day-to-day lives, including how we shop. Since the beginning of the pandemic, eCommerce — already a popular mode of shopping — has reached unprecedented rates, with consumers spending $347.26 billion online with U.S. retailers in just the first six months of the year. Although this has created opportunities for retailers, allowing many to remain afloat in a time marked by uncertainty, researchers are starting to worry about the effect of eCommerce on our environment.

According to a new study published in the Environmental Science & Technology journal, eCommerce sites like Amazon have a much larger greenhouse gas (GHG) footprint than retail stores, and recent greening efforts are unlikely to counteract the damage that’s being done. The study attributes the GHG footprints of “pure players” — non-store-based eCommerce sites — to excess packaging, wasteful consumer habits and an increased demand for immediacy, which has also placed significant strain on last-mile logistics.

ECommerce’s impact on the environment is still coming to light. Currently, many major retailers are committing to implementing sustainable practices, such as using eco-friendly packaging, recycling old goods and investing in alternative energy sources. Whether it will be enough to make a meaningful difference remains to be seen, however, those of us at Legacy are hopeful that creative thinking and technological advancements will help offset the environmental impact of eCommerce.

ANNOUNCEMENT

Port of Los Angeles Unveils New Data-based Planning Tool

Back in June, we reported on efforts by Gene Seroka, Executive Director of the Port of Los Angeles’, to create a nationwide port community information sharing system. The Port of LA took its first steps toward achieving that vision by unveiling a new data tool at the Los Angeles Harbor Commission meeting on September 3. Known as the “The Port of Los Angeles Signal” or “The Signal,” for short, this tool is designed to distribute and publish data from Wabtec’s Port Optimizer in order to provide stakeholders with advanced information on shipments heading into the port.

“We’re giving all of our partners — railroads, chassis providers, truckers, warehouse operators and others in the supply chain — a three-week look at cargo coming into Los Angeles,” said Seroka. “This planning tool will help make our partners more nimble and efficient, especially during volume surges like we are currently experiencing. This is the forward visibility our stakeholders have requested and we are proud to deliver it.”

This is a progressive move from the Port of LA. Since the West Coast labor strike in 2002 and the evolution of larger container vessels, U.S. ports — West Coast ports in particular — have become periodic bottlenecks in the global supply chain. The heavy volumes we’re currently seeing out of Asia and to the U.S. have had a significant impact on the Ports of LA, Long Beach, Seattle and Tacoma. By providing inland carriers with forward-looking insight, the Port of LA aims to deliver foresight for capacity planning and mitigate some of that congestion. The Legacy team is excited to leverage this new visibility tool and recommends that shippers and other parties in the transportation process look at how it can improve logistics operations.

ANNOUNCEMENT

U.S. Weekly Intermodal Volumes up by Nearly a Quarter

According to data from the Association of American Railroads, U.S. freight railroads moved 287,339 intermodal containers and trailers between August 30 and September 5 — a 24.5% increase compared to the same period in 2019. This increase is consistent with the rise in both domestic and international intermodal volumes; the former has been attributed to the surge in eCommerce demand, whereas the latter is the result of factory operations in China returning to normal.

“[Intermodal volumes] have been very, very strong,” said Mark Wallace, Executive Vice President of Sales and Marketing for CSX. “Clearly, the consumer is back. The consumer is spending. Inventories were depleted. People are buying things.”

That said, though some industry experts, including National Retail Federation Vice President for Supply Chain and Customs Policy Jonathan Gold, maintain healthy skepticism about the increase in volumes, they do appear to be cause for cautious optimism. “It’s important to be careful how much to read into these numbers after all we’ve seen this year,” said Gold. “But it is the clearest sign yet that we could be in for a much happier holiday season than many had thought.”

Much like ocean carriers, strong intermodal volumes in 2020 have enabled railroads to implement significant peak season charges. Additionally, increased demand for domestic trucks across North America, particularly southern California, has pushed rates much higher, sending some truck cargo back to the railroads. We expect intermodal volumes to remain strong throughout Q4 and into 2021 as the U.S. economy continues to rebound from COVID. We also expect to see increases that will impact sea freight to interior points when ocean carriers renegotiate their rail rates in Q1 2021.

Are there any stories or topics you’d like to see us cover in next month’s Shipment? Send us an email and let us know; we want to hear from you. For even more supply chain-related news and insights, check out our blog or talk to one of our specialists today.

Until next time, this is the Legacy team, signing off.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more -

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more