Issue 24: COVID Lockdowns in China, The State of West Coast Ports & More

A WORD FROM LEGACY

Whether you’ve been closely following the news or choose to take a more hands-off approach to media consumption, you’ve likely heard the stories coming out of Ukraine. With that in mind, we start today’s Shipment off on a solemn note.

Though the Russian invasion of Ukraine is certainly an important topic within the logistics industry, out of respect for the people directly affected by the conflict, we cannot have any sort of meaningful discussion about its economic impact without first acknowledging its human impact. There has been an incalculable loss of human life, and the situation is, by anyone’s account, a tragedy. The Legacy team stands with those impacted by the violence and hopes for a peaceful resolution.

With that, let’s begin this month’s Shipment with our Market Update.

MARKET UPDATE

February 2022 Brings Second-Highest Reading in LMI History

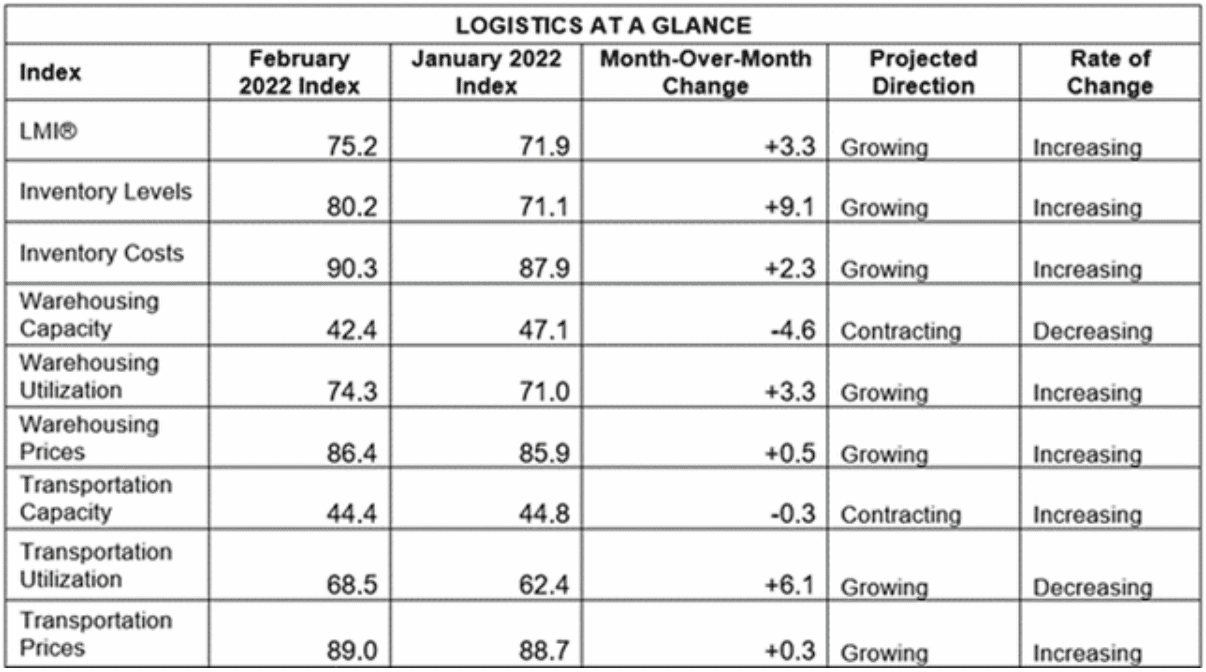

The February 2022 Logistics Managers’ Index (LMI) report — a diffusion index of logistics activity in the United States — had an overall reading of 75.2, the second highest in the LMI’s history and the 13th consecutive month over 70.0, denoting significant expansion within the industry. This was also a significant increase of +3.3 points from January’s reading of 71.9 — a sign of the times, if there ever was one.

As the official report notes, “Beyond the truly tragic loss of human life, a number of costs are extending out of [the Russian invasion of Ukraine] — many of which will have a direct effect on global supply chains.” Already, crude oil prices have skyrocketed, driving up fuel costs within the transportation sector. No-fly zones over Moldova, Eastern Russia and Ukraine have impacted trade routes between Europe and Asia, forcing cargo aircraft to seek alternate — often longer — routes. In a show of support to the Ukrainian people, multiple countries have banned Russian carriers from landing, while shipping companies such as FedEx and UPS have suspended shipments to Russia.

Though the total number of ships queuing off the West Coast and dwell times at the Ports of Los Angeles and Long Beach have steadily declined, they’ve subsequently increased at ports along the East Coast, creating a significant backlog that is not expected to clear until April. Protests along the U.S./Canadian border — which we discussed in last month’s Shipment — continue to create problems with trucking, leading to a 44% increase between January and February in the cost of shipping goods from Canada to the U.S.

Meanwhile, the Inventory Levels Index has reached an all-time high of 80.2; the LMI report attributes this to a number of factors, including firms over-ordering to avoid product shortages, late-arriving goods due to congestion and reduced consumer spending due to inflation. Perhaps unsurprisingly, this has caused Inventory Costs to increase, reaching a new peak of 90.3.

It has also resulted in high Warehousing and Transportation Utilization rates, causing Warehousing and Transportation Capacity to dwindle even further, and Warehousing and Transportation Prices to rise. A growing number of firms are experimenting with automation in an attempt to navigate this challenging dynamic, with larger firms adding automated fulfillment centers to existing stores and smaller operators investing in digital touchscreen and picking systems.

To round out the LMI report, the shipping backlog has prevented automotive manufacturers from getting their hands on essential components; under these conditions, manufacturers are projected to produce only 300,000 of the previously predicted 360,000 for 2022. The semiconductor shortage also continues to plague the electronics industry and is unlikely to let up until 2023 , at the very earliest. Finally, major carriers such as Maersk have their sights set on entering the trucking and domestic third-party logistics (3PL) markets, which could lead to logistics companies creating full-service end-to-end networks.

Also in Today’s Shipment:

- “Stealth omicron” shutters factories across China in new series of lockdowns.

- An end to West Coast congestion is in sight — at least, for now.

- Russian invasion of Ukraine sends the global supply chain into turmoil.

- White House announces plan to launch supply chain data-sharing portal.

IN THE NEWS

“Stealth Omicron” Fuels China’s Biggest COVID-19 Outbreak in 2 Years

A new subvariant of the omicron strain of COVID-19 known as BA.2, or “stealth omicron” — so-called for its difficulty to detect using PCR tests — is rapidly spreading across the globe, with cases detected in over 57 countries and all 50 U.S. states. However, few nations have felt its effects as acutely as China, which is currently experiencing its largest outbreak in two years, with an average of 1,477 cases recorded per day the week of March 6 through March 12.

Following its strict “zero-COVID” virus containment policy, China declared city-wide lockdowns in Langfang, Dongguan and technology hub Shenzhen, as well as all of Jilin province, placing a total of over 52.5 million citizens under lockdown. Shanghai and Xi’an have enacted certain lockdown measures, including remote schooling, restrictions on passenger flights and factory closures, but have so far avoided a complete shutdown.

China’s efforts to curb the spread of the BA.2 subvariant has forced multiple major companies to halt operations, including automakers Volkswagen and Toyota, Apple supplier Foxconn, and tech companies Tencent and Huawei Technologies. The lockdowns have also resulted in the partial closure of Yantian International Container Terminal at the Port of Shenzhen, creating downstream concerns for West Coast sea cargo hubs.

In a comment for Bloomberg, Noel Hacegaba, deputy executive director of the Port of Long Beach, said that the closure of Yantian terminal due to a COVID outbreak in 2021 “decreased San Pedro Bay area import volumes by 14%, with the effects felt for two months.” Hacegaba also stated that, “With the current lockdown being more widespread, the effects could be bigger and last longer.”

The Yantian closure has already led to a dramatic increase in queue lengths at other major Chinese ports, with the number of container vessels waiting to berth in Qingdao alone jumping from 9 to 22 in the span of just a week. Industry experts anticipate that the fallout for West Coast ports over the next month is all but inevitable, with Bloomberg reporting that, “if a big surge of cargo into the Los Angeles-area ports follows once restrictions are lifted, it could seize operations already stressed by equipment dislocation, labor shortages and congestion on the docks.”

Southern Californian Ports Experience Brief Reprieve After Months of Congestion

Following nearly two years of almost constant congestion, Southern Californian ports have finally started to see a reduction in the number of container ships waiting to berth — down from 101 on January 1 to just 44 ships queuing as of March 15 — as the velocity of cargo moving through terminals increased.

The Port of Los Angeles reported its busiest February to date, with a total throughput of 857,764 twenty foot equivalent units (TEUs), for a 7.3% year over year (YoY) increase, and imports of 424,073 TEUs, for a 2.7% increase. The Port of Long Beach also had a banner month, with a total of 796,560 TEUs (a 3.2% YoY increase) and imports of 390,335 TEUs (a 4.4% YoY increase).

While these numbers are certainly encouraging, it may be too soon to breathe a sigh of relief.

Although congestion has cleared along the West Coast, East and Gulf Coast ports are bearing the brunt. In a statement for American Shipper, shipping expert John McCown reported that “January [2022] was the eighth straight month where overall growth at East/Gulf Coast ports exceeded overall growth at the West Coast ports,” likely the result of “shippers changing routing decisions to avoid the widely reported West Coast congestion.” As of February, average container dwell times in the Port of Charleston alone were up 37% YoY.

The Legacy team believes shippers will continue to eye East Coast ports as an alternative to the West Coast in an effort to mitigate risk associated with potential labor disruptions associated with the ILWU union contract renewal, which we addressed in last month’s Shipment. The current agreement expires on June 30, 2022, and there is significant trade pressure on all parties to renew the agreement without disruption.

There’s also the matter of the news out of China. As noted, the partial closure of the Port of Shenzhen and the prospective closure of the Port of Shanghai — both China’s and the world’s largest — has the potential to create cargo backlogs on shipments headed to the West Coast. According to an online post by Bjorn Vang Jensen, vice president of SeaIntelligence, “any closure followed by a reopening at Shenzhen port will create a whiplash effect and lay waste to the progress being made in the U.S. to clear port backlogs.”

However, others are more optimistic. “If no ports shut down but volumes coming out of factories are reduced [by lockdowns] that actually would be pretty good for ports,” said George Griffiths, managing editor of global container freight at S&P Global Commodity Insights, in a statement to American Shipper. He added that, if ports do ultimately close, causing ships to drop calls or blank entire sailings, it could be for the best:

“Any respite the [U.S.] ports can be offered in terms of imports will be positive, given the number of containers that are currently quayside and the number of issues in the hinterland,” said Griffiths. “It will allow an easing of those problems.”

Global Supply Chain Braces for Impact from Russian Invasion of Ukraine

In last month’s Shipment, we were carefully monitoring the situation in Ukraine, sharing early predictions about the potential impact of Russian aggression, with particular attention to commodity prices, cybersecurity threats and cascading geopolitical tensions. Since the publication of that newsletter, the conflict has escalated into all-out warfare, with Russian President Vladimir Putin ordering the military invasion of Ukraine on February 24, 2022.

In the span of just weeks, multiple Ukrainian territories have fallen under Russian control; major cities — including the capital, Kyiv, Kharkiv and Mariupol — have been subject to attack; the Ukrainian people have mounted a resistance that has been praised the world over; anti-war protests have broken out across Russia; and there have been over 15,000 casualties and millions of Ukrainian citizens displaced.

The ripple effects of the crisis have been felt across all corners of the world. Complex global supply chains — already strained under the considerable pressure of the pandemic — have started to crack.

Russia and Ukraine are major suppliers for an extensive list of raw materials, including sunflower oil; wheat; barley; corn; fertilizer; chemical elements such as neon and xenon; and metals such as palladium, platinum, aluminum, steel and chrome. With supply chains all but at a complete halt, automakers and semiconductor manufacturers face materials shortages, while rising food prices threaten the populations of poorer nations across Europe, North Africa and the Middle East. Major companies such as Nestle, Mondelez International, CocaCola HBC and Sumitomo Electric have shut down Ukrainian plants to avoid risk, while countless others — including Verizon, Pfizer and Deutsche Bank — have suspended operations in Russia in solidarity with the Ukrainian people.

As noted, cargo flights between Europe and Asia have been canceled or rerouted around Russian airspace in observance of no-fly zone restrictions, increasing air freight fuel costs and prompting carriers to opt for smaller and lighter cargo loads as a result. Though it’s early yet, these measures — as well as parcel and cargo carriers pulling shipments from Russia — are expected to stretch already limited air cargo capacity even thinner. And we would be remiss not to mention the conflict’s impact on the European energy market: Russia is one of the world’s largest producers of oil and natural gas, and so the crisis has also triggered a precipitous increase in fuel prices.

The full effects of the crisis remain to be seen, but with peace talks making only marginal progress, it is fair to say that shippers would do well to expect the conflict to continue for the foreseeable future and plan accordingly.

White House Unveils New “Freight Logistics Optimization Works” Initiative

In June 2021, the Biden-Harris Administration established a Supply Chain Disruptions Task Force to “provide a whole-of-government response to address near-term supply chain challenges to the economic recovery.” Now, nearly a full year later, the Task Force has announced a new initiative — titled Freight Logistics Optimization Works (FLOW) — to build a National Freight Data Portal for global supply chain data exchange and to develop performance-based and technology-neutral standards for the exchange and use of digital information throughout the supply chain.

According to the White House fact sheet, the FLOW pilot program will include 18 participants selected to “represent stakeholders throughout the supply chain,” including port authorities, ocean carriers, terminal operators, businesses, chassis providers, and logistics and warehousing companies. The pilot program will operate on the principles that “it is a voluntary, secure national exchange for freight information, it is available to participants who share data, and it is sustained by supply chain operational improvement.”

Additional parties interested in participating in FLOW will have the opportunity to submit a bid through a website hosted by the U.S. Department of Transportation, which is expected to go live one month after the program’s launch.

Thanks for joining us for another Shipment; for even more insights, please visit our blog, resource center or contact page to talk to a member of the Legacy team.

Until next time, stay safe, everyone.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more -

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more