Issue 36: Slow Trade, Fast Talks: It’s All In the April Monthly Shipment

MARKET UPDATE

Good News, Bad News: Low LMI Readings Sending Mixed Signals

The readings in the March 2023 Logistics Managers Index (LMI®) could be considered the definition of a mixed bag. The first thing of note, though, is that the March reading sits at 51.1, down -3.6 from 54.7 in February — the lowest overall reading in the 6.5-year history of the LMI.

Transportation Prices, too, are down -5.0 to an all-time low of 31.1. Transportation Utilization isn’t going anywhere either, sitting at a reading of 50.0 with no upward movement. On the other hand, Warehousing and Transportation Capacity are growing, with March readings coming in at 58.2 (+1.6) and 71.4 (+1.0), respectively.

The slow growth of Warehousing Utilization, which sits at 65.0, is likely due to increased customer returns and decreased demand, leaving excess inventory (with Levels reading in at 55.6 and growing) languishing in warehouses. This, then, makes it noteworthy that Inventory Costs read at 66.0 (-4.8), the first time they’ve read in at below 70.0 since September 2020.

Meanwhile, the U.S. economy seems to be flirting with recession, though things are not yet dire — but high interest rates and the ensuing inflation are draining the nation’s money supply at the fastest rate seen since the 1930s. Inflation does seem to be slowing, and while the LMI is tracking record slow growth rates, it’s still tracking growth.

The same cannot be said for Transportation Utilization, which has fallen and stabilized at 50.0. This can largely be attributed to decreased consumer demand, which has played out accordingly in a series of March freight consolidations. First, North Carolina-based FreightWorks Transport shut down, putting 200 logistics employees out of work. Then Flagship Transport closed, which unexpectedly took 455 drivers off the roads. Knight-Swift’s acquisition of U.S. Xpress (which we covered in the February 2023 Shipment) has further consolidated the trucking industry. For the moment, at least, this all seems fitting, since shipping volumes are down for USPS, UPS and FedEx and capacity is opening up for carriers everywhere. The good news out of all this is that fuel prices have dropped, with diesel down to $4.13 per gallon in March and wholesale prices even lower.

(Speaking of which, we’ll be keeping an eye on developing news out of California, where new legislation is banning diesel trucks from operating at the state’s busiest ports. Since the operating costs of electric trucks is approximately three times that of internal combustion engine vehicles, this is a story we’re going to want to watch.)

For a complete overview of the March 2023 LMI across all indices, please refer to the following chart:

LOGISTICS AT A GLANCE

| Index | March 2023 Index | February 2023 Index | Month-Over-Month Change | Projected Direction | Rate of Change |

| LMI® | 51.1 | 54.7 | -3.6 | Growing | Slower |

| Inventory Levels | 55.6 | 62.4 | -6.8 | Growing | Slower |

| Inventory Costs | 66.0 | 70.9 | -4.8 | Growing | Slower |

| Warehousing Capacity | 58.2 | 56.6 | +1.6 | Growing | Faster |

| Warehousing Utilization | 65.0 | 70.3 | -5.3 | Growing | Slower |

| Warehousing Prices | 70.9 | 73.3 | -2.4 | Growing | Slower |

| Transportation Capacity | 71.4 | 70.4 | +1.0 | Growing | Faster |

| Transportation Utilization | 50.0 | 51.9 | -1.9 | No Movement | From Growing |

| Transportation Prices | 31.1 | 36.1 | -5.0 | Contracting | Faster |

Logistics at a Glance chart depicting — across various indices — month-over-month change from February 2023 to March 2023, projected direction and rate of change.

Also in Today’s Shipment:

- Teamsters threaten to strike as UPS announces record profits

- “Subpar” global trade growth amid ongoing stressors

- The Armstrong 2023 Global 3PL Trends Report

- Where are all the hourly workers?

DEVELOPING

Teamsters Threaten to Strike as UPS Announces Record Profits

The last people you’d want to anger in the logistics industry are the 1.2 million North American members of the International Brotherhood of Teamsters (IBT).

In late January, UPS reported the highest profits in the shipper’s 116-year history, north of $100 billion — which means it’s prime time for 340,000 UPS Teamsters to negotiate a new contract guaranteeing better pay and a safer work environment.

Representatives of the Teamsters, including General President Sean M. O’Brien, are sending the shipping giant a crystal-clear message: Meet one hundred percent of our demands, or all 340,000 of us walk.

“We are united in this fight,” said Sal Valenti, a UPS Teamster and New England negotiating committee member, quoted in an April 3 article published by the IBT. “Throughout the pandemic we’ve worked six, seven days a week, and we are going to make sure we get what we deserve.”

In the wake of unprecedented shipping volume due to COVID-19, the full terms of the proposed contract include no more forced overtime, more full-time job opportunities, no more corporate harassment, elimination of a two-tier wage system, and protection from safety hazards in the workplace and in the field. As far as the Teamsters are concerned, there is no room for negotiation. UPS’ current contract with Teamsters in the U.S., Canada and Puerto Rico ends on July 31, 2023.

“We are not going to negotiate a contract that is cost neutral or with concessions,” O’Brien told UPS representatives at an April 17 meeting in Washington, D.C. “We are going to push this company and its management harder than they’ve ever worked before, and for the first time you’re going to face a productivity standard. We have 12 weeks until this current contract expires. Let’s get to work.” The IBT says its members are prepared to strike if UPS fails to deliver, so to speak.

“On August 1, if we don’t have the contract you deserve, there will be no UPS Teamsters working,” General Secretary-Treasurer Fred Zuckerman promised the crowd at an April 2 rally in Boston, Massachusetts.

Needless to say, the North American logistics industry cannot afford to lose these essential workers. In 1997, 185,000 UPS Teamsters walked off the job for 15 days primarily to demand better wages and more job security. The strike cost UPS $780 million as 80% of their shipments lay undelivered. Today, in the golden age of eCommerce, UPS delivers over 6.2 billion packages a year, or 24.3 million packages per day. With other carriers such as FedEx not too keen or confident in absorbing UPS’ volume, the shipper is under pressure from multiple sides to give the Teamsters what they want.

Hopefully, the two sides can reach an agreement without the need for extreme measures, such as when the federal government had to intervene as rail workers threatened a strike in 2022. We’re banking on the assertion that, in the words of UPS CEO Carol Tomé, the Teamsters and UPS are “more aligned than not” on key issues.

BRIEF

Global Trade Growth So-So Amid Ongoing Stressors

In keeping with the plodding theme of 2023 shipping so far, the World Trade Organization predicts that global trade volumes are likely to remain “sluggish” due to multiple global factors, with a projected growth rate of 1.7%.

First, fallout from the ongoing war in Ukraine continues to affect the price of exports such as gasoline and grain, as multiple countries (the U.S. included) maintain their sanctions against Russia. Meanwhile, China’s economy continues to struggle amid COVID-19 restrictions, while global interest rates keep climbing. This is a worrying and frustrating set of circumstances for international shippers, not to mention consumers.

On the bright side, the WTO did acknowledge that 2022’s disappointing growth rate of 2.7% (down from 9.4% in 2021) is better than its gloomy projection of 0.5%.

The WTO does warn shippers not to get too comfortable in their consolation. Global concerns including climate change, food insecurity, financial instability, worldwide debt and geopolitical tensions lurk on the not-too-distant horizon. From global enterprises to regional carrier networks, airtight contingency plans will be a shipper’s best friend in the coming year.

REPORT

Armstrong Publishes 2023 Global 3PL Trends Report

Leading third-party logistics market research and consulting firm Armstrong & Associates has released its annual Global 3PL Trends Report with some intriguing findings (some connected to yours truly, Legacy itself).

Highlights include:

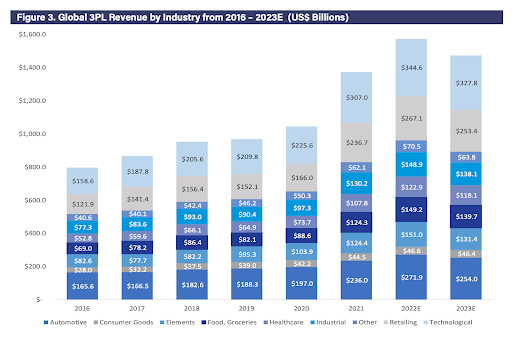

- The global 3PL market reached $1.47 trillion in 2022, up 14.5% from 2021 revenues and nearly twice 2016’s numbers.

- Walmart leads the pack of Global Fortune 500 companies that rely on 3PL services, with 69 active outsourcing partnerships. Out of the world’s eight largest outsourcers — including Walmart/Sam’s Club, Volkswagen, Nestlé, Procter & Gamble/Unilever, PepsiCo, General Motors, Ford Motor Company and General Electric — five use Legacy’s services (all except Volkswagen and Ford).

- Over the past 20 years, the number of Domestic Fortune 500 companies that outsource at least part of their logistics has grown from 46% to 92%. Naturally, the larger the company, the more complex its supply chain and the greater the need for 3PL support. However, many Global Fortune 500 companies are embarking on initiatives to “consolidate and reduce the number of 3PLs they work with.” Too many cooks in the kitchen, perhaps? Dilution of quality customer service?

- On a related note, A&A predicts a downturn in projected 3PL revenue in 2023 across eight major verticals — Automotive, Consumer Goods, Elements, Food and Groceries, Healthcare, Industrial, Retailing and Technological. It is unclear whether A&A’s research points to volume or rates being the culprit; but in light of slow trade growth so far this year, we can assume it’s a combination of both. Time will tell.

UPDATE

Small Changes May Mitigate Warehouse Hiring Doldrums

At one point during the height of the pandemic, logistics companies were hiring hourly workers by the hundreds and thousands at a time. Today, three years since the world shut down, the daily numbers hover in the single digits. What’s going on?

Hourly wage rates are strong compared to historical numbers (between $16 and $23 an hour) but the logistics industry can’t seem to find enough workers. According to the Bureau of Labor Statistics, in March 2023, the warehousing and storage industry filled 12,000 jobs fewer than the previous month. Though hourly rates have dropped a bit from last year (between $0.50 to $1.50 less), that doesn’t seem to be the reason labor is scarce.

Speaking to FreightWaves in April, Kristin Bevens, a vice president at hourly staffing firm EmployBridge, thinks logistics companies need to appeal to the labor market’s heart rather than its paycheck.

Today’s employees want more than competitive pay; according to a 2022 survey by Gallup, employees now want more flexibility, more realistic expectations from employers and a greater ability to utilize their talents. While this may not always be possible in an hourly logistics position, Bevens suggests that companies start looking at hiring differently — from the employee’s point of view.

She points out that Amazon attracts a large volume of hourly workers with its generous benefits and perks, including paid time off and family care assistance. According to Bevens, this model works. “Some [companies] are able to offer a lower wage and get away with it because of the other qualities they bring to the table,” she says.

While this approach may seem unconventional in the logistics industry, it’s a sign of the times, and carriers big and small would do well to take note.

While that’s certainly not all the logistics news that’s fit to print, that’s all we have room for in this month’s Shipment. Thank you for joining us, and watch this space for developing stories. For more 3PL insights, feel free to visit our blog or resource center. We also invite you to contact us directly to discuss 3PL options for your organization.

See you next month.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more -

5 Key Components in International Contingency Planning

The global logistics outlook indicates a lingering crisis mode, requiring adaptation to the new normal of accelerated global disruptions,...

+ Read more