Issue 35: Latest 2023 LMI Report, Carrier Mergers & More

A WORD FROM LEGACY

In like a lion, out like a lamb — that’s the hope, at least. Welcome to our March installment of the Legacy Monthly Shipment, a monthly newsletter stacked with the latest news, insights and trends from the logistics industry. We’re glad you could join us!

First up, let’s do the Market Update.

MARKET UPDATE

February LMI Shows Some Hope Amid Slow Post-Holiday Recovery

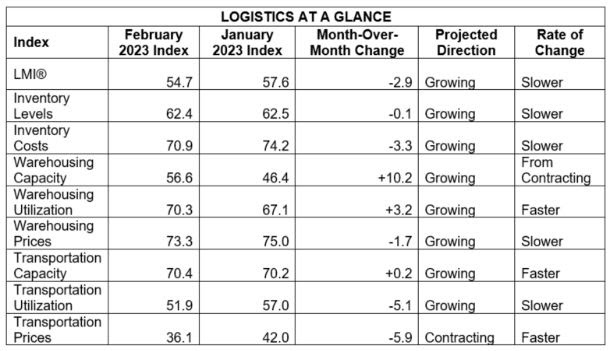

The Logistics Managers’ Index took a slight downturn in February 2023, reading in at 54.7, down -2.9 from January’s reading of 57.6. After two months of growth, the decline can be attributed to weather-related shipping delays, a generally quiet shopping season and sliding Transportation Prices, which, at 36.1, are experiencing the fastest contraction rate seen in the LMI’s 6.5-year history.

Warehousing Capacity, on the other hand, read in at 56.6 (+10.2) in February following two and a half years (30 months) of contraction. While the effects may not be felt for some time to come, this is good news for a number of reasons, including increased storage capacity, lower costs and less supply chain congestion. Even so, many eCommerce giants like Amazon, Target and Sam’s Club continue to expand and enhance their warehousing networks to support increased inventory storage, faster shipping times and more efficient workflows. Ultimately, this expansion could also mean lower inflation rates as the supply chain speeds up.

In the meantime, inflation remains high (up 6.4% from January 2022), straining consumers’ wallets at the grocery store and gas pump. The San Francisco Fed claims this has more to do with supply and warehousing shortages than increased demand. But while U.S. consumers cannot forgo essential hard goods such as food and gas, they can ease their discretionary spending — which is exactly what February’s Services PMI reading of 59.5 (+2.8) indicated. This means that Americans are currently favoring services over physical goods, likely a side effect of easing coronavirus fears and restrictions. (New orders for goods were still up by +4 in February at 61.9.)

Despite a flat Transportation Utilization reading of 51.9 (-5.1) and an elevated Transportation Capacity reading (70.1, up +0.1), the freight industry is displaying marked confidence in the coming months as retailers slowly start to restock their back-to-school and holiday inventories. Mediterranean Shipping Company (MSC), the world’s largest freight line, predicts volumes will increase later in the year, a sentiment echoed by carriers in the U.S., Europe and China. Indicators include a resurgence of Chinese manufacturing and strong employment and energy exports from the U.S.

However, the LMI report cautions us that growth may not be felt throughout the entire supply chain; for an example, look to the 2019 transportation market, in which consumer spending was strong while B2B freight struggled to keep up.

For a complete overview of the February 2023 LMI across all indices, please refer to the chart below:

Also in Today’s Shipment:

- A new transcontinental railroad emerges after a two-year wait.

- Knight-Swift Transportation Holdings buys rival trucker U.S. Xpress.

- Will modifications to ELD regulations actually solve truckers’ problems?

- First signs of trouble in West Coast labor talks.

IN THE NEWS

breaking: A Tale of Two Railroads: STB Approves Transcontinental Merger

In the first major U.S. railroad consolidation since 1996, Canadian Pacific has acquired Kansas City Southern in a $31 billion merger. The deal was approved on March 15, 2023 by the Surface Transportation Board (STB) and will establish the first single-line railroad connecting Canada, the U.S. and Mexico.

Christened the Canadian Pacific Kansas City (CPKC) line, the new system emerges after two years of negotiations, during which Canadian Pacific and Canadian National Railway engaged in a bidding war for possession of KCS and federal regulators debated whether the merger posed a threat to competing railroads and rail service overall. On the contrary, the STB stated that the CPKC line will remain the smallest of the six Class I carriers in the U.S., while still expanding service, adding new efficiencies and reducing travel time throughout the nation’s existing freight rail system. (KCS is currently the smallest Class I railroad by revenue in the U.S.)

The establishment of the CPKC line joins ongoing mitigation efforts to heal the supply chain following several years of COVID-19-related service disruptions. The new transcontinental line will relieve North American roads of 64,000 truckloads per year, with limited impact to shippers and no track redundancies or reroutings, according to the STB.

In response to concerns over merger-related service disruptions, STB Chairman Martin Oberman maintains that the layout of the individual lines does not currently lend itself to bottlenecks, and so foresees minimal issues. In the event of disruptions, Oberman said, STB would require CPKC officials to submit a service recovery plan and a detailed explanation of their operations. During their seven-year oversight period, the board will also require CPKC to keep interline connection points open and justify rate increases upon request.

We may start to see cargo moving along the new CPKC line as early as April 14.

brief: Knight-Swift Transportation Holdings Buys Rival Trucker U.S. Xpress Enterprises

One of the largest trucking operators in the U.S. is about to get bigger. In a $808 million deal, Knight-Swift Transportation Holdings Inc. is acquiring U.S. Xpress Enterprises Inc. in the hopes that the merger will expand its network and net an additional $2.2 billion in total operating revenue. Following a string of recent acquisitions, Knight-Swift is now far and away the country’s largest truckload sector operator.

By bringing U.S. Xpress’ territories and assets under their operational wing, Knight-Swift hopes to offer better service, faster delivery times and broader accessibility to shippers. Following the acquisition, U.S. Xpress will continue to operate under its own brand while adopting Knight-Swift’s operating infrastructure, keeping in line with previous Knight-Swift mergers.

“The markets [are] counting on the fact that Knight-Swift is a great operator, and they can basically improve the margins and return that U.S. Xpress was getting,” explains Mike Regan, Chief of Relationship Development at TranzAct Technologies. “Whether or not that occurs will be seen.”

Knight-Swift has developed a tendency to buy struggling enterprises and turn them around for profit, and it’s paid off — the company reported $7.4 billion in overall revenue in 2022. Despite a 4% decline in the fourth quarter due to a slow freight season, Knight-Swift representatives are confident the acquisition of 21,600 new transport vehicles from U.S. Xpress will contribute to a 30% increase in its revenue base, not to mention a hefty boost to its shipping network.

Report: FMCSA Modifies Electronic Logging Regulations, to Mixed Reactions

Call it increased accountability measures or call it Big Brother — whatever you call it, the trucking industry is fraught with ongoing electronic logging device (ELD) drama.

In 2018, the Federal Motor Carrier Safety Administration (FMCSA) began requiring all commercial truck drivers to log their working hours using ELDs. In combination with the 1938 law limiting truckers to 11 hours of work per 14-hour window, the FMCSA law was intended to curb accidents and fatalities on the job. However, the ELD mandate has only seemed to exacerbate those issues and add more stress to an already stressful occupation.

Truck drivers are paid per mile driven — no more, no less. This incentivizes drivers to cover as many miles as they can, while never exceeding 70 hours in an eight-day period. In the days of paper log books, drivers used to be able to skirt the rules — an industry open secret, in the vein of “What they don’t know can’t hurt them.” In many ways, truckers could not successfully do their jobs without coloring outside the lines.

But now, restricted to digitally logging 11 working hours per 14-hour window, drivers are finding it increasingly challenging to meet their delivery deadlines without overstepping FMCSA rules. For example, if a driver finds themselves 30 minutes from their destination but they’ve hit their 11th hour on shift, they have to stop and log 10 hours off, or face the consequences. And there’s no way to get around this conundrum, because the ELDs are always watching.

This mandate inevitably causes shipping delays, not to mention furious customers and a black mark on trucking companies’ records. If customers are made to wait 10 hours for a shipment because a driver is hamstrung by their ELD records, the customer is well within their rights to cut ties with that shipping partner and call in a competitor.

To make matters more confusing, ELD adoption does not eradicate the possibility of human error. Drivers often forget to log out of their ELD sessions when they go off shift, resulting in disciplinary action for exceeding the 11-hour rule. Industry veterans are also reluctant to use the devices, since the constant digital monitoring erodes their sense of independence.

So, faced with ongoing tech hurdles, worker attrition, and thousands of disgruntled truck drivers, the FMCSA recently proposed modifications to the ELD rules to make the devices easier to use and less prone to error. The modifications would address ELD certification, malfunctions, technical specifications and the process for removal from the FMCSA’s certification list. The modifications would also require the devices to be installed in trucks with pre-2000 engines, which are currently exempt from the ELD mandate.

According to Collin Mooney, executive director of the Commercial Vehicle Safety Alliance, “Expanding the ELD requirement to include these types of vehicles would bring more vehicles under the ELD requirement and help improve hours-of-service compliance and roadway safety for those vehicles.” It must be noted, too, that ELDs have the potential to cut down on driver detention at receiving facilities, since trucking companies can use tracking data to demand compensation for drivers’ wasted time.

But those out on the open road aren’t so sure. Even professional drivers tend to speed, make reckless decisions and forgo rest when attempting to rack up miles and beat a deadline — all of which can result in much worse things than a late shipment. Whether updated ELD regulations will improve safety ratings and streamline logistics in the long run remains to be seen.

Update: Trouble on the Horizon: Labor Talks Are Not All Smooth Sailing

In an uncomfortable case of “he said, she said,” U.S. West Coast dockworkers’ union is accusing the Pacific Maritime Association (PMA) of spinning routine trucking delays into a ploy to turn public opinion against the workers.

This is the first real public sign of trouble in the year-long contract negotiation talks between the PMA and the International Longshore and Warehouse Union (ILWU), which until now have been cordial, albeit slow. Despite a joint agreement that neither party would speak to the media until a decision had been reached, PMA publicly alleged that delays at shipping terminal gates were caused by dockworkers failing to stagger their meal breaks, leaving trucks idling. The ILWU denies this claim, citing efforts to place additional support at the gates on either side of their lunch hour.

This sour note comes at an inopportune time, as U.S. importers and retailers are determining which carriers and ports they’ll give their business to this year. Contract negotiations are already slow due to lower rates and a fear of commitment from carriers and shippers, says Robert Khachatryan, CEO of Freight Right Global Logistics.

“This year it looks like negotiations are moving slower because of the continued drop in rates,” Khachatryan told Bloomberg news. “Carriers don’t want to ink deals that would have them moving cargo below cost, and shippers don’t want to lock in rates that are above the spot rate.”

While some at the top fear a continued decline in West Coast container volumes, others on the ground say they haven’t noticed any significant delays in port operations. Perhaps the best thing the PMA and ILWU can do is forgive, forget and drop the back and forth.

Thanks for joining us for our second Shipment of the year. Stay tuned for more updates on these stories and more as we settle into 2023. In the meantime, please visit our blog or resource center for additional insights, or contact us directly to find out what the experts at Legacy can do for you.

‘Til next time, over and out.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more -

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more