Issue 25: April 2022 LMI, The Hidden Cost of Rising Fuel Prices & More

A WORD FROM LEGACY

They say “when it rains, it pours,” and that’s certainly true when it comes to logistics news. From ILWU contract talks and rising diesel prices to new plans for supply chain policy and a cynical take on giant container vessels, we’ve got a lot of ground to cover, and only so much space to do so. To that end, let’s get right to it, starting with our Market Update.

MARKET UPDATE

April 2022 LMI Drops to 69.7 as Transportation Market Enters Period of Expansion

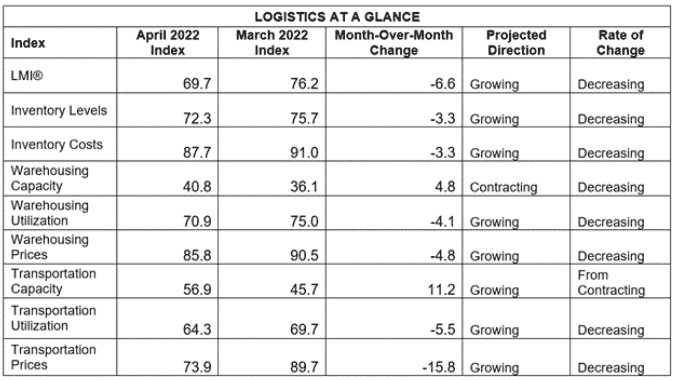

Just when it seems as though the Logistics Manager’s Index (LMI) was doomed to continue its ascent, this month’s report reveals a reading of 69.7, down 6.5 points from March’s 76.2 score. Though this reading is still above the all-time average of 65.3, it’s a noteworthy downward shift — one that can be attributed to expansion within the transportation sector.

That’s right — for the first time in nearly two years, the Transportation Capacity index has increased, up +11.2 points from March 2022 for a reading of 56.9. Likewise, Transportation Prices have decreased by 15.8 points to 73.9. Although there’s still significant growth within the sector, the LMI reports that it’s simply taking place at a slower rate than in months and years past.

On the whole, transportation remains one of the most dynamic components of the LMI, with major shifts often corresponding to changes within the U.S. economy. For example, the deficit between the Transportation Prices and Transportation Costs indices was 59.4 points in April 2021, when the economy was beginning its recovery. By comparison, the deficit between these two indices is now just 17 points as the economy enters a period of significant inflation.

Though the freight market has slowed, it certainly hasn’t come to a stop. Capacity is beginning to expand, and FreightWaves tender rejection index has plummeted from 25.45% in April 2021 to 10.89%, meaning carriers are now able to accept 9 out of every 10 loads. With that said, 10.89% is still a notable increase from April 2019’s 4% tender rejection rate, indicating that although things look better for shippers, we aren’t out of the woods just yet. Additionally, demand for trailers and new Class-8 trucks has increased, outstripping available supply.

Continuing with April 2022’s transportation-heavy focus, the LMI’s Transportation Price index came in at a reading of 73.9 (-15.8 from March 2022) and the Transportation Utilization index registered at 64.3 (-5.5 from March 2022). These readings indicate that the freight market is regressing toward the mean; however, smaller carriers and newer market entrants continue to struggle with lower demand, preventing them from capitalizing on the rate of growth. Intermodal options remain limited due to railroad congestion and a shortage of rail cars, which presents issues for companies looking to move agricultural products.

Rising fuel prices are one of the top stories for the month, with diesel prices hovering well above $5.00 per gallon. Reasons for these skyrocketing prices include rising inflation, the Russian invasion of Ukraine cutting off available fuel supply and a shortage of labor and equipment impeding U.S. oil production. Despite these record fuel prices, spot truck market rates have actually decreased; contract rates are likewise on the decline, albeit at a slower pace.

Despite the rising cost of goods due to inflation, consumer spending grew through Q1, up 0.7%. As a result, Inventory Levels — while down slightly from March 2022 — remain high at 72.3, as do Inventory Costs at 87.8. With the ongoing Shanghai lockdown, all eyes are on China. The Chinese Purchasing Manager’s Index registered a reading of 47.4 for April 2022 — its lowest reading since February 2020 — indicating significant contraction. Factory production and export orders are even lower, at 44.4 and 41.9, respectively, and many carriers are deliberately avoiding the Port of Shanghai. The LMI predicts that, given the situation, we’ll likely see a slowdown at U.S. ports in Q2 similar to the one we saw in 2020, followed by months of congestion as shippers scramble to catch up.

Last, but certainly not least, Warehousing Capacity (40.8) continues to contract as demand for warehousing outpaces available supply, and downstream firms report high rates of Warehousing Utilization Growth (76.4). Strangely enough, despite this continued demand, Amazon reported its slowest rate of sales growth in 20 years and paused plans to double the size of its fulfillment network. The LMI predicts that if Amazon’s slowdown in sales is any indication, eCommerce may have hit a temporary saturation point.

Also in Today’s Shipment:

- The long-anticipated ILWU contract negotiations are finally here.

- FreightWaves editorial director Rachel Premack makes the case against big boats.

- Newly appointed Chamber of Commerce VP shares plans for shaping supply chain policy.

- Exploring the wide-ranging effects of rising diesel prices — and what’s being done to mitigate them.

IN THE NEWS

All Eyes on the West Coast as ILWU Contract Talks Begin

After months of nervous anticipation, contract negotiations between the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA) officially began on May 10. The bargaining agreement will cover more than 15,600 dockworkers at 29 ports, including those at the Ports of Long Beach and Los Angeles, who belong to ILWU Locals 13, 63 and 94. PMA is responsible for representing the interests of 70 ocean carriers and marine terminal operators along the West Coast.

In the lead up to the negotiations, PMA President and CEO Jim McKenna offered his thoughts on the situation at the Port of LA’s monthly media call.

“I think the pandemic and coming together and really working towards overcoming obstacles has really solidified our ability to work together,” said McKenna. “I think as we head into negotiations, we are going to see that same type of attitude. […] Hopefully everybody is focused to the point that there will be no further disruption to a fragile supply chain and I think we are going in with that spirit of cooperation.”

This sentiment is consistent with that expressed by the two parties in a joint statement issued on May 9. “Talks are scheduled to continue on a daily basis until an agreement is reached,” the statement reads. “Both sides said they expect cargo to keep moving until an agreement is reached.”

When asked about the expected duration of the talks, McKenna made clear that he expects them to extend beyond the current contract’s July 1 expiration date, citing the extended timeframe of prior negotiations. Indeed, the past three ILWU contract negotiations — which took place in 2002, 2008 and 2014 — ran three months, three weeks and eight months, respectively, past their expiration dates. Hopefully, that’s the only way these talks will mirror past negotiations; there’s little desire amongst shippers to repeat the events of 2002, which resulted in port shutdowns, or 2014, which led to work slowdowns.

Although the outcome of these contract negotiations will not be made available to the public, we do have a good sense of what each party aims to achieve. According to the PMA’s website, the association aims to:

- Engage in good-faith talks without work disruptions

- Provide longshore workers with world-class wage and benefits

- Prioritize safety and training

- Modernize terminals to handle cargo growth

- Meet stringent environmental regulations

ILWU President Willie Adams released an open letter on May 6, citing ILWU dockworkers’ commitment to keeping cargo moving throughout the pandemic and expressing concerns about terminal automation.

“To strengthen America’s economy, it’s not enough for ports to hold the best economic cards,” said Adams. “They have to play them in ways that help the American workers who make, grow, and move the things we need for our lives. […] I can tell you that the men and women of the ILWU are looking forward to the opportunity to meet with the employers and seek a contract that honors, respects, and protects good American jobs and U.S. importers and exporters, while reflecting the hard work they have been doing not only throughout COVID but in our 88-year history at the ports.”

OPINION

Could Colossal Container Vessels Be Contributing to Supply Chain Chaos?

“Giant container ships are ruining everything” — so says Rachel Premack, editorial director at FreightWaves, in a new opinion piece.

The Emma Maersk’s 2006 debut sent shockwaves through the global shipping community; the first in its class, this massive container ship was capable of carrying 15,000 twenty-foot equivalent units (TEUs). In the years since, container vessels have only gotten bigger, with new models boasting a capacity of over 24,000 TEUs. These ships, Premack argues, bear at least partial responsibility for “much of our ongoing shipping crisis” — and she has the research to back it up.

In preparation for the piece, Premack spoke to four industry experts — Campbell University professor Dr. Salvatore Mercogliano; Capt. John Konrad, CEO of gCaptain; University of Vermont professor Richard Sicotte; and Matt Stoller, director of research at the American Economic Liberties Project — before coming to the following conclusions:

- Megaships underpin the global shipping oligopoly: Compared to the 1970s, when the existence of hundreds of carriers prevented any one company from dominating market share, alliances and acquisitions have led just 10 major carriers to command 80% of the market. While consolidation may be good news for carriers, boosting their financial performance, it also gives them substantial leverage over importers and exporters, enabling them to charge inflated rates.But where do massive container ships factor into the equation? Prior to the 2008 financial crisis, banks were all too happy to finance the production of giant ships, but when the recession hit, “the freight dried up.” While many carriers went bankrupt, those that remained closed ranks, choosing to form alliances rather than continue to compete. Which brings us to today: With just 10 companies responsible for moving most of the world’s goods and commanding entire fleets of massive container vessels, shippers are left with few alternatives.

- Megaships cause port congestion: The ships keep getting bigger, while ports remain the same size — that’s the basic premise behind Premack’s second assertion. Although giant ships are highly effective at moving large volumes of cargo across oceans, ports simply weren’t designed to accommodate vessels of this size, leading to port congestion and — in worst-case scenarios — ships getting stuck.Although modernization efforts are underway at some ports, it’s taxpayers who end up eating the cost for these upgrades. For example, the Port Authority of New York and New Jersey spent a whopping $1.7 billion to raise the Bayonne Bridge to make way for megaships, a project that was fully funded by taxpayers.

- Megaships are the cause of ocean carriers’ financial struggles: It seems ocean carriers have yet to learn their lesson from Hanjin going under, as they continue to invest eye-watering sums into the production of mammoth ships. In theory, these vessels should have been profit and efficiency drivers, but in reality they lead to overcapacity — which, in turn, led carriers to drive down shipping rates and forced many into bankruptcy. Although the pandemic has enabled major carriers to recoup some of these costs, Premack suggests that this windfall is temporary, and that the days of the megaship are nearly over.

BRIEF

Pain at the Pump: Unpacking the Impact of Rising Diesel Costs

As noted in our Market Update, diesel costs have hit record highs, with the national average reaching $5.62 per gallon. With trucking companies dependent on diesel to keep things moving, shipment costs have skyrocketed, throwing many businesses’ transportation budgets into disarray. According to the Wall Street Journal, one manufacturing company reported that its shipping costs had risen as much as 15% to 20% compared to this time last year.

Smaller trucking fleets have also found themselves hard-hit by increasing costs; although larger companies typically build fuel surcharges into contracts in order to cover rising fuel costs, many smaller companies and independent owner-operators can’t afford to pass expenses on to their shippers without alienating their customer base. As a result, these smaller fleets have been forced to burn through their cash flows, with little cushion to fall back on.

From contributing to worsening inflation and placing strain on the transportation sector, it’s clear that rising diesel prices pose a direct threat to U.S. infrastructure. And overseas in Europe, economies face a shortage of diesel, which could severely impede economic growth.

In response to these challenges, the International Road Transport Union (IRU) has launched a 17-point emergency plan to help governments around the world address rising fuel prices and their impact on transportation networks. These points include “an adjustment mechanism on fuel excise for commercial transport operators,” a call “for all modes of commercial transport to pay the same fuel tax to keep decarbonisation plans on course” and recommendations for governments to “review decarbonisation policies carefully to plan a more gradual shift to renewable fuels.”

Although the IRU’s plan clearly takes a long-ranging approach to combating astronomical diesel costs, it points to an interesting conclusion: that rising fuel prices could accelerate the transportation sector’s adoption of renewable energy.

INTERVIEW

Newly Appointed Chamber of Commerce VP Shares Policy Vision

Last month, the U.S. Chamber of Commerce promoted John Drake to Vice President of Transportation, Infrastructure and Supply Chain Policy. Prior to this appointment, Drake held the title of Executive Director of Supply Chain Policy and, before joining the Chamber of Commerce, served as the senior manager of public policy at Amazon and was a senior appointee in the Department of Transportation.

In a new interview with FreightWaves, Drake shared his thoughts on how the Chamber of Commerce plans to shape supply chain policy. Here are some highlights:

- On the decision to combine supply chain and transportation/infrastructure portfolios: “Supply chain challenges as well as transportation and infrastructure investment are important issues for the business community. The primary justification for combining the two roles into one is because there’s a lot of overlap in those two buckets. When I was just doing supply chain work, much of the focus was on ships and the backups at the ports, even though you could make the case it was a transportation and infrastructure issue.”

- On legislative priorities heading into the midterm elections:

- “A big focus is the America Competes/USICA legislation. It includes a supply chain resiliency office to be established at the Department of Commerce, which is intended to take a strategic look at the resiliency of key supply chains critical to the U.S economy.”

- “The Ocean Shipping Reform Act is getting quite a bit of attention. Both the House and Senate versions have passed their respective chambers, I think that will likely get negotiated into law before the end of the year.”

- “Regarding the [upcoming] FAA reauthorization bill, airfreight is very important because of the high-value products carried.”

- “After that, we’re focused on the success of the infrastructure bill, making sure that those dollars are spent well, but the biggest impediment to it is the permitting process.”

- On policies to address diesel prices:

- “To take gasoline off the table, or push policies that make it harder to find new sources of fossil fuels, are bad. So on the permitting side for new energy projects, I think we need to be mindful because trucks will still be requiring diesel for the near future.”

- “The Chamber does not support a gas tax holiday — it’s not clear that that will actually result in a lowering of prices, while the revenues generated from that tax are critical for building the infrastructure we need going forward.”

- “Fuel prices are the No. 1 driver of costs for the trucking industry, which is hurting because of this but also due to labor challenges. […] I think there’s real opportunity on the driver side to get the under-21 pilot underway at DOT.”

- On ILWU contract negotiations: “I think the administration needs to understand that these negotiations going south is bad for everybody, especially if you care about congestion at our ports, and inflation generally. So I think the administration needs to lean in hard to get a good resolution to this next contract. Part of that needs to be automation.”

We’ve had the quite the roundup this month, and we still weren’t able to get to all the stories we wanted to cover, so here’s some additional reading to keep you busy:

- Locked-down Shanghai finds new cases, breaking “zero COVID” streak (Reuters)

- U.S.-EU Trade and Technology Council establishes Economic and Technology Policies & Initiatives (White House)

- Shipping bottlenecks hit Port of New York and New Jersey (WSJ)

- Carriers, shippers grapple with how to cut emissions in airfreight (SupplyChainDive)

- Transit times reveal true state of reliability, not queueing ships (The Loadstar)

We’ll also continue to keep a close eye on developments in the ILWU contract talks, so be sure to stay tuned for updates in future Shipments. Until then, we encourage you to check out our blog or resource center for even more industry insights, or reach out directly with any questions you have for the Legacy team.

We’ll see you in the next Shipment.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.

Popular Posts

Search Posts

-

6 Cornerstones to a Successful 3PL-Customer Relationship

Hiring a third-party logistics (3PL) provider is a strategic approach for businesses to increase their capacity without expanding their...

+ Read more -

Canadian Rail Strike? – What We Know So Far

On May 1st, CN (Canadian National Railway) and CPKC (Canadian Pacific Kansas City) rail workers voted overwhelmingly to authorize a strike...

+ Read more -

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more