Issue 15: The Effects of Deregulation, Growing Concerns Around Climate Change & More

Welcome once again to the Legacy Monthly Shipment, your destination for all things transportation management-related.

With spot rates still on the rise and port congestion a continued concern, it may seem like June has more of the same in store for us, but we have some exciting stories to share that we think may be of interest. Let’s get started.

Today’s Shipment:

- Nearly 50 years out, we look at how deregulation has led to the dwindling carrier market.

- Growing concern around the impact of climate change puts ports under the microscope.

- Partial closure of one of the world’s busiest ports intensifies congestion and spot rate hikes.

- All signs seem to indicate that the U.S. rail freight market is on track for recovery.

- According to one supply chain expert, the current truck driver shortage is just more of the same.

REPORT

Going, Going, Gone: As Carriers Consolidate, Shippers Suffer the Consequences

In the April 2021 issue of the Monthly Shipment, we touched on how the consolidation of the ocean carrier market over the past decade has contributed to spot rate hikes and high contract rates today. But the ocean freight market isn’t the only one marked by a scarcity of carriers — according to a recent article from Mark Solomon for FreightWaves, the air and rail markets, as well as the parcel and LTL industries, are similarly afflicted.

Per FreightWaves, the dwindling number of carriers can be attributed to deregulation, which began in 1977 and continued over a nearly 20-year period. Although proponents of deregulation argued that it would increase competition within the carrier market and drive rapid innovation, it’s seemingly had the opposite effect: Rather than heighten tensions between carriers, deregulation has instead inspired them to close ranks and build alliances. The result? Fewer options available to shippers and an exceedingly strong carrier market.

There are, of course, exceptions to this: Carriers in the truckload industry and brokerage sector have not consolidated in the same way that their counterparts have. Both markets remain highly fragmented, however — as Solomon notes — they face their own issues with shrinkage, which also leave shippers at a disadvantage.

On the whole, transportation capacity consolidation in the ocean, parcel, LTL and rail industries has had its ups and downs. Carriers’ ability to scale has certainly led to greater efficiency, better service and cost reductions for shippers, however, shippers’ gains vary by industry.

In the parcel industry, FedEx and UPS have a firm hold on the market, as their market share and service capability allow for unobstructed rates or accessorial increases and enable them to dictate buying terms. Rail carriers have a similar advantage. The ocean freight market is similar in many ways, but ocean carriers must also shoulder the burden of high infrastructure investment.

Transportation capacity consolidation in the ocean, parcel, LTL and rail industries has been both good and bad. The carriers’ ability to scale has resulted in more efficiency, greater technology, expanded services and cost reduction for shippers. However, shipper gains vary by industry. Similar to the Organization of Petroleum Exporting Countries (OPEC), historically, ocean carriers’ ability to manage market pricing has been mixed. That said, in the past 12 months, ocean carriers have shown remarkable improvement in their ability to manage capacity and price, which continued consolidation will enhance.

Finally, LTL industry consolidation grants the top 10 carriers approximately 70% of market share, as well as more advanced technology and a diversity of services to deliver freight. These carriers have a strong hold on the market coming off the Great Recession and have the ability to escalate prices one to two times a year without significant buyer negotiating power.

Although carrier consolidation can lead to greater rate stability over time, it also means that carriers will be able to more easily manage capacity and artificially manage supply to keep rates high, even in softer markets. To get the most favorable rates possible, shippers are advised to diversify their carrier base if volume allows. Non-asset-based providers, such as brokerages and NVOCCs, can help drive cost out, offer access to more advanced technology and provide more diverse services with a higher level of touch than most asset-based carriers.

BRIEF

Are Ports Prepared to Handle the Effects of Climate Change?

After numerous severe weather events — including the storm that led to the disastrous ONE Apus incident in November 2020, which put the container vessel out of commission until this past March — a growing number of shippers and carriers are turning their attention to the impact of climate change on the global supply chain.

Ports, in particular, have proven to be an area of concern. Based on their waterfront location, ports are most likely to be affected by severe weather events, such as hurricanes, as well as rising sea levels. And, given how interconnected the supply chain is, many downstream assets depend on ports’ ability to maintain business as usual. As a result, there’s been mounting pressure for ports to establish protections — a task that some are better at than others. For example, according to a report from Matt Leonard for SupplyChainDive, the Ports of New York and New Jersey made significant operational and structural improvements in the aftermath of Hurricane Sandy. The Port of Los Angeles has a dedicated plan for making infrastructural changes based on the findings from a 2018 report on its exposure to sea-level rise.

Unfortunately, the Ports of NY, NJ and LA are the exception, rather than the rule. According to research from the University of Rhode Island, only 10 ports out of roughly 300 in the U.S. have undergone resilience planning. This can be attributed to a number of factors: At present, there are no formal standards for these protections, leaving ports without a definitive roadmap. Likewise, there are no official mandates to incentivize ports to actually make the necessary upgrades. Then, there’s the matter of complexity: Since the supply chain is so interconnected, ports looking to engage in resilience planning must work closely with utilities providers, port tenants and government agencies to implement changes.

NEWS

COVID-19 Outbreak Causes Yantian Port Closure, Worsening Congestion

Just when it seems like the tail end of pandemic-related supply chain disruption is nearly in sight, it rears its ugly head yet again. A COVID-19 outbreak on May 21 prompted a partial closure of the Chinese hub port of Yantian, one of the busiest in the world. Though brief, the closure has led to hundreds of canceled sailings and has created a considerable backlog at the port, exacerbating the global container shortage and the rise of container freight rates from Asia. As of June 7, the Freightos Baltic Index registered an 11% increase on spot rates from Asia to North Europe, at $10,492 per 40 ft.

Perhaps unsurprisingly, the situation is going to get worse before it gets better. In an official statement, Maersk announced that “The situation continues to deteriorate as more positive COVID cases have been confirmed in Shenzhen where Yantian port and Shekou port are located and in Guangzhou where Nansha port is located.” The Danish shipping company also reported that, as of June 7, “export laden container gate-in continues to be accepted only 3 days prior to vessel ETA, and only after the terminal confirms the advance reservation made by trucking companies for laden containers gate-in in Yantian port.”

The Yantian COVID outbreak is yet another example of the fragility of supply chains. Unfortunately, disruptions are inevitable, and importers should plan accordingly. For example, North American inventory levels remain very low. In response to this, the Legacy team expects importers to build high inventory levels in the future to mitigate potential supply issues. We also expect importers to add redundancy to their supply chain where possible and to consider more near-sourcing.

To give yourself the best possible chance of weathering disruption, we recommend the following:

Today’s Shipment:

- Map out your supply chain and determine where redundancy is needed (and possible)

- Run disruption scenarios to test possible outcomes

- Evaluate future inventory plan levels to offset potential supply issues

- Evaluate your customer contracts for any impact resulting from supply disruption

OUTLOOK

New Data Offers Positive Outlook for U.S. Rail Freight Market

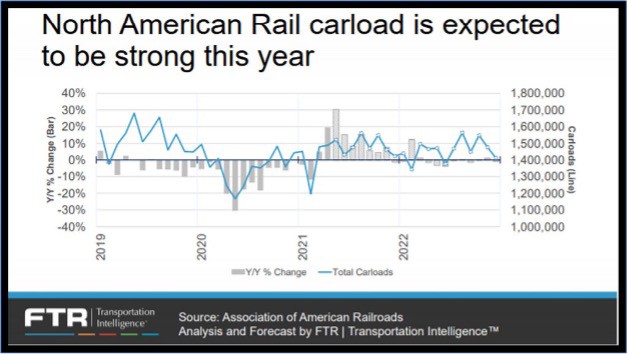

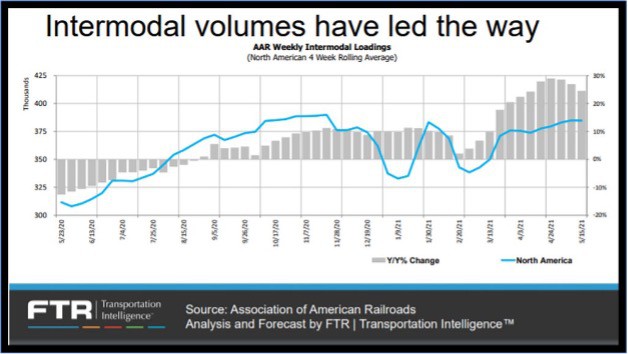

In a bit of happier news, it looks as though the U.S. rail freight market is on track to to recovery. New data compiled by the Association of American Railroads and analyzed by FTR Transportation Intelligence indicates that North American rail carload is expected to be strong for the remainder of 2021, with rail intermodal volumes leading the way. Speaking of intermodal volumes, those have rebounded from record lows last spring, as have selective carload commodity shipments and rail grain shipments. As is typically the case, this recovery — including recovery within distinctive commodity markets — is consistent with the steady recovery of the overall U.S. economy.

The Class 1 railroads — BNSF Railway Co., CSX Transportation, Canadian National, Kansas City Southern Railway, Norfolk Southern, Canadian Pacific and Union Pacific Railroad — all play a significant role in the movement of industrial goods from the steel, energy and agricultural industries by rail car. They’re also responsible for moving finished products intermodally within North America, as well as internationally. Each of these railroads is evaluating its infrastructure in order to drive out inefficiencies and enhance services to meet the growing global economy.

The economic slowdown resulting from the COVID-19 pandemic seems to have finally come to an end, with a strong rebound in demand for rail services, which could result in future carrier consolidation. Looking at the current market, we see rail backlogs of up to three weeks in the Ports of NY, LA and Long Beach. It’s clear that more port and rail infrastructure will be necessary in order to handle current and growing intermodal volumes, especially if the current truck driver shortage persists.

OPINION

According to Experts, Truck Driver Shortage Comes as No Surprise

As regular readers are well aware, the astronomical increase in online sales volumes during the pandemic has placed shippers between a rock and a hard place. Although shippers are desperate to meet delivery demands, the ongoing driver shortage has made it almost impossible to do so. And, according to a recent report from CNN Business, shippers’ best efforts to attract talent — including offering substantial pay hikes — have done little to generate actual interest. According to some industry insiders, it might even have the opposite effect, as many truck drivers are using the increased pay as an opportunity to work fewer hours and spend more time at home.

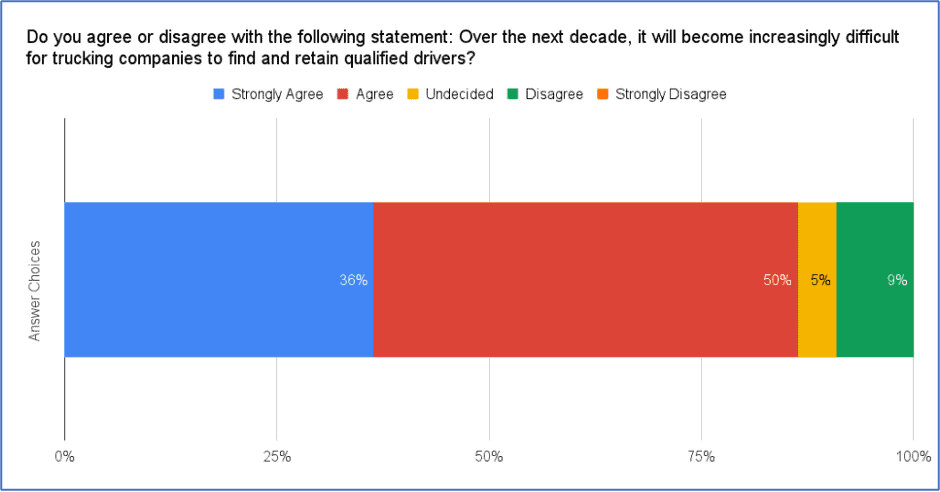

What’s new about the current shortage? If you were to ask Adrian Gonzalez, not much. In his latest article for Talking Logistics, the transportation management expert and president of Adelante SCM (a proud Legacy partner) argues that although the causal factors behind the shortage may be unique, the shortage itself isn’t. In other words: same story, different day.

And Gonzalez is far from alone in thinking so. According to a 2019 survey he conducted across Indago members — all of whom are supply chain and logistics executives — the vast majority of respondents either agreed (50%) or strongly agreed (36%) that it would become increasingly difficult for trucking companies to find and retain qualified drivers over the next decade.

We here at Legacy agree with Gonzalez’s take. Truck drivers have a very difficult job, one in which they’re responsible for managing the demand of delivery timelines, finicky shippers and an impatient environment on roads and highways. The level of respect that drivers actually receive in no way corresponds to the difficulty of the work they do — truck drivers are truly the backbone of the supply chain and are often taken for granted. To attract more drivers, the industry will have to do more than just offer greater pay — it must provide additional comforts for drivers on the road and find ways to leverage technology in order to reduce strain or demand on drivers.

Shippers: Drivers and their companies are your partners in the supply chain, so it’s important to value them as such. In order to show drivers the respect and appreciation they deserve, as well as to ensure that you receive the best service possible, try to become a shipper of choice — here are a few tips to help get you started:

- Pay carriers quickly and accurately.

- Efficiency is key, so don’t keep drivers waiting.

- Remember the Golden Rule: Treat drivers and carrier staff as you would want to be treated.

- Try to be flexible; work with carriers on pickup and delivery times or general operational needs.

- Offer greater visibility by planning and giving carriers lead time; if you anticipate changes in your business, let carriers know as soon as possible so that they have time to adapt.

- Communicate with carriers early and often.

- Work closely with carriers to understand how you can help them drive efficiency, while still meeting your shipping demands.

As always, we appreciate you taking the time to read and hope these insights have been useful. Let us know what stories you’d like to see covered in next month’s Shipment, or head on over to our blog or resource center for more industry insights.

See you next month — Legacy, over and out.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more -

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more