Issue 21: Omicron Variant Could Delay Supply Chain Recovery

A WORD FROM LEGACY

With the end of 2021 drawing near and a new year in sight, it’s almost impossible not to reflect upon the considerable changes that both Legacy as a company and the logistics industry as a whole have been through.

For our part, we’ve undergone a company-wide rebranding, enjoyed a few wins and, of course, helped countless clients navigate uncharted waters. On a macro scale, there have been lows in the form of interminable port congestion, high freight rates and the ever-looming specter of COVID-19 — but there have been high points, too. From the widespread distribution of vaccines to the steady-but-sure recovery of the global economy, there has been as much cause for celebration as there has been for concern.

Though the future remains uncertain, we head into 2022 with the knowledge that in order to find a way forward, you need to learn to take the bad with the good. We encourage you to keep that in mind while reading these stories, and beyond. Now let’s get started.

MARKET UPDATE

Logistics Industry Continues to Expand with 73.4 LMI Score for November 2021

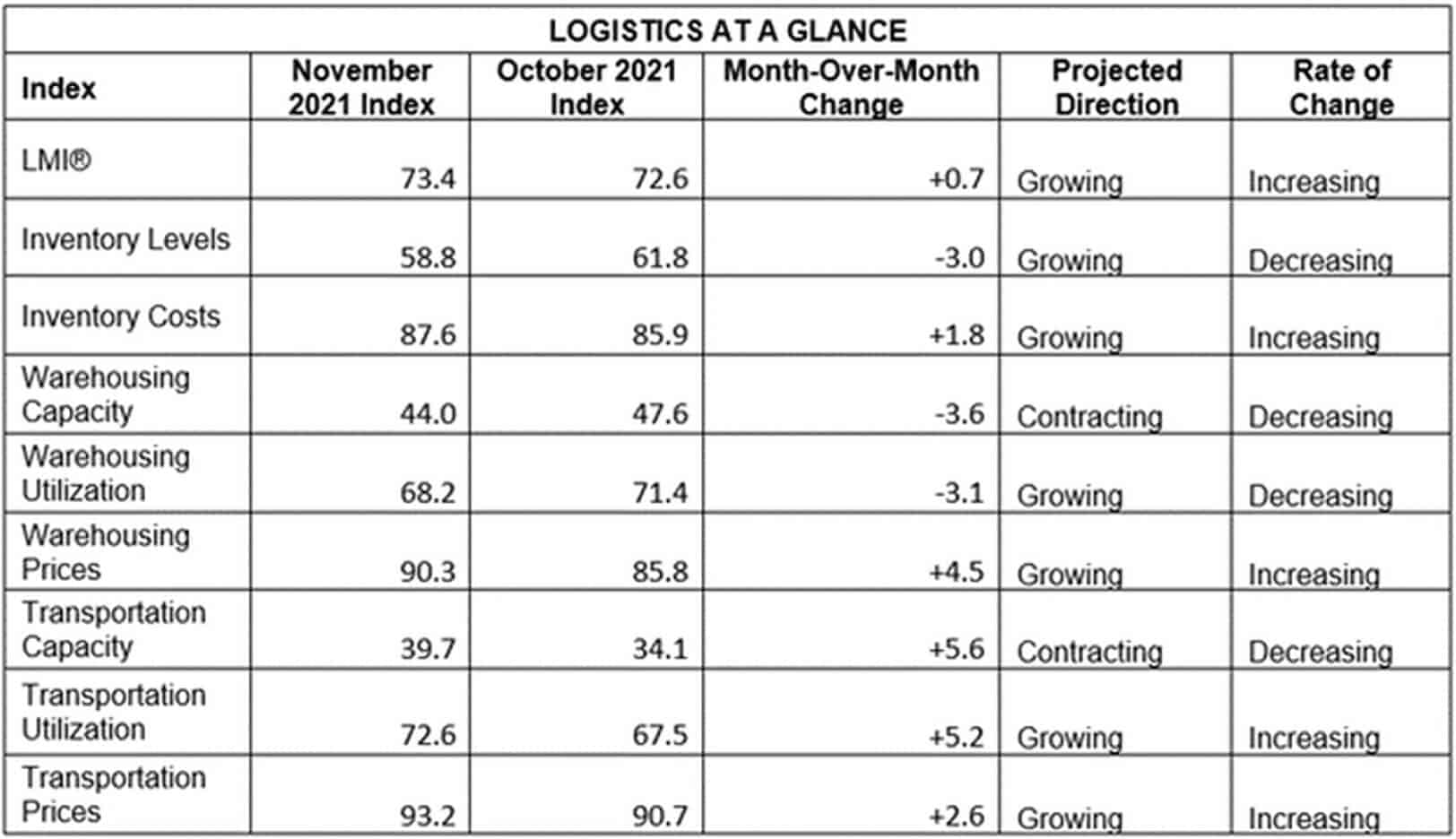

The November 2021 Logistics Manager’s Index (LMI) is up 0.8 points from October’s reading, for a score of 73.4. According to the LMI report, “Overall growth has now been over 70.0 — a level we would classify as significant expansion — ten months in a row and 13 of the last 15.”

Though the report notes that “this month’s number is driven by many factors,” rising warehousing costs have been a major contributor. In fact, the Warehousing Prices Index reached a reading of over 90.0 for the first time in LMI history, in large part “due to the rapid movement of a significant volume of inventory from upstream storage … to downstream retailers.” Though this aggressive approach has driven warehousing costs up, it’s paid off in a big way, with holiday season inventory shortages being nowhere near as severe as originally anticipated.

November also saw retailers taking a new strategic approach to holiday sales, spreading out discounts and special offers throughout the shopping season so as to prevent sudden spikes in demand. As a result, Black Friday and Cyber Monday sales were down from 2020, a decrease of 1.1% and 1.4%, respectively. That said, peak season retail sales remained strong, with the National Retail Federation forecasting an 8.5%–10% increase in November and December year-over-year sales.

Much like retail sales, the U.S. economy also continues to grow, with the addition of 210,000 jobs. Though this is less than the 550,000 jobs predicted, 25% of jobs added were in the transportation and warehousing sectors, which should help with capacity constraints — a sorely needed win, given that the Warehousing Capacity Index was down to 44.0, marking the 15th consecutive month of contraction.

This contraction is due, in part, to the fact that ports are now threatening to impose fines on idle containers in an effort to reduce congestion. Rather than pay these fines, importers have scrambled to find warehousing space for goods, which has also increased Warehousing Utilization (68.2) and Warehousing Prices (90.3). Actually moving inventory also remains challenging due to contracting Transportation Capacity (39.7), which has led to high Transportation Utilization (72.6).

To see a full reading of the LMI, including scores across individual indices, please refer to the chart below.

Also in Today’s Shipment:

- Uncertainty around the omicron variant threatens to deal another blow to the global supply chain.

- Despite promises of expedited shipments, cargo handling delays plague the air freight market.

- The FTC launches an official inquiry to assess the damaging effects of anticompetitive practices.

- Improved port congestion disguises a massive container ship backlog on the West Coast.

NEWS

Omicron Variant Could Delay Supply Chain Recovery

Already overtaxed supply chains are about to face their next big challenge. On November 26, the World Health Organization (WHO) declared the B.1.1.529 variant of COVID-19 — known as omicron — a variant of concern. According to the WHO’s official announcement, “Preliminary evidence suggests an increased risk of reinfection with this variant, as compared to other [variants of concern].”

Though the full picture has yet to emerge around the omicron variant, which was first reported in South Africa and has since been detected in the U.S., Canada, Australia, Brazil and throughout most of Europe, it has the potential to lead to a new series of lockdowns and enforced quarantines in major manufacturing hubs. There are also concerns that the spread of omicron will exacerbate the already troubling labor shortage, with workers understandably reluctant to work in close quarters and risk potential exposure.

This comes as unwelcome news to businesses and logistics professionals, as the emergence of the omicron variant threatens to put already fraught supply chains under additional stress and to reverse hard-won forward momentum. Consumers are similarly on edge, concerned that the variant’s spread will contribute to already significant inflation and increase already high gas prices.

All eyes seem to be on China now. At time of publication, there have yet to be any reported cases of omicron in mainland China; however, this is unlikely to last, especially given that Manzhouli, a city located in the Inner Mongolia Autonomous Region on the border of Russia, has become the epicenter of the most recent outbreak. Once cases are reported in the mainland, the Chinese government is expected to enforce its strict “zero-COVID” policy, which includes mass lockdowns, extensive testing, quarantine mandates, contact tracing systems and port restrictions. Industry insiders already anticipate that this zero-tolerance approach will result in widespread factory and port shutdowns, halting production and delaying shipments.

BRIEF

Shippers Contend with High Rates, Cargo Handling Delays in Air Freight Market

Speaking of the omicron variant, its effects are already being seen in the air freight market. Numerous nations have imposed travel restrictions in response to omicron’s outbreak, shutting down open travel corridors and significantly reducing available belly capacity. Despite reports that demand has softened, Bruce Chan, Director of Global Logistics at Stifel, stated that “Capacity seems to be getting tighter,” citing labor shortages and airport cargo congestion as contributing factors in addition to the new COVID variant.

Indeed, delays in airport cargo handling operations have significantly hampered the movement of freight, with cargo volumes dropping 1.2% from October to November. It isn’t an issue that’s specific to one region, either: Freight forwarders the U.S., Europe and Asia have all reported significant delays. Given that a growing number of retailers have turned to air freight in an attempt to expedite shipments, accepting high rates as the cost of doing business, these delays raise the question as to whether shippers are really getting what they pay for.

As for what lies ahead for the air freight market, the immediate future remains uncertain, but an unpleasant picture is starting to take shape. Even once the worst of the pandemic is over and the supply chain has entered a period of relative stability, changing social and cultural mores could mean reduced belly capacity and consistently elevated rates become the norm.

“There’s at least some risk that belly capacity may never fully recover if we see more permanent cultural adaptation to a hybrid in-person/virtual business environment,” said Chan. “Finally … we believe the eventual transition of discretionary dollar spend, away from goods and back to services, may be elongated as well.”

PRESS RELEASE

FTC Aims to Make Sense of Supply Chain Disruption with Official Inquiry

In a November 29 press release, the Federal Trade Commission (FTC) announced plans to conduct a study in order to “shed light on the causes behind ongoing supply chain disruption and how these disruptions are causing serious and ongoing hardships for consumers and harming competition in the U.S. economy.”

As part of the study, the FTC has ordered nine major retailers, wholesalers and consumer good suppliers — including Walmart, Amazon, Kroger, Kraft Heinz and Procter & Gamble — to share internal documents regarding supply chain strategy, pricing, marketing and promotions, sales volumes, market shares and more. The FTC has also solicited voluntary comments from these companies concerning their views on “how supply chain issues are affecting competition in consumer goods markets” and provided a 45-day window to respond to the inquiry.

Given the severity of ongoing supply chain disruption and its effects on the U.S. economy, the FTC is under mounting pressure to investigate anticompetitive practices amongst major companies, including those subject to the inquiry, that have either contributed to or have exacerbated the current situation. Though it’s unlikely that the inquiry will have any immediate results, antitrust specialists speculate that it could influence future regulatory actions.

UPDATE

An Astonishing 96 Container Ships Waiting to Berth at SoCal Ports

In the September 2021 issue of the Shipment, we reported that there were a record-breaking 75+ container ships at anchor or drifting in San Pedro Bay. According to a new report from American Shipper, that record has since been blown out of the water, with a total of 96 container ships now waiting to dock at the ports of Los Angeles and Long Beach — 40 within the 40-mile “in port” zone, and an additional 56 just outside of it. The backlog is so significant, in fact, that the queue of ships waiting to berth extends as far south as Mexico and as far west as Taiwan.

This stands in stark contrast to recent reports of reduced port congestion at ports along the Southern California coast. As noted in our market update, the ports of LA and Long Beach have threatened fines on idle containers; according to Gene Seroka, Executive Director of the Port of LA, this approach has resulted in a 40% decrease in ships at anchor over a four-week period. Under different circumstances, this would be a noteworthy achievement; however, once the Maritime Exchange of South California implemented its new queuing system and counting methodology in mid-November, it soon became clear that solving the issue of port congestion didn’t eliminate the considerable backlog of ships.

In fact, the queuing system — which reserves a ship’s spot in line based on its calculated time of arrival, rather than the previous “first-come, first-serve” approach — isn’t expected to reduce congestion or the number of ships waiting at all but was instead designed to improve safety and air quality off the SoCal coast. Though it will offer greater visibility into the total number of ships tied up in the bottleneck, the new counting methodology isn’t expected to offer any measurable improvements, either.

As has been the case for the better part of 18 months now, we find ourselves in a “wait-and-see” situation, so stay tuned for additional updates in the months to come.

That’s it for this month’s Shipment; we thank you for your time and, as always, encourage you to visit our blog or resource center or simply give us a call should you need assistance.

A very happy holidays from all of us here at Legacy Supply Chain — we’ll see you in 2022.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more -

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more