Issue 5: Turbulent Hurricane Season Could Pose Problems for Shippers

Hurricanes, earthquakes and outages — oh my! We’ve certainly had an eventful news cycle since the July 2020 issue of the Legacy Monthly Shipment. In this month’s issue, we’ll be exploring the impact of these events, as well as other hot button issues, on the transportation brokerage industry. Without further ado, let’s dive into today’s shipment.

Today’s Shipment:

- NOAA forecasts predict turbulent 2020 Atlantic hurricane season

- Logistics professionals turn to “preemptive logistics” to solve transparency issues

- Amazon looks to vacant department stores to resolve capacity challenges

- Wait times continue to plummet as tender rejection rates rise

- A rise in U.S. manufacturing could indicate the economy is on the road to recovery

FORECAST

2020 Hurricane Season Anticipated to be “Extremely Active”; NOAA Urges Preparedness

Hurricane Isaias made landfall earlier this month, leaving a wake of destruction along the East Coast, from North Carolina to Canada. Though many ports shut down or declared themselves on high alert in advance of the storm, they resumed normal operations in the immediate aftermath as states assessed the damage. Although it looks as though Isaias is unlikely to have any long-term effects on the domestic supply chain, the remainder of the 2020 Atlantic hurricane season is “one of the most active seasonal forecasts that the [National Oceanic and Atmospheric Administration] has produced in its 22-year history of hurricane outlooks.” Based on this forecast, the NOAA strongly encourages businesses to take preliminary precautions.

Historically, hurricanes and other natural disasters have a significant impact on transportation in that they disrupt normal trade lanes, which impacts the existing capacity/demand balance. The need to rebuild or repair damage resulting from such events absorbs chunks of the existing supply, which results in increased transportation costs regionally, nationally or even globally.

Several of our clients based in the Southeast and along the East Coast have expressed concern about this year’s hurricane season. Although we know for a fact that rates are high and expected to increase as capacity grows tighter and tighter over the remainder of the year, hurricanes are often sudden and unpredictable in nature, making it difficult to advise our clientele on how rates will be affected. We’ve seen an approximately 15% increase in rates in the last two months; if hurricane season ends up being as active as the NOAA anticipates, we could see rates increase to the 40% to 50% range in affected areas. This would undoubtedly have a ripple effect on rates across the rest of the country due to reduced capacity.

The way we see it, the moral of the story — which is consistent with the NOAA’s commentary — is to plan ahead. Every shipper should have some form of contingency plan in place well in advance of an actual disaster to mitigate its impact to business. For guidance on how to develop such a plan, we recommend that you visit our supply chain and warehouse logistics contingency planning hub.

SURVEY

Over 60% of Logistics Companies to Use Data, AI to Ship Goods Ahead of Purchase Orders

According to a recent Ericsson survey of logistics professionals — many of whom are in decision-making roles — logistics companies are increasingly turning to data analytics and artificial intelligence in an effort to increase supply chain transparency. Ideally, such solutions will enable organizations to engage in “preemptive logistics” — that is, to “predict demand for products, services and solutions before customers even make purchase decisions.” This is just one of the many ways digital transformation is reshaping logistics, especially in light of COVID-19; other examples include investing in blockchain, in-housing logistics, localized warehousing and so on.

There can be no doubt that the supply chain industry has become a prime target for digitalization. The industry has long been highly fragmented, both domestically and internationally, in terms of how transactions are handled, which leaves many shippers vulnerable to risk. To that end, many organizations have partnered with tech firms to improve productivity and visibility, manage global risk, enhance modeling and forecasting and so on.

At Legacy, we’re working with technology partners to optimize the customer experience and to more accurately assess global risk. For example, we’re currently in the process of exploring ways to automate data entry. This automation enables us to provide our clients with more real-time visibility into precise product location and enables our clients to communicate more effectively with their own customers. This technology provides added insight into future capacity issues and their effect on pricing. Ultimately, we’re looking for innovative ways to manage complexity within the market and solve the problems our clients really care about; these continued internal investments are providing strong gains toward achieving these goals.

NEWS

Amazon, Simon Property Group Team up to Transform Department Stores into Fulfillment Centers

It seems like where there’s a will, Amazon always finds a way. Despite its reputation as the leading disrupter of the mall industry, the eCommerce behemoth is exploring a partnership with Simon Property Group Inc., one of the largest mall operators in the world. The deal, which is currently under negotiation, would turn defunct department stores — JCPenney and Sears storefronts, specifically — into Amazon distribution hubs. This partnership would enable Simon to recoup capital lost due to department store bankruptcy filings and Amazon to accommodate the increased demand for warehousing space in a shrinking capacity market.

The unprecedented growth of eCommerce has led not only to the death of traditional bricks and mortar and a capacity shortage, but also to an increased demand for immediacy. Rising consumer expectations have placed significant stress on last mile delivery chains, in many cases forcing delivery workers to work overtime in order to accommodate demand. Should this strategic partnership come to pass, it will successfully position Amazon closer to its end consumers, thereby satisfying the demand for immediacy; it will also position Amazon closer to currently untapped labor pools in more urban areas, helping to mitigate some of the industry’s current labor challenges.

This partnership and others like it are poised to usher in the next wave of mall transformation, as many department stores go the way of the dinosaurs and eCommerce continues its breakneck forward momentum. Could hybrid retail stores/fulfillment centers be the evolutionary stage of the omnichannel supply chain, and could they lead to the rebirth of the traditional mall? Only time will tell.

CHART

Wait Times Decline as Demand for Capacity Continues to Increase

Freight market volatility remains a persistent issue for shippers as carriers reject load tenders at an unprecedented rate. FreightWaves’ Chart of the Week shows that carrier wait times have plummeted as national tender rejections rise. Though there’s likely some correlation between the two, the decline in wait times can also be attributed to distancing measures, technological improvements, low volumes and a number of other factors. What is clear is that reduced capacity within the market has placed additional pressure on carriers to load and unload goods efficiently.

The transportation market continues to gain strength, which we believe to be a positive sign that the economy is slowly, but surely, returning to normal. That said, consistent with FreightWaves’ findings, there is a capacity crunch in the market that’s driving rates up to late 2017/2018 levels. We’re also seeing a tremendous increase in spot load/spot rate activity, especially in intra-U.S. lanes. Cross-border Canadian lanes are especially tight in terms of capacity; Legacy is seeing market rate increases 15% to 20% higher than what we saw in January and February of 2020. There’s simply not enough capacity coming from Canada to the U.S., creating a US-Canada capacity imbalance. That said, there’s still a high volume of product going into Canada. We recognize that this is concerning to our clients, so we’re making every effort to keep them apprised of the situation.

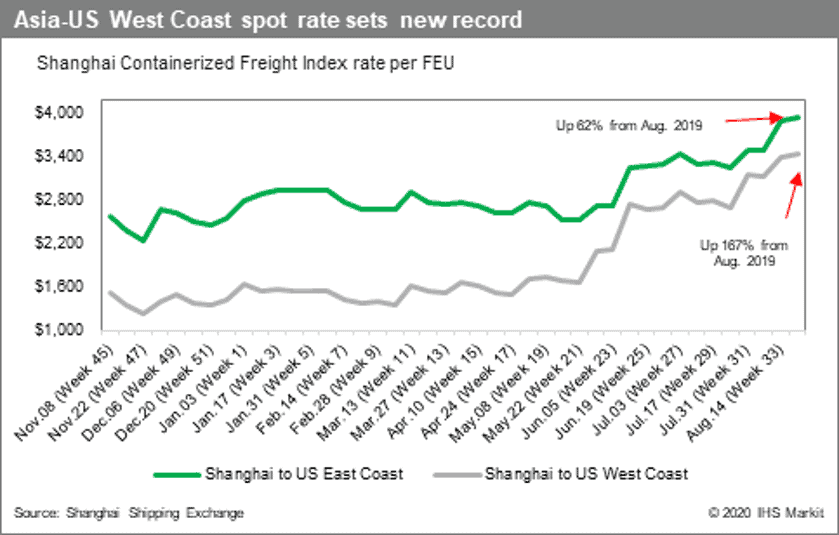

On the sea freight side, Trans-Pacific container rates are pushing $4000 per FEU to the West Coast, nearly 200% over August 2019. These cost increases are fueled by DIY home improvement purchases, eCommerce demand and retail rebounding. Though carriers have added most capacity back into service, we believe rates will remain high through year end.

Ultimately, our message to shippers is that freight is still moving, though not at the levels it used to be due to demand outstripping capacity. The later shippers come to the game, the greater the risks of delay and higher costs, so continue to plan, continue to communicate and continue to book shipments as early as possible.

REPORT

ISM Data Shows Growth in U.S. Manufacturing, Inspires Cautious Optimism

Data released by the Institute for Supply Chain Management (ISM) for the month of July has inspired cautious optimism that the U.S. economy may be on the road to recovery. ISM data indicates that the U.S. Purchasing Managers Index (PMI) has reached 62.1 across five of the top U.S. manufacturing sectors — a 4.8% increase from June and the highest level since August 2018. ISM data also shows that new export orders are up, rising 2.7% to 50.4, while imports have grown 4.3% to 53.1 on the PMI.

These are volatile times to be sure, with many unknowns. However, we’ve seen growing activity and expect a steady rebound across manufacturing, retail and other industries. This growth may be gradual, but it does give us cause for hope. In the meantime, we can’t stress enough the importance of planning; early bookings for any mode of transportation will help shippers mitigate the effects of capacity constraints, delays and hiring costs.

What news stories have caught your attention this month? Shoot us a quick email and let us know — we’re always interested in hearing from our readers. And, as always, for more supply chain-related news and insights, you can head on over to our blog or talk to one of our specialists today.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more -

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more