Issue 18: Container Ship Back-Up Hits New Records

A Word from LEGACY

Greetings, everyone! We’re back again with another installment of the Legacy Monthly Shipment, your go-to source for logistics industry news, insights and opinions.

It’s almost October, which means peak season is just around the corner. With capacity already stretched thin and transportation and warehousing rates on the rise, we should have another challenging season ahead of us. With that in mind, let’s kick off today’s Shipment with our Market Update.

Market Update

LMI Shows Continuted High Reading as Firms Gear up for Peak Season

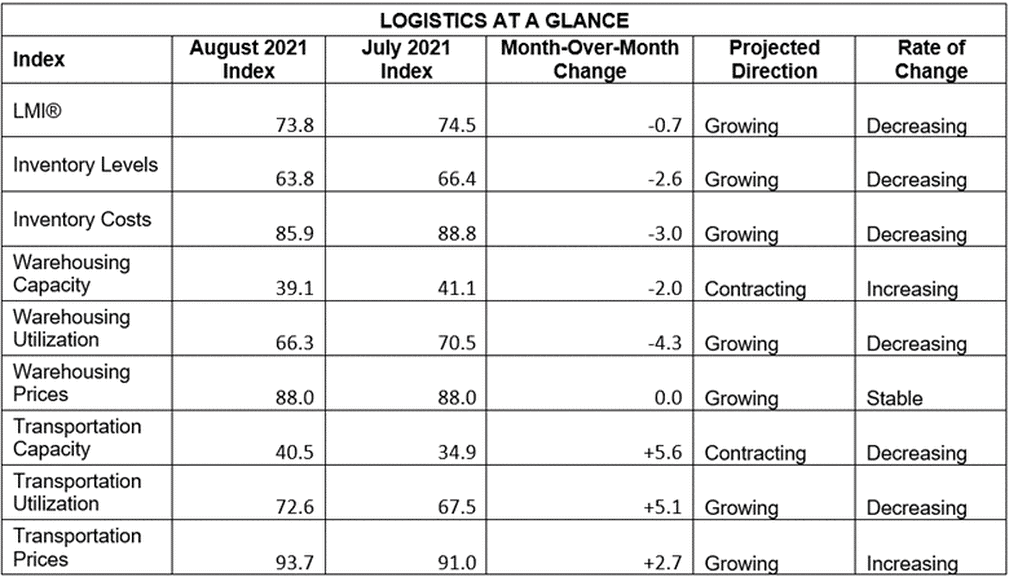

Despite a -0.7 dip, the August 2021 Logistics Managers’ Index (LMI) — released on September 7 — remains sky-high at 73.8, the fifth highest reading in the history of the index. Per the official report:

Growth across inventory levels, inventory costs, warehousing utilization and warehousing prices continues to increase, albeit at a decreasing rate;

- Growth across transportation prices and utilization are increasing at an increasing rate;

- Warehousing prices are increasing steadily; and

- Warehousing and transportation capacity are contracting.

It’s a story that has become all-too-familiar over the past nearly two years: The logistics industry continues to grow at an unprecedented rate, while the underlying infrastructure struggles to support it. Summer 2021 proved to be a season of unparalleled expansion, and if early reports are any indication, constraints and high rates are expected to continue throughout the remainder of the year.

According to one source, Q4 2021 consumer demand will exceed even the record levels witnessed in 2020, leading to increases in capacity demand. We do not expect any noticeable softening in this demand in the near-to-medium term. This paints a troubling picture, given that both transportation and warehousing capacity are contracting significantly, with respective index readings of 40.5 and 39.1.

Ocean transportation capacity remains in high demand, though rates for sea cargo have largely stabilized. On the domestic side, truck rates continue to escalate as more rail cargo switches to truck and drivers remain in short supply. The warehouse labor market continues to disappoint, with only 235,000 jobs added in August, hurting efficiency and driving costs up. This dynamic has prompted firms to be more proactive in their peak season planning than ever before, with many scrambling to build up their inventories to avoid shipping-related stockouts in Q4.

We see no relief in sight until Q2 2022, at the very earliest. Longshoreman contract renegotiations will begin in July 2022, at which time we can expect some port labor disruptions in the lead up to renewal discussions. Finally, there remains the continued risk of COVID flare-ups, further disrupting global supply chains.

Despite all of this, the Council of Supply Chain Management Professionals (CSCMP) has a cautiously optimistic view of the future, stating that:

“The rapid increase in container prices seems to suggest that supply chains have reached an inflection point in which the strain on capacity is now leading to sharp price increases which will eventually lead to a market correction in the form of significantly increased capacity.”

To see a full reading of the LMI, including scores across individual indices, check out the chart below.

Also in Today’s Shipment:

- San Pedro Bay shatters records — but for all the wrong reasons.

- Political tensions around House and Senate votes leave the FAST Act in the lurch.

- Global chip shortage expected to extend into 2023, despite chipmakers’ best efforts.

- Port of Long Beach develops text-based alert system to address congestion, drayage woes.

- Digitally replicate your supply chain with the new Google Cloud Supply Chain Twin.

In the News

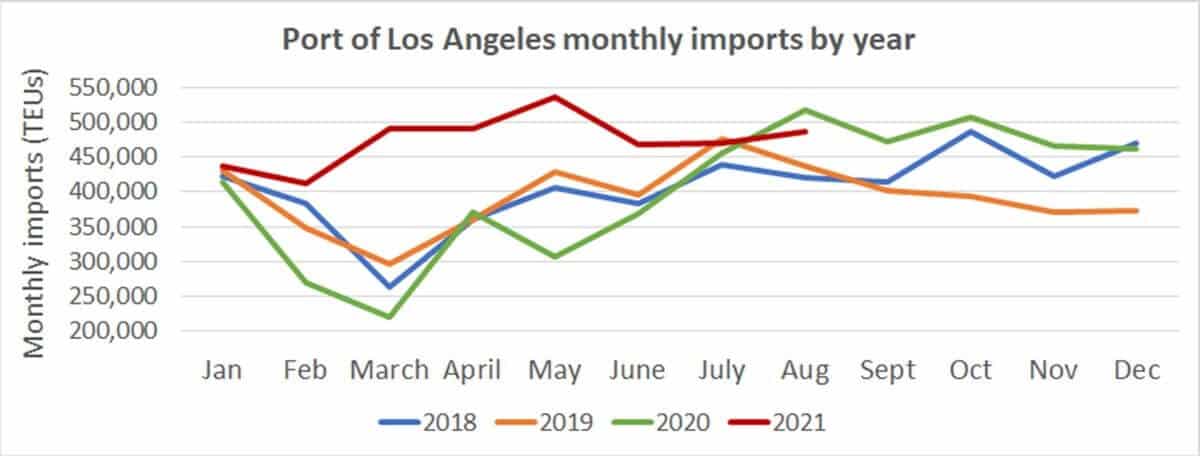

Number of Ships Queuing in San Pedro Bay Reaches Record High

Just when it seems like port congestion can’t get any worse, it does. At the time of this writing, there are over 75 container ships at anchor or drifting in San Pedro Bay, blowing all previous records out of the water — and there could soon be more.

“Our usual VTS [Vessel Traffic Service] area is a 25-mile radius from Point Fermin by the entrance to Los Angeles, which gives a 50-mile diameter to drift ships,” said Capt. Kip Loutit, executive director of the Marine Exchange of Southern California, in a statement to American Shipper. “We could easily expand to a 40-mile radius, because we track within that radius for air-quality reasons. That would give us an 80-mile diameter to drift ships.”

The record-breaking number comes one day after a Port of Los Angeles press conference during which executive director Gene Seroka reported that container dwell times and street dwell times were nearing all-time highs at six days and 8.8 days, respectively. Seroka also stated that on-dock rail dwell time had reached 11.7 days, not far off from its 13.4-day peak. These figures are relatively consistent following what has been over a year of nearly non-stop congestion at the port, resulting in a 5.9% decrease in imports to LA year on year.

Fate of the FAST Act Tied up in Upcoming Infrastructure Bill Vote

Fate of the FAST Act Tied up in Upcoming Infrastructure Bill Vote

As the September 30 expiration deadline looms large, negotiations around the Fixing America’s Surface Transportation (FAST) Act appear to have come to a standstill.

Signed into law by the Obama administration in 2015, the FAST Act was designed to provide long-term funding — to the tune of $305 billion — for critical transportation projects. The Act’s provisions include expedited permitting processes, discretionary grant programs to support freight movements, the establishment of a new finance bureau and stronger Buy America requirements for public transit. Though the program was originally slated to conclude in 2020, the Trump administration approved a one-year extension, which included an additional $13.6 billion in funding. As we approach the end of that extension period, it’s anyone’s guess as to whether legislators will choose to reauthorize the Act.

The fate of the FAST Act is dependent upon the results of the House vote on the bipartisan Infrastructure Investment and Jobs Act, tentatively set for September 27. The bill, which the Senate passed on August 9 following weeks of fierce negotiation, is a $1.2 trillion infrastructure package, including $39 billion in funding for public transit and $66 billion for passenger and freight rail. Democrats have maintained, though, that the House vote will not proceed until the Senate passes a $3.5 trillion budget reconciliation bill — an economic plan that would “make sizable federal investments in child care, immigration and climate change programs.”

As reported by FreightWaves, it seems increasingly unlikely that the infrastructure bill vote will proceed prior to the FAST Act deadline, as negotiations between both parties on the reconciliation have all but stalled out. With multiple Senators up for reelection in 2022, the impending vote has become something of a balancing act for moderate Democrats angling for support on both sides of the aisle. Senators have also had to split their attention as high-priority issues, including the evacuation of Afghanistan and Hurricane Ida, have required Congressional action.

Without any clear path forward for either bill or the FAST Act, all we can do is stay tuned.

Global Chip Shortage Expected to Persist into 2023

Global Chip Shortage Expected to Persist into 2023

The semiconductor bottleneck that has plagued the automotive industry since late 2020 has developed into a full-blown global chip shortage, one that’s expected to continue well into 2023.

In an article for SupplyChain247, the eCommerce experts at Sourcengine shared the latest findings from their quarterly lead time report, including key insights from tech insiders and industry analysts. Unfortunately, the outlook is bleak: Chief executives from multiple tech companies have stated that it will likely take the industry years to recover from the current shortage, and lead times for Intel and Advanced Micro Devices data center and server ICs have jumped from 45 to 66 weeks.

Chipmakers have responded by aggressively ramping up production, with United Microelectronics Corporation dedicating $3.5 billion over the next three years to fabrication capabilities and Taiwan Semiconductor Manufacturing Company increasing fabrication by 60%. Despite this valiant effort, analysts from multiple firms — including Forrester Research, Arete Research, Credit Suisse and Plurimi Investment Managers — agree that chip demand will remain high and component scarcity will persist until 2023.

In light of these predictions, global consultancies advise that manufacturers pre-book production capacity with foundry service providers and OSAT companies, increase their market intelligence, closely monitor changes in chipmaker lead times and stockouts and, most importantly, be flexible.

Port of Long Beach Debuts New Truck Alert Notification System

Port of Long Beach Debuts New Truck Alert Notification System

Could something as simple as a text-based alert system help eliminate drayage bottlenecks and port congestion? That’s what the Port of Long Beach aims to find out with Truck Alert, a new opt-in notification system that enables port truck drivers to receive real-time updates about changing traffic patterns on their phones.

“Truck Alert is designed to reduce road congestion by providing truck drivers an opportunity to improve scheduling and enhance turn times during the unprecedented cargo surge we’re experiencing,” said Mario Cordero, Executive Director of the Port of Long Beach in a September 8 press release. “This new program will enhance our ability to move cargo quickly, safely and efficiently through the Port.”

The announcement comes at a critical juncture, as drayage providers’ turn times continue to increase, forcing shippers to pay detention and demurrage charges. Given the fact that the Federal Maritime Commission (FMC) launched an official investigation into the detention and demurrage billing practices of the nine largest ocean carriers this past July, drayage providers are keen to avoid taking similar heat. The hope is that by gaining real-time visibility into road conditions, including closures, crashes and traffic, drayage providers will be able to optimize truck turn times.

Truck Alert also has the potential to alleviate the ongoing driver shortage, which has contributed to supply chain bottlenecks. Once able to complete six to seven jobs a day, drayage drivers now find themselves only able to complete three, largely due to extenuating circumstances, such as chassis and equipment shortages. And less time spent on the road means there’s less money to be made, discouraging drivers from taking open positions. If Truck Alert is successful in reducing port congestion and optimizing drivers’ routes, it could offer significant uplift to driver recruitment and retention efforts.

Google Cloud Aims to Enhance Supply Chain Visibility with New Offering

Google Cloud Aims to Enhance Supply Chain Visibility with New Offering

What if you could clone your supply chain? Though it might sound like the premise of the next sci-fi blockbuster, it’s actually the defining idea behind Google Cloud’s new Supply Chain Twin solution.

Launched on September 14, Supply Chain Twin is an innovative solution that enables companies to build a digital representation, or digital twin, of their physical supply chain in order to enhance end-to-end visibility, promote cross-team collaboration and access artificially intelligent workflows. Google Cloud also unveiled Supply Chain Pulse, a user engagement module within Supply Chain Twin that provides access to advanced analytics, performance visualizations and real-time alerts for potentially disruptive events.

“Siloed and incomplete data is limiting the visibility companies have into their supply chains,” said Hans Thalbauer, Managing Director of Supply Chain and Logistics Solutions for Google Cloud in an official company statement. “The Supply Chain Twin enables customers to gain deeper insights into their operations, helping them optimize supply chain functions — from sourcing and planning, to distribution and logistics.”

Chicago-based supply chain visibility services provider project44 was tapped as the first strategic partner for the project; Google will also work closely with Deloitte, Pluto7, TCS and other system integration to help firms integrate the new solution with their existing infrastructure.

Thanks for checking out this month’s Shipment. For even more logistics insights courtesy of the Legacy Supply Chain team, check out our blog or resource center, and be sure to keep an eye out for next month’s issue.

Until then, this is Legacy, over and out.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more -

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more