Issue 29: August 2022 LMI Report, ILWU & PMA Talks Reach Standstill & More

A Word from Legacy

We’re sure you’ve seen the headlines: “Impending railroad strike set to cost economy $2 billion per day ,” and others to that effect. We’re certainly starting fall off with a bang, and with news this big, there’s no sense in beating around the bush — so let’s jump right into this month’s Shipment with our Market Update.

Market Update

August 2022 Reading Marks Largest Slide Over 5-Month Period in LMI History

The August 2022 Logistics Managers’ Index (LMI), which was released on September 6, reads in at 59.7. Although this is only a 1-point decrease from the July 2022 reading, it marks the first reading below 60.0 since May 2020 and the third consecutive reading below the all-time average of 65.3. This month’s reading is also a far cry from the March 2022 LMI, which reached an all-time high of 76.2, making this “the largest slide we have seen over a five-month period in the history of the index.”

Based on these indicators, it’s clear that the logistics industry is continuing to expand, albeit at a far slower rate than in months past. Consumer demand is gradually waning, but a surplus of goods continue to circulate through the supply chain — the direct result of firms overstocking inventory earlier in the year amidst fears of shortages. This has created, the LMI notes, “the tightest warehousing market we have seen in years, along with the loosest transportation market.”

Indeed, the LMI’s Warehousing Capacity index dropped by 4.8 points to 42.3, marking two straight years of contraction. This downward spiral is a direct result of unrelenting supply chain congestion stemming from port congestion, labor shortages and labor disputes.

In Southern California, contract negotiations between the Pacific Maritime Association (PMA) and the Inland Longshore and Warehouse Union (ILWU) remain at a standstill and although ILWU has maintained its pledge not to strike, many firms have chosen to redirect shipments to alternate ports as a precaution. The issue with this approach is that few of these alternative ports have the necessary infrastructure to support the sudden surge in demand, creating backlogs along the East Coast and leading to transportation delays.

Without available warehousing space to accommodate excess inventory, retailers are becoming more resourceful, utilizing empty containers stationed in parking lots as temporary inventory storage. The primary issue with this, of course, is that it ties up transport equipment, including shipping containers, truck trailers and chassis, creating bottlenecks inland.

Whether supply chains return to normal will depend entirely upon warehousing capacity coming back online — something that seems unlikely any time soon, given that the U.S. will need an additional 330 million square feet of warehousing by 2025 just for eCommerce, with another 660 needed for traditional distribution both upstream and downstream. This limited availability is, unsurprisingly, driving warehousing costs upward, especially in high-demand areas such as California’s Inland Empire. The Council of Supply Chain Management Professionals — the organization behind the LMI — predicts that this demand and, subsequently, warehousing metrics, will remain strong well into 2023.

Although warehousing prices may be on the rise, transportation prices are experiencing a steady decline. Average truckload prices have fallen to $2.53 per mile, down 11 cents from July, largely due to reduced fuel costs. Ocean freight rates have also substantially decreased, with container shipping rates from China to Los Angeles have dipped below $4,000 per 40-foot container — that’s approximately one-third the average spot-market price from a year prior.

In addition to reduced transportation rates, shippers will also be glad to hear that U.S. employers added 315,000 jobs in August 2022 — up 71,000 from the year prior — including 4,700 in the transportation sector. These new jobs will add much-needed Transportation Capacity, which was down by 4.8 points from July 2022’s LMI, but still growing at a reading of 64.3.

Unfortunately, freight volumes were down 2.6% year-over-year (YOY). In light of these conditions, the CSCMP advises shippers to keep an eye on the LMI’s Transportation Utilization metric, which is down 7.7 points and stands on the verge of contraction. Should the market tip completely into a state of contraction, it could pose a problem for carriers and shippers alike in Q4.

To close out this month’s Market Update, inventory levels continue to grow, though at a reduced rate thanks to the considerable efforts of retailers to run down their inventory levels (often at cost). All told, a significant amount of inventory remains within distribution networks, causing the Inventory Prices index to reach a reading of 76.8. Under these conditions, the CSCMP cautions firms to be mindful of the bullwhip effect — although it’s imperative that retailers reduce inventory levels, they should be careful in their approach so as to avoid holiday season shortages.

For a complete overview of the August 2022 LMI across all indices, please refer to the chart below:

| LOGISTICS AT A GLANCE | |||||

| Index | August 2022 Index | July 2022 Index | Month-Over-Month Change | Projected Direction | Rate of Change |

| LMI® | 59.7 | 60.7 | -1.0 | Growing | Slower |

| Inventory Levels | 67.6 | 68.8 | -1.3 | Growing | Slower |

| Inventory Costs | 76.8 | 79.0 | -2.2 | Growing | Slower |

| Warehousing Capacity | 42.3 | 47.0 | -4.0 | Contracting | Faster |

| Warehousing Utilization | 65.3 | 68.8 | -3.5 | Growing | Slower |

| Warehousing Prices | 75.0 | 76.2 | -1.2 | Growing | Slower |

| Transportation Capacity | 64.3 | 69.1 | -4.8 | Growing | Slower |

| Transportation Utilization | 51.6 | 59.3 | -7.7 | Growing | Slower |

| Transportation Prices | 48.0 | 49.5 | -1.5 | Contracting | Faster |

Also in Today’s Shipment:

- West Coast labor talks come to a standstill due to tensions between two unions over a Seattle terminal.

- Nationwide railroad strike averted as railroad corporations and workers to come to an agreement.

- Ocean shipping rates have plummeted and will likely continue to do so well into 2023.

- A softening truckload market creates new opportunities for shippers to renegotiate for lower contract rates.

In the News

Union Conflict Brings ILWU-PMA Labor Negotiations to a Grinding Halt

Regular readers of the Monthly Shipment might not be surprised to hear that labor talks between ILWU and PMA have stalled. What you might find surprising, though, is that negotiations have come to a standstill not because of a disagreement between dockworkers and their employers, but rather because of a disagreement between ILWU and another union, the International Association of Machinists and Aerospace Workers (IAM).

Although details about the ongoing West Coast port labor negotiations are closely guarded — both ILWU and PMA have agreed not to discuss the talks publicly — the Wall Street Journal reports that conflict over a terminal at the Port of Seattle has prevented a timely resolution. Per the official report, ILWU “wants its next labor contract to ensure that a cargo-handling terminal at Seattle uses ILWU workers to maintain and repair equipment.” The only problem with that request is that in 2020, the National Labor Relations Board granted IAM jurisdiction over the terminal in question, thereby preventing PMA from awarding the contract to ILWU.

True to its word, ILWU has kept workers on the job and operations moving throughout the negotiations, and on July 26, ILWU and PMA released a joint statement announcing that they had reached a tentative agreement regarding health benefits. However, that appears to be the last sign of meaningful progress in the talks, which have now entered their fourth month — and their second without a contract in place — as ILWU allegedly refuses to discuss other issues, including wages and automation, until the conflict is resolved.

Though this is far from the most contentious of negotiations — past negotiations between ILWU and PMA have led to strikes and shipment delays — the standstill has set both dockworkers and shippers on edge. Despite ILWU’s agreement not to strike, mounting labor tensions throughout the supply chain, including a slew of trucker protests and an impending railroad strike, call into question whether that agreement will stand. In anticipation of potential disruption, many importers have diverted shipments to East Coast and Gulf Coast ports, which has only served to shift port congestion from one side of the country to the other.

As always, the Legacy team is keeping a close eye on this story, and will share any updates in future Shipments.

Railroad Strike Averted as Union Representatives & Rail Officials Agree to Terms

Railroad Strike Averted as Union Representatives & Rail Officials Agree to Terms

As noted in our previous story, U.S. freight railroad workers were set to strike on , September 16, prior to tentative agreement by all 12 unions.

Contract negotiations between railroad corporations and 12 labor unions represented over 150,000 workers. According to the Bureau of Labor Statistics , the railroad industry in the U.S. lost 40,000 jobs between November 2018 and December 2020 due to cost-cutting measures — measures that have reportedly contributed to record profits for some of the largest corporations. Despite the reduced headcount, the demand for railroad freight remains the same, leading workers to cite unfair and unsustainable working conditions, including disciplinary attendance policies, a lack of paid time off and challenging on-call schedules.

The situation has escalated to the point where Congress and President Biden intervened to avert a strike. The industry “close call” and the continuation of negotiations with west coast longshoremen are further examples of the volatile state of the industry.

Shippers See Dramatic Decrease in Ocean Shipping Rates

According to the Freightos Baltic Index, ocean shipping rates have dropped by as much as 60% from January 2022 — and they’re expected to further ease for the remainder of the year and into 2023.

This is a far cry from the market conditions we witnessed at the height of the pandemic, and even throughout 2021. As the Wall Street Journal reports, major retailers and manufacturers alike over-ordered inventory in anticipation of shipping delays and demand that never materialized, causing them to carry excess inventory. Though this surplus of inventory has presented challenges from a warehousing standpoint, forcing importers to devise creative solutions for their storage problems, it has also pulled peak season forward and saved firms from having to restock shelves.

“This is really a [nonpeak] season because for the first time ever, volumes moved in the second half are lower than those moved in the first half,” said Peter Sand, chief analyst at Xeneta, in a statement for the WSJ.

The factors driving this shift are both varied and complicated. For example, rising inflation continues to put a damper on consumer spending, reducing the demand for ocean freight. Industry analysts predict that this stagnating global trade growth could signal the beginnings of a global recession. We can also attribute this shift to easing supply chain disruption, including reduced port congestion levels, which bodes well for shippers and the global supply chain as a whole.

Another silver lining is that ocean carriers no longer have dominion over the spot market. In fact, this summer, spot rates fell below the average price for long-term contracts for the first time since April 2020, creating opportunities for smaller importers that do not have access to the contract market.

Shippers Negotiate Lower Contract Rates in Softening Truckload Market

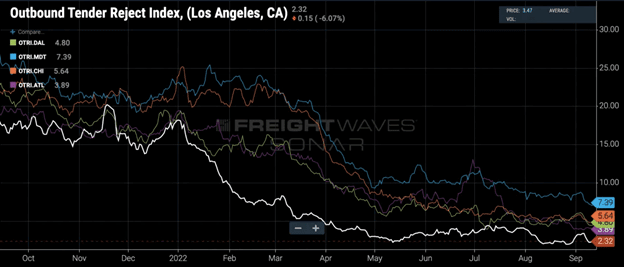

Ocean freight isn’t the only market seeing a reduction in contract rates — softening conditions within the truckload market have led to significant price decreases, as well as an increase in available capacity. According to FreightWaves SONAR, outbound tender rejection rates for Los Angeles, Chicago, Atlanta, Dallas and Harrisburg are all on the decline, with Los Angeles rejecting only 2.32% of outbound loads — a stark difference from the 20% rejected as recently as March 2022.

This shift in the market has enabled shippers to lower their contract rates — something they were reluctant to do this past spring amidst uncertainty around the state of the truckload cycle.

Where once the market was dictated by seasonality, with a brief increase in activity around Labor Day and a lull before the official start to the holiday season at Thanksgiving, activity has remained fairly elevated over the past few years due to pandemic-era surges in demand. As has been the case in most of our stories this month, a surplus of inventory and reduced consumer spending has eliminated some of the urgency and demand within the truckload market, enabling it to return to a more predictable seasonal cadence.

This softening, along with what’s shaping up to be a relatively mild peak season, likely comes as welcome news to shippers. Although there is the potential for a small peak season boom before the end of 2022 — in part precipitated by the impending railroad strike — it will be short lived in the absence of any other major events.

We hope you’ve enjoyed reading this month’s Shipment as much as we’ve enjoyed writing it, and we look forward to seeing you again next month (when we’ll undoubtedly provide an update on the railroad strike). Until then, our blog, resource center and team of logistics experts are ready and available to provide you with even more insights.

This is the Legacy team, over and out.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more -

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more