Issue 20: House Passes Infrastructure Investment and Jobs Act

A WORD FROM LEGACY

Conversations about the global supply chain are taking place at every level of society these days, from the boardroom to the family dinner table. It seems as though supply chain disruption has captured almost everyone’s attention, and it’s easy to understand why.

While many of the current issues importers and exporters face are familiar to industry professionals (though perhaps more severe than we’re used to seeing), the frequent headlines and shipping delays are completely out of the norm for the rest of the populace. For some, empty shelves in major stores are an uncomfortable reminder that we’re still living through “unprecedented times,” no matter how much we might wish otherwise.

With the holidays — or peak season, for those of us in the logistics world — well on their way, we can expect things to look more normal than they did at this time last year. The emphasis here is on “more normal,” as disruption has already led to delays, forcing retailers to encourage shoppers to buy early. We can only hope that, as the public becomes more aware of the constraints on the global supply chain and the players within it, consumers are willing to extend a little more patience and understanding.

This “Holiday Season Supply Chain” moment brought to you by your friends at Legacy — now let’s unpack this month’s Shipment.

MARKET UPDATE

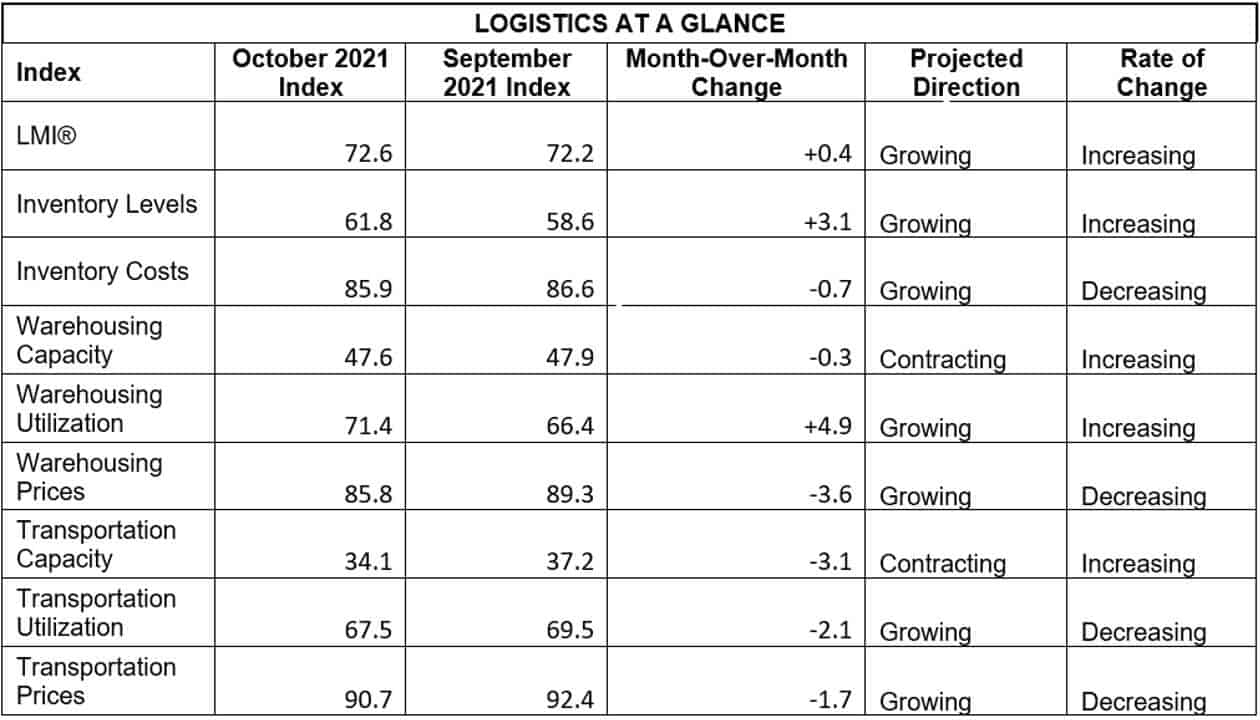

October 2021 LMI Changes Tack, Begins to Steadily Increase Once Again

Following last month’s five-year anniversary reading, the October 2021 Logistics Manager’s Index (LMI) has crept up 0.4 points, from 72.2 to 72.6. Though the increase might seem marginal — perhaps even inconsequential — to the untrained eye, it marks a reversal in the LMI’s trajectory, which had been decreasing over the past four consecutive periods. This slow but steady descent had given some industry insiders hope that the market was on a path toward stabilization; however, this new reading dispels that notion.

According to the official LMI report:

“The growth in this month’s index is fueled by metrics from across the index, particularly those involving capacity, cost and upstream inventories. The transportation crunch remains particularly pronounced, with Transportation Prices reading in above 90.0 for the seventh time in the last eight months. For the fourth consecutive month we observe an all-time high reading for Warehousing Prices, coming in this month at 89.3. Interestingly, this still comes in behind Transportation Prices, which read at an astronomical rate of 92.7 — it’s sixth out of seven readings to breach 90.0.”

Despite the overall economy slowing to 2%, consumer demand remains as strong as ever, with at least one logistics expert claiming that supply chains are processing more goods now than at any other point in history. As a result, inventory levels continue to grow, but exceedingly limited transportation and warehousing capacities mean importers have few options to move or store shipments. In fact, many firms have started using intermodal containers and chassis as temporary storage.

This glut of inventory has contributed to significant congestion at ports; ports have responded by imposing restrictions on shipment container stacking and, in some cases, even charging additive penalties in an attempt to incentivize shippers to move containers more quickly. Naturally, this second approach has been a controversial one and has garnered opposition from major shippers such as Walmart, Amazon and Office Depot, which claim that such actions will increase costs without actually addressing the issue at hand.

Though the future remains uncertain, the Council of Supply Chain Management Professionals — the official publisher of the LMI — predicts that the situation within the logistics industry will only begin to normalize once “the readings for Inventory Costs and Inventory Levels once again converge,” and that “it seems unlikely that stabilization will be any time soon.”

To see a full reading of the LMI, including scores across individual indices, please refer to the chart below.

Also in Today’s Shipment:

- At long last, the $1.2 trillion infrastructure bill finally makes its way to Biden’s desk.

- Communication gaps between CBP and ports exacerbate port congestion issues.

- Rising demand both creates profitable opportunities and introduces new challenges for air cargo carriers.

- One industry expert shares his predictions for the COP26 climate negotiation summit.

NEWS

House Finally Passes Long-Awaited Infrastructure Investment and Jobs Act

From conflict over the Democrats’ proposed reconciliation bill to the quiet death of the Obama-era FAST Act, we’ve been closely following the Infrastructure Investment and Jobs Act as it has made its way through the Senate and to the House. Now, after months of tense negotiations, we’re pleased to report, the House of Representatives passed the $1.2 trillion infrastructure bill with a vote of 228 to 206.

The spending package includes $550 billion in new infrastructure spending and $110 billion for improvements to roads and bridges and is, according to SupplyChainDive, expected to be “the largest new investment the federal government has made on infrastructure in decades.” In addition to investing in the U.S. transportation network, the bill also allows for the creation of the Office of Multimodal Freight Infrastructure and Policy, “an intermodal planning authority that will develop and manage the nation’s freight policy and grant programs.” The collective hope is that by establishing this office, the U.S. government will be able to implement freight policies at the federal, state and local levels to enhance supply chain efficiency.

The infrastructure bill’s long journey finally came to an end on November 15, when President Biden officially signed it into law.

REPORT

Lack of Communication Between CBP and Ports Adds to Congestion

A critical communication failure between U.S. Customs and Border Protection (CBP) and major ports along the West Coast has contributed to already severe port congestion — so says a recent report from American Shipper.

The publication revealed that, according to a statement from the Marine Exchange of Southern California, vessels are only required to give ports 96 hours’ notice in advance of arrival. However, this directly contradicts CBP guidance, which stipulates that vessels seeking clearance in U.S. ports “must file their manifests with CBP’s Automated Manifest System (AMS) 24 hours before the vessel departs from the port of loading.”

Though this lack of communication has not historically caused problems, the introduction of new maritime agents has thrown a wrench into the works, as newer agents lack the established relationships with terminals needed to secure landing slots for incoming vessels. Without these connections, agents have instead developed a habit of notifying ports mere hours before vessels’ arrival, thereby forcing ports to scramble to find space and unscheduled vessels to anchor until space becomes available. Given the number of ships at anchor in San Pedro Bay alone, the wait is expected to be a long one.

“We need to link up with Customs on these nontraditional companies chartering so we can have a deeper line of sight,” said Gene Seroka, executive director for the Port of Los Angeles, in an official statement to American Shipper. “This would help improve the planning process.”

As recently as October, the number of unscheduled vessels awaiting space in the Port of LA reached 17, with vessel sizes ranging from 2,500 to 8,000 TEUs. Though the Port of Long Beach reported only five unscheduled vessels waiting with a total of 16,000 TEUs, chief operating officer Noel Hacegaba said that the average wait time was 28 days, with a range between 10 and 39 days.

BRIEF

Peak Season Demand Drives Air Freight Rates Sky High

With peak season imminent, air carriers are bracing for an inevitable surge in demand in the air freight market. As port congestion continues to make headlines — even in this very newsletter — retailers are exploring viable alternatives to ocean freight in an effort to meet holiday deadlines, including expediting shipments via air transportation.

The situation has created favorable market dynamics for air carriers, which have been able to substantially increase rates as capacity dwindles; on the other side of the equation, looming deadlines, factory closures and port congestion have all forced shippers to accept higher prices. For evidence of this, look no further than Colgate-Palmolive’s October 2021 earnings call: According to the official transcript, plant closures in Asia as a result of COVID-19 restrictions required the CPG brand to air freight product to retailers — a decision that came, in the words of President and CEO Noel Wallace, at a “significant cost.”

Though air carriers certainly hold the leverage at the negotiation table, they face unique challenges all their own. As reported in The Loadstar, “air cargo executives have cited problems across major hubs in Europe, including Amsterdam, London, Brussels, Frankfurt and Liege, as well as in the US” due to capacity constraints, labor shortages and COVID restrictions.

With major airports such as London Heathrow and London Gatwick experiencing “significant delays, as sheds are unable to cope with the growing demand,” some freight forwarders have started to route cargo through smaller airports to reduce congestion. Furthermore, frequent schedule changes and capacity issues have made it increasingly difficult to forecast labor needs, hampering recruitment efforts. Some importers have responded to these air transportation challenges by chartering private flights, with at least one provider freight forwarder reporting a significant uptick in charter inquiries in advance of Black Friday.

OUTLOOK

What COP26 Means for the Transportation Logistics Industry

October 31 marked the beginning of the 2021 United Nations Climate Change Conference, or COP26 — a 13-day summit centered around climate negotiations. The summit has placed numerous industries and their respective contributions to carbon and greenhouse gas emissions under the microscope. Conversations about the transportation sector, specifically, took place on November 10; here’s a highlights reel of what was discussed:

- Over 30 countries and dozens of businesses in the manufacturing industry committed to ensuring that all new vehicle sales be zero-emission by 2035 in leading markets, and by 2040 in all other markets. The U.S., China, and Germany all noticeably abstained from signing the official declaration.

- 18 nations, including the U.S., the U.K., France, Canada and Japan, signed a new declaration in support of the development of emissions targets for aviation that align with the Paris Agreement’s 1.5C temperature pathway.

- In the private sector, the Sustainable Aviation Buyers Alliance (SABA) admitted new members, including United Airlines, JetBlue and Amazon Air.

19 nations — including Australia, Canada, Germany, the U.S. and the U.K. — and over 200 businesses signed the “Clydesdale Declaration,” an initiative focused on the development of zero-emission shipping routes between ports with the stated of goal of created at least six green shipping corridors by the mid-2020s.

And that’s it — another Shipment in the books. The entire Legacy team wishes you well this peak season and, should you require any assistance, we encourage you to give us a call. And, as always, if you’re looking for more logistics new, tips and trends to tide you over until next month’s Shipment, we recommend visiting our blog or resource center.

We’ll talk to you soon.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more -

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more