Issue 14: Shippers Start Planning for Christmas Capacity Crunch

Greetings, friends, and welcome to the Legacy Monthly Shipment! As always, we’ll be offering you expert insights on some of the biggest stories and trends affecting the logistics industry today.

After what’s felt like months of doom and gloom in the form of high rates, constricting capacity, container shortages and the like, it’s finally starting to look like there may be a light at the end of the tunnel. From a possible end to port congestion to the projected stabilization of ocean freight volatility, we’ve got some good news to share this month — so let’s jump right in.

Today’s Shipment:

- Shippers take a creative approach to managing pandemic-induced last-mile delivery challenges.

- Volatility and capacity constraints may be the new norm as rollover rates continue to rise.

- Recent improvements in the Port of LA could signal an end to West Coast port congestion.

- Tightening capacity within the air freight market has left shippers scrambling to move cargo.

- The stranglehold of high ocean freight rates seems as though it’s beginning to loosen.

- Holiday shipping season is nearly upon us — time to plan for the Christmas capacity crunch.

- Check out the inaugural entry into our Legacy Whiteboard Series.

STRATEGY

Shippers Seek Ways to Adapt to the New Reality of Last-Mile Logistics

Much has changed within the global supply chain as a direct result of the COVID-19 pandemic, including the industry’s approach to last-mile logistics. Where once demand could be reasonably forecasted, increasingly high volumes of eCommerce sales have led to dramatic surges in demand, placing additional pressure on an already strained last mile.

“Many retailers and carriers described a ‘super peak’ in 2020, where shipment levels traditionally seen between October and January began in early April and continued throughout the summer and the holidays, ultimately eclipsing annual volume expectations,” said Shawn Winter, VP of Mobility Solutions at Descartes Systems Group in this month’s issue of Supply Chain Brain Magazine.

This super peak resulted in delivery delays on a global scale as last-mile providers scrambled to accommodate the increased volume, all while trying to manage typical last-mile complexities, such as route planning, unpredictability in transit and customer communications. According to Winter, in order to “successfully flex while managing shipping volumes and capacity demands,” shippers have had to get creative and seek new strategies to get last-mile logistics back on track. These strategies include:

- Competition: Major retailers partner with smaller competitors with delivery capacity to move excess loads

- Route Optimization: Shippers create greater delivery density by increasing the total number of stops per route

- Dynamic Delivery Appointment Scheduling: Shippers provide customers with delivery options to increase route density and expedite delivery by dispatching orders the same day they’re received

ECommerce — the primary driver of high last-mile delivery volumes — grew by roughly 44% in 2020 as opposed to just 15% in 2019. In order to accommodate this influx of volume, which is unlikely to go away any time soon, many providers have expanded their service options to deliver within hours. We’ve also seen increased competition between providers in this space — FedEx, UPS, Amazon, the U.S. postal service, LTL carriers and local providers — resulting in a race for the shortest delivery window possible. While tech has vastly improved delivery optimization, consumers can still expect to see more trucks in their neighborhood, and drivers can anticipate working long hours to maintain service.

REPORT

Container Rollover Rates Continue to Rise, Driving Supply Chain Delays

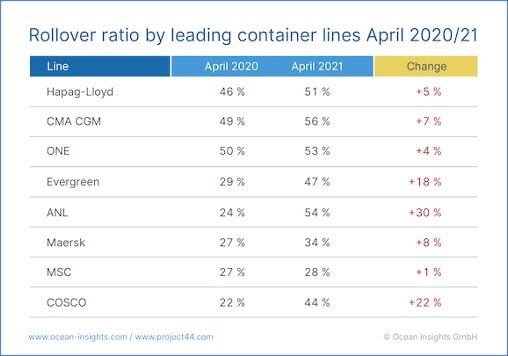

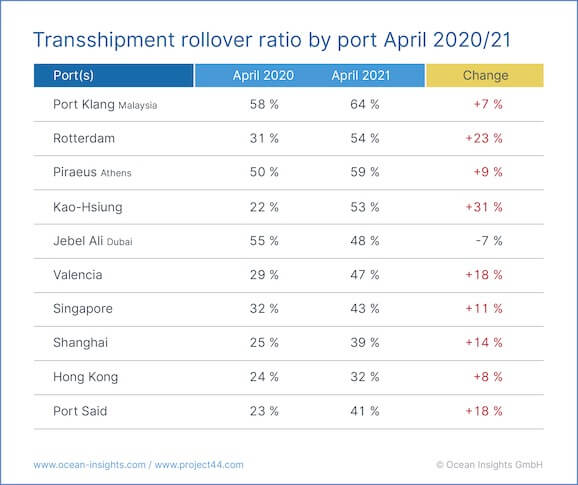

According to new data from project44, a supply chain visibility solutions provider, the percentage of containers missing their scheduled sailing continues to rise, with an average rollover rate of 39% across all ports and lines for the month of April. These rollovers — the result of unprecedented cargo volumes, container and labor shortages and ongoing port congestion — have led to significant delays and a substantial decrease in global container service scheduled reliability, with the lowest levels on record recorded in February 2021.

“With shippers entering their second year of pandemic-induced volatility, these numbers are a sobering reminder that volatility and under capacity are the new normal,” said Josh Brazil, VP of Ocean Markets for project44. “Furthermore, rates are almost universally trending upwards, and well above the levels posted during April 2020.”

Of ports surveyed, Port Klang reported the highest rollover rate at 64%; other ports with rates over 50% included Piraeus at 59% and Rotterdam at 54%; Kao-Hsiung showed the greatest change, with a 31% YoY increase. On the container line side, CMA CGM, ANL and ONE had the highest rates, at 56%, 54% and 53%, respectively, while ANL reported the greatest change with a 30% YoY increase.

“Carriers have been watching their rollover rates increase for over a year, and have so far failed to mitigate the situation,” said Brazil.

Economic recovery, inventory rebuilding and strong consumer demand continue to drive the demand for capacity. The traditional trans-Pacific contract season did not materialize as anticipated, as contracts that were signed remained limited to available capacity and premium charges. It’s clear that carriers continue to have the upper hand and will likely maintain it for at least another year — in fact, effective May 15, the industry has seen another 8% increase in rates on top of premiums of $5,000–$6,000.

The trans-Atlantic and other trade lanes are experiencing similar challenges. The simple fact of the matter is that vessels are overbooked around the world. At any sign of relief, we can expect carriers to “manage” capacity in order to maintain strong relative demand levels.

In light of this, the Legacy team continues to recommend that clients book a minimum of 4–6 weeks in advance — but bear in mind that early booking and payment of premium fees do not guarantee space. Vessel capacity is expected to remain tight through the remainder of the year and into 2022. The air cargo market is also feeling the capacity crunch as more cargo is shifted from ocean to air, so importers are advised to grab air cargo space while it’s available or risk losing it. Some importers are also reporting growing production delays; this could escalate for some commodities as the Chinese consumer market rebounds. Be sure to maintain strong communication with your suppliers in anticipation of this.

OUTLOOK

Seroka Forecasts an End to Los Angeles Port Congestion

After six months of nonstop port congestion, the situation on the West Coast may be starting to look up. In an online session moderated by Nick Ruggiero of project44, Gene Seroka, Executive Director at the Port of Los Angeles, provided an updated estimate on the timeline for reducing the number of vessels at anchor in the port. Seroka — who had originally stated that vessels queues would be eliminated by midsummer — said that shippers can now expect anchorage to be cleared by late May or early June thanks to recent productivity gains.

As covered in previous issues of the Monthly Shipment, the Port of Los Angeles — as well as other West Coast ports — has been subject to severe congestion for the better part of two years due to a combination of tariffs and increased demand stemming from the pandemic. At long last, there are signs of improvement, with May 2021 throughput estimated at 840,000 TEUs — 40,000 fewer than the month before. Based on these numbers, Seroka stated that the port would likely return to a “normal” pattern as early as August 2021.

The Port of LA can handle 10 vessels per day under normal circumstances but, in light of this congestion, has worked diligently to grow its capacity to 15+ vessels per day. This is an impressive effort considering some of the challenges that the port has faced due to COVID-19, labor shortages and so on. The improved turn times resulting from this effort will have positive downstream effects on other West Coast ports as vessels rotate from LA to the next stop. That said, though the situation in the Port of LA has certainly improved, rail lines continue to see backlogs to interior points from the Port of Tacoma, the Port of New York and New Jersey and so on.

If you’ve diverted cargo to other points, now’s the time to talk to your provider about the changing landscape. Is the Port of LA becoming an option again? Regardless, continue to book early and plan for delays — though we may see less port congestion, we’ll continue to see delays in other parts of the supply chain.

BRIEF

High Cargo Volumes & Tightening Capacity Create Seller’s Market for Airlines

Over the past year and a half, as capacity in the ocean freight market has become more constrained and rates have increased, a growing number of shippers have taken to the skies in an attempt to circumvent capacity issues and shipping delays. But now, with the air freight market running at peak levels five months before peak season actually begins, it seems as though someone’s going to have to pay the piper.

According to a new report from CLIVE Data Services, aircraft are 71% filled with cargo, based on a dimensional weight calculation; this is 10 points higher than in 2019, and 4 points higher than in 2020. Additional data indicates that air cargo volumes continue to increase while capacity has stagnated, and even decrease: Although cargo throughput is nearly the same as it was in 2019, overall capacity is 18% lower. We can, in part, attribute these capacity issues to the low number of international passenger flights, which were limited due to COVID-19 travel restrictions. According to the International Air Transport Association (IATA), passenger aircraft were responsible for 39% of cargo capacity within the market.

Rising demand, high cargo volumes and capacity constraints are a recipe for high shipping rates, which is good news for airline carriers — less so for shippers. Industry experts speculate that airlines will continue to leverage the situation to their advantage by forcing shippers to upgrade service and allocating additional resources to more profitable markets, including the North American market.

Not all hope is lost, though. As the population of fully vaccinated individuals grows, government leaders around the world are exploring the possibility of either reducing or lifting international travel restrictions, which would reintroduce sorely needed capacity to the market.

The COVID-19 pandemic has resulted in a 25%+ reduction in global air cargo capacity, and contracting capacity within the ocean freight market and low inventory levels throughout the U.S. have escalated the demand for air cargo space. As a result, rates have become very volatile, in some cases changing on a day-to-day basis. We expect the pressure on the air freight market to continue and even increase as we approach the holiday season. Although the potential return of passenger flights will add capacity to the market, timing and scale remain uncertain.

Continue to plan ocean shipments 5–6 weeks in advance and book air cargo space a minimum of seven days in advance due to backlogs at origin. As noted, rates are high and remain volatile due to overflow from sea freight and generally heavy demand. If it’s a viable option, consider alternatives to air cargo, such as shipping to the West Coast (via Asia) or the East Coast (via Europe) and trucking to the final destination, or shipping partial orders by air and the remaining balance by sea.

FORECAST

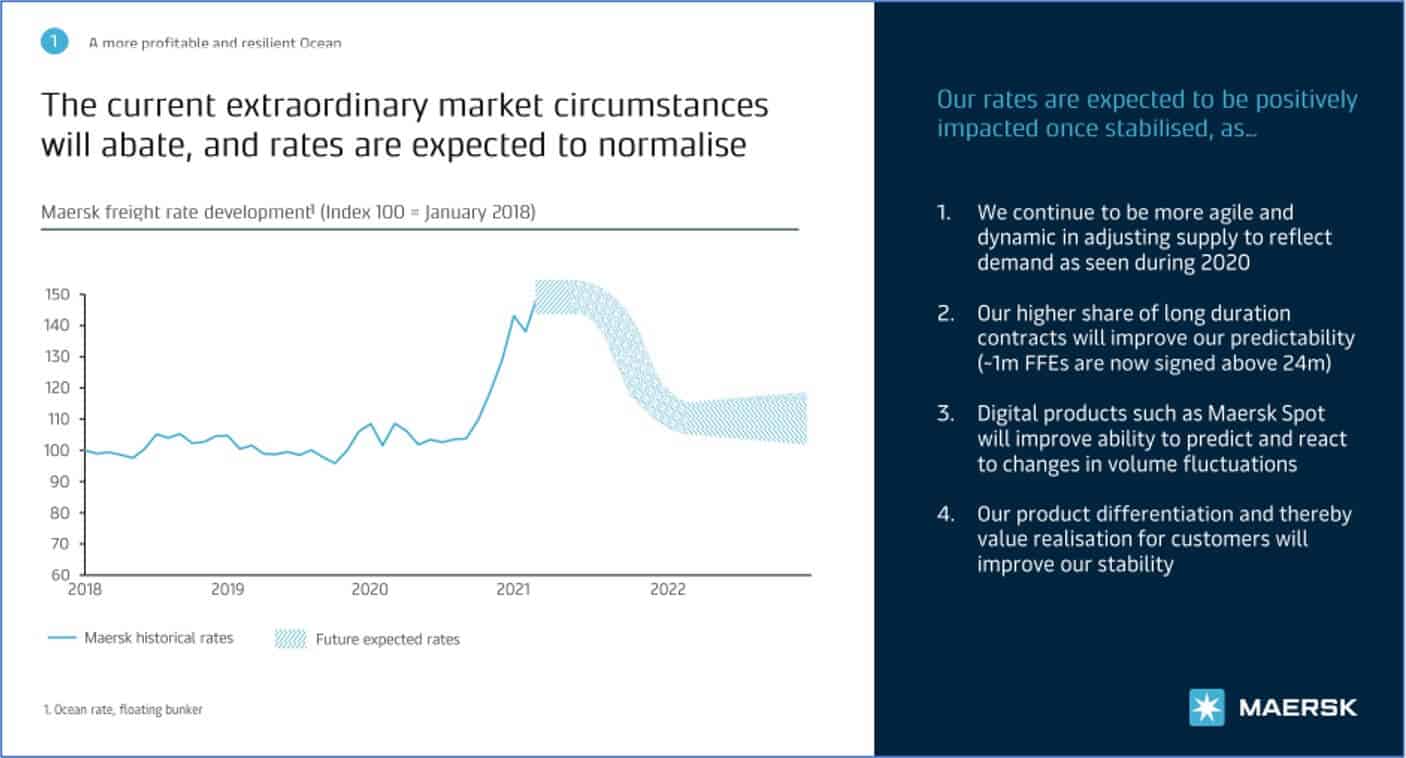

World’s Largest Container Shipping Carrier Predicts Decline in Ocean Freight Rates

Following over a year of precipitously high ocean freight rates, the tide may finally be turning. At Maersk’s annual investor conference, held on May 11, CEO Sorek Skou stated that the Danish liner wants to “ensure a soft landing from the current elevated rates.” Although rates are unlikely to return to pre-pandemic lows — Johan Sigsgaard, Head of Ocean Products at Maersk, assured investors that “rates will normalize at a rate above historical” — they are expected to stabilize by 2022.

This is welcome news for shippers, who have borne the brunt of high rates, often accompanied by service unreliability. Though volatility will persist, to some degree, throughout the remainder of the year and into the next, it will likely be a far cry from the current state of the market, in which rates reached record highs.

Supply chain disruption due to the COVID-19 pandemic in 2020 and the 2021 economic rebound have caused unusual spikes and declines in demand. These demand fluctuations have resulted in continued capacity and pricing volatility in the ocean, air, rail and truck freight markets. U.S. inventory levels are at historic lows as we approach the beginning of the traditional holiday shipping season in June/July. Those of us on the Legacy team don’t expect to see demand level out before early 2022 — from there, inventory levels will likely determine what demand for capacity looks like.

As always, it’s in your best interest to book early — ideally, a minimum of 5–6 weeks in advance for ocean shipments. Plan for delays on the water and when goods reach North America. Heavy demand has also impacted domestic truckload, rail and LTL services, so do what you can to get ahead of your shipments from Asia and plan for transport on arrival.

INSIGHT

Christmas Capacity Crunch Just Around the Corner

Christmas in July? In the supply chain world, it’s more likely than you might think.

According to the Census Bureau’s March retail trade report, the boom in containerized imports has caused the retail inventory-to-sales ratio to plummet to a record low, which means that importers need to start planning for the holiday season now in order to get inventory levels up in time for peak holiday shopping.

According to Jason Miller, associate professor of supply chain management at Michigan State University’s Eli Broad College of Business, retailers would need to increase their inventories by $65.11 billion in order to reach the 2019 inventory-to-sales ratio by the end of October, when demand is expected to reach its peak. Miller added that in order to achieve the circa-2019 inventory-to-sales ratio this year, inventories would have to grow by 85.4% more than they did in the same period in 2019. “I don’t see how that figure […] gets done given how tight things are now,” said Miller.

The current demand relative to supply in the trans-Pacific space continues to escalate as North American companies order to rebuild inventories. Unfortunately, with the traditional holiday shipping season due to start at the end of Q2 or in early Q3, we expect this will only compound the existing capacity problem. Relief from premium charges and high rates from carriers seems unlikely, and space will remain tight at least into Q1 2022. Air cargo capacity will also remain tight, only improving as international flight schedules begin to recover — that said, with COVID-19 threatening parts of Asia again, a true rebound in air cargo capacity seems further off.

At the risk of sounding like a broken record, continue to book ocean shipments 5–6 weeks early. If necessary, consider interim replenishments by air to fill the gap, but keep in mind that even air freight requires a lead time of at least seven days. Manufacturers should consider domestic suppliers where possible, and distributors and retailers should evaluate whether it’s reasonable to limit product SKU variety in favor of core item production. Some distributors and retailers may also consider shipping core or unfinished products with value-added services provided in North America. Plan for long lead times and premium costs to move cargo and note that paying premium fees for space — now a requirement for a high percentage of shipments — does not guarantee space. Stay close to your providers and give them the lead time to support your space needs.

VIDEO

Balancing Supply & Demand in the Transportation Industry

We’re excited to unveil our Legacy Whiteboard Series — a new video series that will take an in-depth look at some of the challenges, opportunities and trends affecting logistics today. In our inaugural video, Russ Romine, VP of Transportation Services here at Legacy, offers a breakdown on balancing supply and demand in the transportation industry.

Thanks again for joining us for this month’s Shipment. We’ll be continuing to keep our eye on these and other stories as they evolve — in the meantime, let us know what you think, or what you’d like to hear us write about in next month’s issue.

You can also find us online: Check out our blog or resource center, or drop us a line to talk to one our logistics specialists.

Until next time, this is the Legacy team, signing off.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more -

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more