Issue 22: Railroads and Shippers at Odds in the War over Demurrage Fees

A WORD FROM LEGACY

Welcome to the first Legacy Monthly Shipment of 2022! We hope you’ve enjoyed your holiday revelries and are ready to dive back into the world of logistics.

Now that the holidays have come and gone, it’s business as usual for shippers — and, unfortunately, that means dealing with capacity constraints, labor and equipment shortages and supply chain bottlenecks.

No sense beating around the bush — let’s jump right in.

MARKET UPDATE

Final Logistics Managers’ Index Report of 2021 Comes in with a Reading of 70.1

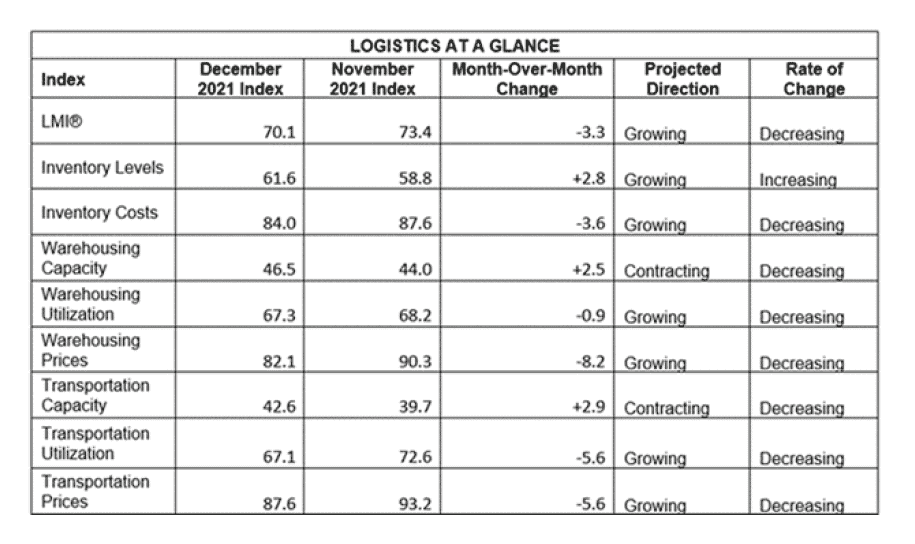

Released on January 4, the December 2021 Logistics Managers’ Index (LMI) Report showed a reading of 70.1, down 3.3 points from the prior month. Despite this decrease, expansion within the logistics industry remains strong as even, with readings of 70 or more — indicating significant expansion — for the past 11 months, and for 14 out of the past 16 months.

Dire prognostications about inventory shortages and shipping delays sent retailers scrambling, with many over-ordering stock to accommodate surges in demand. While it’s true that holiday sales volumes exceeded pre-pandemic levels and were even up 8.8% year-over-year, the predicted shortages never fully materialized. This has left retailers with an excess of inventory on hand and more arriving by the day, contributing to high readings across the Inventory Levels (61.6), Inventory Costs (84.0) and Warehousing Prices (82.1) indices. According to the official LMI report, inventory levels will likely remain high for some time, leading to a potential bullwhip effect.

In keeping with this, demand for storage space remains incredibly strong, leading Warehousing Utilization to grow (with a reading of 67.3) and Warehousing Capacity to contract (with a reading of 46.5). Transportation Capacity is also contracting for the 19th consecutive month, with a reading of 42.6, due to a lack of labor and equipment and availability. The U.S. unemployment rate has dropped to 4.2% — a 21-month low — with significant job growth in the warehousing and transportation markets. However, the hiring push, though effective, has yet to satisfy industry-wide demand.

All told, the logistics crunch is unlikely to go away in 2022, certainly not in the first half of the year. Firms have invested in logistics solutions — for everything from automation to dynamic routing to supply chain management — at an unprecedented rate, leading many logistics tech companies to achieve $1B+ valuations.

Also in Today’s Shipment:

- White House Supply Chain Disruptions Task Force unveils new 90-day plan.

- Railroads report $1B+ in demurrage fees for 2021, much to the ire of shippers.

- Freight forwarder data paints a dismal picture for trans-Pacific ocean shipments.

- The future is here with TuSimple’s first autonomous truck run on public roads.

IN THE NEWS

ANNOUNCEMENT

Introducing: The Biden-Harris Trucking Action Plan

On December 16, the Supply Chain Disruptions Task Force — a team assembled by the White House to address supply chain bottlenecks — unveiled the Biden-Harris Trucking Action Plan. The 90-day plan is designed to “support and expand access to quality driving jobs now and in the years ahead” by:

- Providing $30 million in Federal Motor Carrier Safety Administration funding and developing a toolkit to expedite the licensing process

- Kickstarting a 90-day, nationwide challenge to expand Registered Apprenticeship programs, which provide high-quality training for new drivers and support employers’ driver retention efforts

- Conducting veteran-focused outreach and recruitment programs in conjunction with the Department of Labor’s (DOL) Veterans’ Employment and Training Service and the Department of Veterans Affairs

- Launching a joint DOL and Department of Transportation Driving Good Jobs initiative to host driver listening sessions, better understand working conditions within the industry and identify opportunities for new entrants from underrepresented communities

Thus far, reactions to the plan have been mixed. Multiple industry groups, including the American Trucking Associations and Harbor Trucking Association, have praised the plan for its focus on driver safety and training.

However, many drivers and owner-operators have expressed skepticism. Todd Spencer, president of the Owner-Operator Independent Drivers Association, said that, while there “are some elements we support, including further analysis of driver compensation and unpaid detention time,” the plan overemphasizes hiring and training and “fails to address excessively high driver turnover rates.”

Others still have opted for a “wait and see” approach, stating that while the White House’s investment is certainly appreciated, only time will tell whether it has any sort of meaningful impact. What is clear is that the 90-day plan — which will conclude in March 2022 — is merely the first step in a larger initiative from the Biden administration to address issues within the trucking industry, and that the success or failure of these short-term solutions will inform longer-term strategy.

NEWS

Railroads and Shippers at Odds in the War over Demurrage Fees

According to a new report from Supply Chain Dive, the seven Class I railroads that operate in the U.S. collected $1.18 billion in revenue from demurrage fees during the first three quarters of 2021. This record-setting figure — the highest recorded since 2011 — has caused an uproar amongst shippers, who have been forced to accept rising costs despite service drops.

“It’s insult to injury — here you are having issues either receiving or sending product and it is costing you money to come up with alternatives,” said Scott Jensen, communications director of the American Chemistry Council. “And then railroads are penalizing you in demurrage.”

Demurrage fees have been on the rise over the past few years, as transportation demand and port congestion have risen to unprecedented levels, preventing cargo from moving. Who is responsible for these bottlenecks remains a hotly contested issue, with railroads claiming that shippers have flooded rail yards with imports due to a combination of warehousing constraints, driver shortages and equipment shortages.

Shippers, for their part, argue that demurrage is the direct result of railroads’ pre-pandemic efforts to implement Precision Scheduled Railroading (PSR) — a lean network approach that involved reducing employee headcount, closing service yards, changing service schedules and scaling back container idle time allowances. This approach created issues, shippers claim, when railroads found that they were unable to bring services back online quickly enough to accommodate post-pandemic demand.

Despite their insistence that “revenue via demurrage is not the goal,” railroads have enjoyed substantial revenue uplift from the practice — so much so that federal regulators have taken notice.

Previous issues of the Shipment have reported on the White House’s efforts to investigate detention and demurrage practices amongst railroads and ocean carriers. In 2020, the Surface Transportation Board (STB) implemented a new rule requiring Class I railroads to charge shippers demurrage fees directly; more recently, it established a machine-readable data requirement.

Though railroads have balked at these requirements, which are designed to bring transparency to the billing process, advocacy groups such as the Freight Rail Customer Alliance are confident that they will “allow shippers and receivers to more effectively monitor, identify, and challenge unreasonable demurrage practices and charges when they do occur.”

DATA

Importing Goods from Asia? You’ll Be Waiting a While

U.S. retailers looking to import goods from Asia via ocean freight should expect transit times of three months or more — so says the latest from Greg Miller for American Shipper.

At time of publication, multiple sources — including Flexport, Freightos, Shifi and Sea-Intelligence — reported significant shipment delays due to COVID-induced supply chain bottlenecks. Some highlights:

- Flexport’s Ocean Timelines Indicator, which measures “the time from that cargo-ready date at the exporters’ gate to the date when products leave the destination port,” reached an all-time high of 113 days the week of January 2–8. This was 41 days higher than the same time last year (an increase of 57%), and 62 days higher than January 2020 (an increase of 121%).

- According to Freightos’ end-to-end average monthly transit time calculations, shipments took an average of 80 days in December for trans-Pacific cargo — 27 days higher than in December 2020 (a 51% increase) and 37 days longer than in December 2019 (an 87% increase).

- Shifi, which tracks ocean transit time for ships from major Chinese ports to the ports of Los Angeles and Long Beach, calculated an average transit time of 34 days — more than double the pre-COVID average of 16 days and two weeks longer than average transit times in mid-2021.

- Sea-Intelligence’s North American terminal congestion index shows high-40s readings in late December 2021, more than double December 2020’s mid-to-low-20s readings.

TECH

TuSimple Celebrates First Autonomous Trucking Run on Open Public Roads

We’re only a few weeks into 2022, but if TuSimple’s first successful autonomous truck run on open public roads is any indication, the future of the transportation sector is already here.

According to TechCrunch:

“TuSimple’s Autonomous Driving System (ADS) navigated 100% of the 80-mile run along surface streets and highways between a railyard in Tucson, Arizona and a distribution center in Phoenix, which took place with no human intervention, marking a milestone for the company that aims to scale its technology into purpose-built trucks by 2024.”

This is a major step for the autonomous trucking startup, one which, according to president and CEO Cheng Lu, transitioned the idea of full-scale commercial deployment from “a science project” to “engineering work.” Given the success of this run, it’s easy to see why major OEMs such as the Traton Group and logistics companies such as DHL are scrambling to reserve trucks.

TuSimple and competitors such as Embark Trucks, Kodiak Robotics, SmartDrive and Locomation are in a race to make driverless trucking a reality. The idea is that by removing drivers from the equation, they can introduce additional freight capacity to the market, solve the ongoing driver shortage, reduce traffic congestion, help logistics companies and shippers alike cut down on costs and make the road a safer place.

Though there are still certainly some kinks to work out — driverless vehicles in general, let alone trucks, specifically, have received criticism from labor leaders and raised safety and data regulation concerns — TuSimple is celebrating its victory, one that could be a sign of major changes to come within the logistics industry.

Thank you for checking out this month’s Shipment. We’re so excited to see what 2022 has in store for the logistics industry and can’t wait to share the latest breaking news, trends and more with you.

Don’t want to wait until next month’s Shipment for even more industry insights — visit our blog or resource center for in-depth, informative content created by our team of experts, or contact us directly to talk to a Legacy supply chain specialist.

Happy New Year, folks — we’ll catch you next month.

-

Legacy Achieves Platinum Status for Delivery Excellence From Amazon

When it comes to supply chain performance, the margin for error is razor thin. Customers expect orders to arrive quickly, accurately, and...

+ Read more -

IPS Corporation selects Legacy as 3PL Partner to drive Supply Chain Transformation

FRANKLIN, IN | September 10th, 2025 – Legacy SCS announced that it has been selected by IPS Corporation, a global leader in Water...

+ Read more -

How GForce Transformed Its Supply Chain Into a Powerful Growth Engine

When GForce Arms launched in 2020, the mission was simple but ambitious: deliver affordable, reliable firearms with the speed and...

+ Read more