Issue 9: Unprecedented Container Loss Reported in ONE Apus Incident

After what has felt, to many, like the longest year on record, 2020 is finally winding to a close. Shippers and carriers, though, remain as busy as ever, putting the final finishing touches for Q1 2021 into place.

In our year-ending edition of the Legacy Monthly Shipment, we discuss the latest supply chain news stories and turn our eyes to the future. Let’s see what’s in store.

Today’s Shipment:

- Capacity constraints and high rates expected to carry over from Q4 2020 into Q1 2021.

- With multiple vaccine candidates in sight, shippers rush to prepare for distribution.

- Early reports on the ONE Apus incident indicate an unprecedented loss of containers.

- High trans-Pacific container volumes create challenges for carriers and shippers alike.

- In an effort to reduce congestion, the Port of Long Beach commits to dual transactions.

INDEX

Capacity Contracts for the Sixth Consecutive Month as Rates Soar

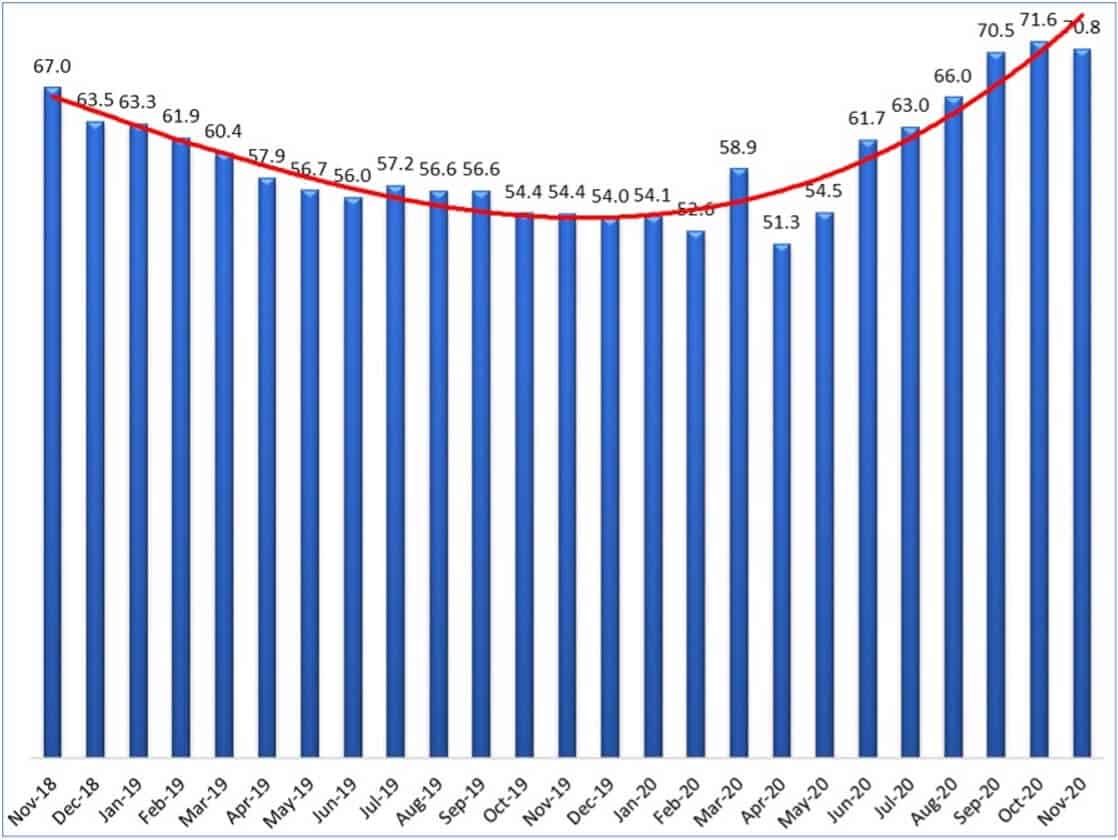

If you’ve been following the Legacy Monthly Shipment over the past few months, it likely comes as no surprise to hear that capacity constraints and high rates continue to plague shippers everywhere. November’s overall Logistics Managers’ Index (LMI) registered a 70.8% reading — down 0.8 points from October, but up roughly 20 points from the all-time low in April.

Drilling into the data, the transportation capacity index remains on a downward trajectory; it stood at 35.1% in November, down 2.9 points since October, making it the sixth straight month in contraction territory. By comparison, the transportation prices index has increased to 85.8% — up 48.1 points since April. Given that online sales are expected to remain strong, this pattern of low capacity and rising rates is expected to continue well into Q1.

The LMI reinforces what we’re seeing on the ground: continued tight capacity for both transportation and warehouse space, as well as consistent upward price pressure. For all the negative news about the economy, the movement of goods has been unprecedented and demand for capacity remains strong — all encouraging signs.

At this time, it’s critical that shippers continue to anticipate — and plan for — longer lead times. Shippers should make international bookings a minimum of three weeks in advance to help ensure adequate space. Once cargo starts moving, plan for 25%–30% longer transit times due to congestion and labor shortages. We recommend that domestic shippers book loads with their carriers or brokers as far in advance as possible to allow for capacity planning and mitigate service failures and high costs.

We expect high volumes and demand for transportation capacity to continue into March, perhaps longer. For domestic shippers evaluating their 2021 RFP renewals in January or February, we recommend that you consider freight brokers as part of your solution. We expect asset-based capacity to remain tight for at least the first half of the year, and a broker can help fill your capacity needs.

Even carriers that once offered guaranteed expedited container movement at a higher price have started to drop their guarantees in light of capacity constraints. Still, for shippers whose cargo is of a more urgent nature, it could prove beneficial to remain open to alternative routings or expediting.

UPDATE

COVID-19 Vaccine Continues to Pose Unique Challenges for Distributors, Forwarders

Now that one COVID-19 vaccine has received emergency authorization from the FDA and a second due for authorization in just a matter of days, shipping companies are under the gun to resolve any lingering logistical issues that could stand in the way of mass distribution.

As discussed in an earlier issue of the Shipment, supply chain experts have expressed concerns for months about the availability of cold storage facilities capable of meeting vaccine refrigeration requirements. These concerns persist, especially given that Pfizer’s vaccine must be kept at a temperature of minus 70 degrees Celsius — colder than winter in Antarctica. Although the production of freezer systems has steadily ramped up since the summer, and Pfizer has developed packaging with a built-in cooling system and GPS-enabled thermal sensor, the question remains whether healthcare facilities in rural areas have the infrastructure in place to keep the vaccine sufficiently cold.

Vaccine distribution presents an entirely different challenge for forwarders: Given how tight capacity continues to be, many have had their air freight cargo bumped in favor of vaccine shipments.

Here at Legacy, we’re starting to see early signs of tightening in the air cargo market. We expect that capacity challenges will heighten in specific trade lanes as vaccine distribution channels begin to fully develop in 2021 and will be most felt in the US-Euro trade lane. China’s Sinopharm vaccine, which the country has approved for release and is likely to be distributed to some nations, could affect trans-Pacific capacity if any PRC carriers are deployed to distribute it.

In addition to the vaccine, there are numerous supporting products — vials, syringes and so on — to consider that are currently being manufactured in China. Production for these goods will likely ramp up in support of vaccine distribution, which will certainly affect capacity out of Asia. It’s in shippers’ best interest to continue to follow the market, talk to suppliers and forwarding transportation partners and plan early. Get everything in place before air freight capacity becomes a problem because it’s likely to become one.

NEWS

Record Number of Containers Lost or Damaged in ONE Apus Incident

On November 30, 2020, during a trans-Pacific voyage from Yantian, China, to the Port of Long Beach, California, the container ship ONE Apus encountered severe weather conditions, including gale-force winds and large swells. The inclement weather caused the vessel to roll, sending nearly a quarter of its cargo into the ocean.

After the loss, the vessel was routed back to Japan (where it arrived on December 9) because there was no space at U.S. ports to rework the load. Unharmed containers have been rerouted to their final destination.

According to an official report from the ship’s owners and managers, the total number of containers lost or damaged stands at 1,816, about 64 of which contain dangerous goods, including fireworks, batteries and ethanol. This total count makes the ONE Apus incident the worst on record since the sinking of the MOL Comfort in 2013. Insurance claims from the spill are expected to top $50 million.

Container losses at sea or during unloading occur frequently, but rarely on this scale. Given that there’s an inherent risk factor to shipping cargo internationally by sea or by air, we encourage our clients to consider cargo insurance to protect the value of goods in transit. If you’re interested in discussing cargo insurance, Legacy can provide information on available insurance programs.

For clients with cargo on the ONE Apus, the Legacy team is in regular communication with the carrier on the disposition of any containers involved in the incident; we will update you as more information becomes available.

REPORT

Trans-Pacific Container Import Volumes Remain Higher Than Expected Heading into Q1

After months of higher-than-average volumes, trans-Pacific container imports were expected to finally decrease following the first week of October. Now nearly midway through December, trans-Pacific container volumes remain as strong as ever and are unlikely to let up until February, shortly after Chinese New Year. With consumers still stuck at home with no definitive end in sight, online sales out of the U.S. remain strong, despite mitigating economic factors. This new, COVID-related eCommerce shopping pattern has dramatically increased the number of container imports coming out of China.

According to The Signal, the Port of Los Angeles’ forecasting tool, inbound volumes are expected to hit a new peak of 177,161 TEUs from December 13–19. The influx of containers has contributed to port congestion, essentially turning San Pedro Bay into a parking lot. This congestion has led carriers to omit calls, impose surcharges and increase capacity on Asia-East Coast services. High trans-Pacific container volumes have also caused concern amongst shippers over contract renewals; spot rates also remain high, placing shippers in a disadvantageous position as they enter negotiations.

As of mid-December, there are approximately 20+ vessels off the coast of Los Angeles and Long Beach waiting to berth for unloading. Port terminals are experiencing labor shortages, union challenges, space issues, chassis shortages and more. Given that the Ports of Los Angeles and Long Beach are the largest gateways in the U.S., trans-Pacific import cargo delays have a downstream effect on cargo transiting to much of the interior. Other ports are being used as alternatives, though they, too, are experiencing heavy volumes. We expect this congestion to carry into March or longer.

With this heightened and heavy volume expected to continue into the spring, it could affect the 2021 trans-Pacific RFP season. In light of this, we recommend that shippers and importers consider pulling non-vessel operating common carriers (NVOCCs) into their RFPs.

Think of it this way: If you enter into negotiations with carriers and lock in contacts using a fixed rate structure while the market is still strong, you’ll be stuck with high rates. If you negotiate with an NVOCC, such as Legacy, that has both fixed carrier contracts and the ability to work inside the spot market, you can get a fixed price long term that will likely be a little higher than the carrier’s because the NVOCC works at the same rate as the carrier and then margins on it. The difference is that, when the market is volatile or begins to move — especially if it moves down — an NVOCC can negotiate spot rates on your behalf and secure better pricing than your fixed rate with a carrier might have been.

Additionally, with a fixed price structure, if the market gets hotter, you might find yourself locked in with a particular carrier that begins to have space problems. By comparison, an NVOCC can bring multiple carriers into play and offer more flexibility in terms of finding space. Ultimately, NVOCCs offer a lot more flexibility than fixed carrier pricing, though we advise larger clients to consider a mix of both options in order to meet their needs.

ANNOUNCEMENT

Port of Long Beach Announces Commitment to Increase Dual Transactions by 50%

Speaking of high trans-Pacific container volumes, the Port of Long Beach has implemented a plan to help improve cargo flow and reduce congestion. In an official press release, the Port announced that the four companies that operate its six container terminals have committed to raise the rate of dual transactions at their facilities by at least 50%. This commitment comes as part of a concerted effort from the Port and its cargo terminal operators to improve its appointment systems, balance inbound and outbound cargo traffic and enhance supply chain efficiency.

“Increasing the share of dual transactions will optimize truck deliveries, terminal appointments and chassis availability during this unprecedented time in the Port’s history,” said Port of Long Beach Executive Director Mario Cordero. System enhancements are currently underway at all Long Beach terminal facilities; Cordero also noted that the Port is exploring the idea of a single appointment system to cover all terminals.

The Port of Los Angeles is also trying to increase dual transactions, with Port of Los Angeles Executive Director Gene Seroka proposing monetary incentives for dual transactions.

This announcement from the Port of Long Beach comes as great news for draymen and shippers. For some time now, steamship lines have only allowed one-way transactions to either pick up or drop off containers in an effort to drive terminal efficiency. This has prevented draymen from taking export containers in, grabbing import containers and taking them back, which has forced draymen to make appointments both ways. The fact that the Port is reintroducing dual transactions shows that top brass is aware of and appreciates the challenges that draymen currently face and making a concerted effort to reduce congestion.

It’s been a tough year, but we’ve made it through and there’s hope on the horizon: With vaccines rolling out and GDP on the rise, 2021 already looks to be a much better year than 2020.

What topics or trends would you like to see the Legacy Monthly Shipment cover in the New Year? Shoot us an email and let us know — we want to know what stories matter to you.

As always, our blog and resource center are chock full of valuable information to enhance your supply chain operations, and our team of experts is at the ready to assist with anything you might need.

Until next time, this is the Legacy team signing off. Happy holidays, and we’ll see you next year.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more -

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more