Issue 13: Ever Given Container Vessel Causes Suez Canal Blockage

Hello and welcome to the Legacy Monthly Shipment, your trusted source for all things supply chain and logistics news, insights and trends.

Since the end of last month, it seems like all anyone can talk about is the Suez Canal incident — and for good reason. Although the Ever Given has been freed for the better part of a few weeks, its grounding is expected to have downstream effects throughout the global supply chain for weeks to come. We get into that in this issue of the Shipment, as well as take a closer look at some other major events that will continue to shape the year ahead.

Let’s get into it.

Today’s Shipment:

- Owners of the Ever Given declare General Average as losses start to add up.

- What the Ever Given incident tells us about the supply chain at large.

- Ocean carriers made out like bandits in 2020 — and are likely to do so in 2021, as well.

- Rising demand combined with import delays could spell trouble for American shoppers.

- A container shortage could decelerate the recovery of Indian trade.

NEWS

First General Average in 3 Years Declared Following Suez Canal Blockage

On the morning of March 23, 2021, the Ever Given became lodged in the Suez Canal. It was a story that quickly became viral news, attracting global attention, even from those outside the logistics industry. But what made for an amusing tale to talking heads on Twitter proved to be a crisis for shippers: The blockage, which lasted for a full six days, forced shippers to reroute container vessels around the Cape of Good Hope and to scramble to find secure berths at ports. All told, the blockage has contributed to rising cargo prices, container shortages, port congestion and, of course, shipping delays.

Even now, with the Ever Given freed and normal traffic beginning to resume through the Canal, the extent of the damage resulting from the blockage remains unclear. Osama Rabie, chairman of the Suez Canal Authority, has publicly stated that losses and damages from the blockage could exceed $1 billion. Shippers with cargo onboard the Ever Given anticipate delays of weeks — even months — on shipments as an investigation is conducted into the vessel’s grounding. As a result, Shoei Kisen Kaisha — the Japanese leasing company that owns the Ever Given and is, itself, a subsidiary of Imabari Shipping — has declared General Average, with Richards Hogg Lindley appointed as adjustor.

A quick bit of history: The law of General Average is a principle of maritime law, one that dates back centuries. In fact, the earliest incarnation of General Average can be found in the Lex Rhodia, the Rhodian Sea Law of circa 800 BC. In its current form, the law of General Average protects an ocean carrier from liability in the event that it has to jettison cargo to avoid damage to the vessel. General Average also distributes the full cost of the loss and any additional services rendered in the recovery of the vessel evenly across all stakeholders — in this case, any shipper with cargo onboard the vessel. Per The Loadstar, the last time General Average was declared, following the 2018 fire on board the Maersk Honam, salvage security was fixed at 42.5% of cargo value and 11.5% as a General Average deposit.

This is a clear and present reminder of the risks that shippers face, as well as the importance of cargo insurance. Already met with significant financial setbacks due to delayed shipments, Shoei Kisen Kaisha’s declaration puts shippers with uninsured cargo in an even more vulnerable position, forcing them to help foot the bill for salvage operations lest they lose that cargo. As of yet, it’s unclear whether fines due to negligence will also be included in the general loss.

We’ve said it before, and we’ll say it again: It’s always in a shipper’s best interest to invest in insurance. Although events of this magnitude may be rare, heightened demand and an increased sense of urgency have placed significant pressure on the global supply chain; efforts to move goods with greater speed could contribute to accidents and a higher rate of risk. The good news is that cargo insurance is surprisingly affordable — if you remain unsure, talk to your freight forwarder to discuss insurance options.

INSIGHT

Ever Given Incident Offers Insight into Global Supply Chain Complexity

The grounding of the Ever Given has captured the attention of logistics insiders and outsiders alike — and as more details come to light around the incident, an intricate picture of the global supply chain has also come into view.

According to analysis from supply-chain software provider E2open LLC and published in the Wall Street Journal, at least 66,480 cargo containers were delayed as a result of the incident — containers holding everything from household goods and food products to textiles and construction materials. Though the vast majority of shipments were consumer products en route from China to Europe, other delayed shipments included 11,200 containers bringing wastepaper from the U.S. to India; 1,600 boxes containing auto parts headed from Germany to China; and 1,519 containers of lumber en route from Belgium to China.

In addition to creating significant setbacks for shippers, the Ever Given incident has also compounded port congestion. The incident led to a backlog of over 400 vessels in the Suez Canal — some of which rerouted around the Cape of Good Hope, adding two weeks of transit time to Europe. Now that that backlog has started to clear out, major ports throughout Europe — including the Ports of Rotterdam, Antwerp and Hamburg — have been hammered by ships arriving at the same time to unload. This congestion has also tied up a significant volume of container equipment, contributing to the ongoing container shortage. Based on the current market, we here at Legacy anticipate that this container shortage will increase costs and lead to capacity challenges lasting from mid-April to mid-June 2021.

REPORT

Ocean Carriers Experience Most Profitable Quarter in Shipping History

Despite the challenges presented in 2020, ocean carriers came out on top — with seemingly nowhere to go but up. Q4 20 proved the most profitable quarter in container shipping history for ocean carriers, with investment management firm BlueAlpha estimating cumulative fourth-quarter net earnings at $9 billion. The firm also estimated a $15.8 billion net profit for the year for all top-ranked lines — more than double the total profit ocean carriers have produced in the past five years.

Experts attribute this wildly successful quarter — and year — to rising transpacific rates, container shortages and an organized effort from carriers to reduce capacity on many tradelanes. Those efforts have certainly paid off and have set 2021 up to be even more profitable. The combination of massive spot rate hikes and higher contract rates places carriers in an enviable position, with some carriers already reporting historically high Q1 21 profits.

Carriers have learned a valuable lesson over the past year about how to maintain and even grow profit margins. When demand plummeted during the first wave of COVID-19, carriers pulled capacity from the market. From the outside looking in, this might have seemed like standard procedure; however, carriers quickly realized that if they worked together to pull capacity out of the market, they could turn the situation to their advantage when demand came back online. As a result, carriers — already highly consolidated due to acquisitions over the past 10 or so years — have become even more unified, with new alliances forming in the trans-Pacific and trans-Atlantic markets. For evidence of this, look no further than the fact that carriers strategically removed additional capacity from the market around Chinese New Year in order to maintain their footing; we expect them to continue to make calculated moves like this in the future, prompting a continually strong carrier market.

Although this is great news for carriers, it poses certain challenges for shippers, with multi-year contracts becoming more commonplace. Given the current state of the market, we advise that shippers not put all their eggs in one basket: Rather than sign a contract with just one carrier, consider partnering with an NVOCC, which has access to all carriers, can navigate the market through its peaks and valleys and even offer additional services on the back end.

INDEX

Demand Continues to Grow as Transport Supply Remains Constrained

Much has been said of the dramatic surge in consumer demand in 2020 — and thanks to fiscal stimulus, it shows no signs of letting up in 2021. When paired with rapidly depleting inventories, as we reported on in last month’s Shipment, this could spell trouble in the form of empty shelves in American stores.

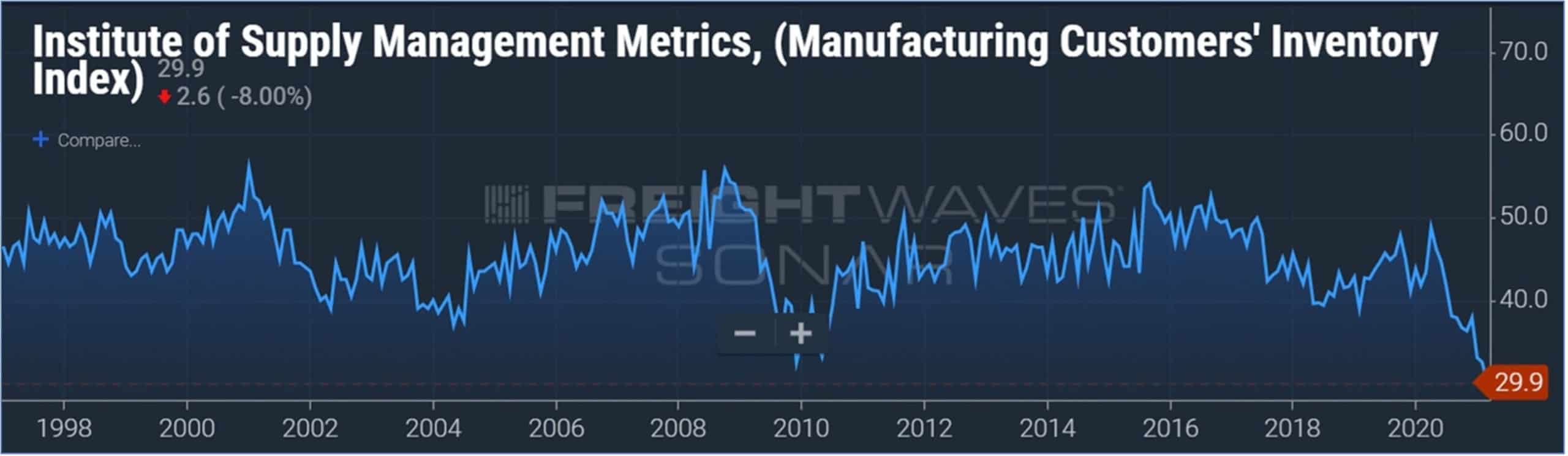

Late last month, the Institute for Supply Management’s (ISM) Manufacturing Customers’ Inventory Index plummeted to just 29.9 points — a historical low following eight months’ worth of historical lows. Analysts predict that cargo volumes will remain strong for the foreseeable future due to inventory restocking, and that import demand will continue to grow.

FreightWaves’ SONAR chart illustrating the ISM Manufacturing Customers’ Inventory Index.

In the meantime, bookings continue to rise, with FreightWaves reporting record highs on its China-U.S. bookings index; this is expected to place additional strain on already overburdened ports. Fallout from the Ever Given incident is also expected to contribute to port congestion in Europe and restocking delays due to reduced vessel and container-equipment availability.

Increased demand from what appears to be a strong U.S. recovery is adding fuel to the flame. Based on current industry projects, volumes are expected to remain at or above the 2 million TEU mark for 11 out of 12 months by August 2021. Prior to 2020, monthly imports had reached 2 million TEU just once before, in October 2018. Rail transport for boxes moving inland from both the East and West Coasts is experiencing delays of up to 2–3 weeks as rail cart shortages slow the movement of goods to Interior Point Intermodal (IPI) locations. Chassis and trucks are causing further delays at destination ramps.

This has made it so that IPI bookings are only available at premium rates — or worse, not at all — as carriers cancel IPI services in favor of West Coast terminations to get equipment back to Asia. Shippers seeking alternatives via Houston or the East Coast will find themselves out of luck, as space on the East Coast is even tighter than on the West Coast, and Houston rates have skyrocketed to over $10,000. Fallout from the Suez Canal closure is expected to impact the East Coast this month, tightening equipment in Asia further and feeding the cycle of premium booking and reduced services. As a result, cargo transloading to interior points has become the norm, rather than the exception, and space allocations continue to place pressure on reasonable carrier contract discussions.

Given the odds, all shippers can do is plan in advance. For trans-Pacific and trans-Atlantic cargo, we recommend that you start to look at shipments based on a “must deliver date” basis and book a minimum of four weeks in advance for space. For IPI cargo, accept premium rates when available, or consider West Coast transloading to truck or rail.

For Indian subcontinent shipments, book as early as possible due to ongoing equipment shortages (more on that momentarily). If Full Cargo Load (FCL) equipment is unavailable, consider Loose Cargo Load (LCL) shipments, but be aware that this can add 1–2 weeks to transit time. Generally speaking, any cargo — whether FCL or LCL — moving to interior points may be slowed by domestic rail backlogs. Therefore, plan on extended transit times and, if necessary, terminate on the West or East Coast for less-than-truckload and truckload shipping on forwarding.

Finally, consider air cargo as an alternative to ocean freight. Rates and capacity are volatile as more ocean cargo moves to air; however, this may be a viable option for some.

BRIEF

Rebound in Indian Trade Threatened by Container Shortage

India’s container imports rebounded in Q4 20, reinvigorating trade for the country. But despite Maersk’s Q4 India trade report starting that Indian trade was “making solid strides towards returning to normalcy,” challenges persist in the form an ongoing shortage of export containers.

India’s trade imbalance has been a hot topic in the past year, as demand for textiles and apparel out of North America and seeds, beans, cereal and flower out of African and Gulf countries drove exports sky-high. Conversely, political tensions with China and coronavirus-related lockdowns caused a significant drop in imports from China and the U.S., India’s two largest trading partners.

Though that trade balance does appear to be evening out — largely due to COVID-19 vaccine distribution efforts — there’s still a container shortage to contend with. According to the Federation of Indian Export Organisations (FIEO), the lack of available containers contributed to a 0.67% YoY increase in exports for February — down from 6% in January. The FIEO has responded to this shortage by creating an online container marketplace to support outbound trade.

Over the past few decades, India has become a major global supplier of goods. As recently as 2018, U.S. tariffs on Chinese goods and sourcing changes have prompted companies to move production to India. Although this has been a net positive, the country was hit hard by the COVID-19 pandemic; following a brief recovery period, India has reentered lockdown due to a surge in cases resulting from the emergence of a more contagious variant of the virus. This has placed India in a challenging position for shipping and logistics — though systems remain online, there are limitations on truck moves from interior points to ports.

To reiterate, we advise shippers to book early (4–6 weeks out, if possible) and consider LCL or air freight as options to get cargo moving.

What stories have caught your attention this month? What issues or trends are of particular interest to you? Reply to this email to let us know — we want to hear from you.

As always, for additional logistics insights, we recommend that you check out our blog or resource center. And for more personalized advice, talk to one of our specialists directly.

See you next month.

-

Legacy Achieves Platinum Status for Delivery Excellence From Amazon

When it comes to supply chain performance, the margin for error is razor thin. Customers expect orders to arrive quickly, accurately, and...

+ Read more -

IPS Corporation selects Legacy as 3PL Partner to drive Supply Chain Transformation

FRANKLIN, IN | September 10th, 2025 – Legacy SCS announced that it has been selected by IPS Corporation, a global leader in Water...

+ Read more -

How GForce Transformed Its Supply Chain Into a Powerful Growth Engine

When GForce Arms launched in 2020, the mission was simple but ambitious: deliver affordable, reliable firearms with the speed and...

+ Read more