Issue 34: East Palestine Derailment, Maersk & MSC End 2M Alliance & More

A WORD FROM LEGACY

February may be the shortest month of the year, but it certainly isn’t short on news.

Hello, and welcome once again to the Legacy Monthly Shipment, a monthly newsletter in which we deliver news, insights and trends for the logistics industry. From the Norfolk Southern train derailment in East Palestine, OH, to A.P. Moeller-Maersk and the Mediterranean Shipping Company (MSC) announcing the end of their 2M alliance, we’ve got a lot to talk about this month; let’s get started with our Market Update.

MARKET UPDATE

First LMI of 2023 Marks Second Increase After Prolonged Period of Decline

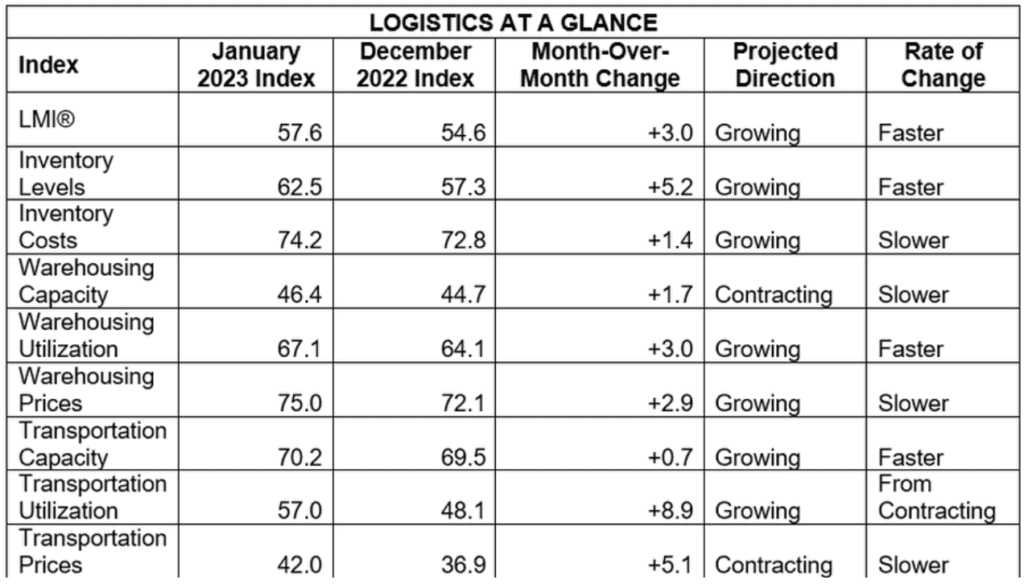

The January 2023 Logistics Managers’ Index (LMI) came in at a reading of 57.6 — a 3-point increase from December 2022 — marking the second consecutive month-to-month increase after seven months of declining growth and pointing to what industry experts suspect may be a larger trend. Let’s take a look at some of the factors prompting this change.

First and foremost, the official LMI report notes that 517,000 jobs were added to the United States economy in January. Despite mass layoffs within the tech industry, other sectors saw substantial growth, including transportation and warehousing, which added 23,000 workers.

Though this unprecedented growth comes as welcome news, it also raises concerns about how the Federal Reserve will respond. Despite job growth and reduced inflation, Federal Reserve Chair Jerome Powell recently announced that the central bank will continue to increase short-term interest rates — a move that economists worry could stymie further job growth, wage increases and, most importantly for shippers, consumer spending.

After a year of carrying surplus inventory, it seems firms were finally able to run down their backlogs over the holiday season and are now working to replenish their available supply. The experts behind the LMI predict that we won’t see a repeat of this pattern in 2023, noting that “the lack of backlog at the ports combined with shorter order times might lead back to something resembling ‘normal’ seasonality.” If this prediction is accurate, it would be the first time the industry has seen traditional seasonality since 2020 and would cause inventory levels to climb slowly, peaking in Q3.

Speaking of inventory, inventory costs remain high, with the January 2023 Inventory Costs index registering a reading of 74.2 — up 1.4 points from December and the 28th consecutive month of growth. Now that China has rolled back some of its zero-COVID policy restrictions, firms will have an easier time replenishing their inventories; however, questions still linger for U.S.-based firms looking to open or reopen manufacturing facilities within the country.

Inventory replenishment may also breathe some much-needed life into the transportation sector, which has experienced a significant slump over the past few months. Experts at both JB Hunt and Knight-Swift anticipate an increase in freight demand in Q2, which couldn’t come at a better time, as the Transportation Capacity index continues to rise, clocking in at a reading of 70.2. Transportation Utilization rates have also increased, with a reading of 57.0 in January — a 8.9-point month-over-month —, which is reflected in renewed demand for class 8 trucks.

This increase in utilization has the potential to drive up transportation prices, which comes as welcome news to carriers (less so for shippers, who have enjoyed unusually low contract and spot market rates). Should prices begin to climb again, the LMI report states that it “would not only provide relief for carriers, but also provide evidence that the overall economy could be headed toward a ‘soft landing.’” This shift will depend not only on consumer spending, but also fuel availability: Although fuel prices have stabilized since Summer 2022, supply remains limited due to the ongoing Russian invasion of Ukraine.

One thing that has remained consistent over the past year is demand for warehousing space. The Warehousing Capacity index continues to contract, reading at 46.4, marking the 30th consecutive month of contraction — the longest run in LMI history. While demand remains high, that could be subject to change in the coming months: According to real-estate services firm Cushman & Wakefield, companies leased 132 million square feet of industrial space across the U.S. in Q4, a 28.2% decrease from Q3. While this is still indicative of strong demand, it’s less than we’ve seen over the past 18 months. All the same, warehousing utilization remains high (up 3 points to a reading of 67.1) and, consequently, so do warehousing prices (up 2.9 points to a reading of 75).

Finally, the LMI report notes some “interesting shifts in the market” throughout the month of January — namely, that available warehousing capacity increased, showing the first signs of expansion in an over two-year period. It remains to be seen whether this is simply a lull in the market, or a sign of a larger shift.

For a complete overview of the January 2023 LMI across all indices, please refer to the chart below:

Also in Today’s Shipment:

- The latest updates on the Norfolk Southern train derailment in East Palestine, Ohio.

- Maersk and MSC announce the end of their industry-changing 2M alliance.

- Prolonged contract negotiations between ILWU and PMA cause unease amongst shippers.

- Retailers seek to secure substantially lower ocean-freight rates as contract season looms large.

- Chinese spy balloon drama prompts questions about supply chain diversification.

IN THE NEWS

breaking: East Palestine Train Derailment One of the Worst Rail Disasters in Freight History

On February 3 at 9 p.m., a Norfolk Southern freight train carrying several cars of vinyl chloride and other toxic materials derailed in East Palestine, Ohio. The scene of the derailment looked like something from a disaster movie, with thick clouds of toxic black smoke — caused by controlled burns — choking the air.

Though the cause of the derailment is still under investigation, video evidence authenticated by the National Transportation Safety Board (NTSB) seems to suggest that an overheated wheel bearing on one of the train cars was the primary cause for the crash.

A recent report from FreightWaves sheds light onto other factors that could have contributed to the crash, noting that rail unions have called the practices of Class I operators such as Norfolk Southern into question in recent years. These practices include precision scheduled railroading which, as FreightWaves reporter Jack Daleo states, “often necessitates longer and heavier trains that are more prone to derailments” and “sacrifices certain safety measures for speed, like blocking, which is when heavier cars are moved to the front of the train for smoother braking.”

Norfolk Southern workers, in particular, claim that they’ve been aware of issues with the derailed train, 32N, for years, even dubbing it the “32 Nasty.”

Although many of East Palestine’s residents have since returned to their homes following temporary evacuation orders, the total fallout remains to be seen, and many outlets are calling the derailment one of the worst rail disasters in freight history. At time of publication, the Environmental Protection Agency (EPA) had screened some 486 homes, finding no trace of toxins, and had declared the town’s municipal water supply to be safe to drink; however, certain waterways near the crash site remain contaminated.

Norfolk Southern already faces multiple class-action lawsuits from town residents claiming negligence and seeking payment for property damage, economic loss and exposure to hazardous chemicals. For its part, the EPA has vowed to hold the company responsible for the derailment. Whether the disaster will prompt meaningful changes to Class I safety regulations remains to be seen.

As a final note, all of us at Legacy would like to offer our condolences to those affected by the disaster, and we hope for a swift resolution for the citizens of East Palestine.

brief: Shakeup in Ocean Shipping: Maersk & MSC Part Ways, Ending 2M Alliance

It’s official: As of January 2025, the alliance between two of the world’s largest container lines, Maersk and MSC, will cease to exist. The alliance — known as the 2M alliance — was formed in 2015, covers Asia-Europe, trans-Pacific and trans-Atlantic trade routes and is widely recognized for ushering in the modern era of ocean carrier consolidation.

Although it’s been roughly a month since Maersk and MSC issued their joint announcement, stating that “Discontinuing the 2M alliance paves the way for both companies to continue to pursue their individual strategies,” a recent report from SupplyChainDive examines the potential repercussions of this decision.

As Associate Editor Alejandra Salgado reports, the end of the world’s largest shipping alliance will likely cause other ocean carriers to reconsider their own alliances, which could lead to increased competition and low rates. While this would be to shippers’ benefit, the end of such alliances could also lead to service volatility and a higher number of blank sailings.

The decision to end the 2M alliance will dramatically reduce Maersk’s ocean shipping capacity — though that may be the point, given that the carrier appears to be focusing its attention on fulfillment and trucking in an attempt to evolve into an end-to-end supply chain provider.

In direct contrast, MSC is increasing its ocean shipping capacity, placing multiple orders for new container vessels, as well as scouring second-hand and charter markets. This has prompted some speculation that MSC initiated the breakup, with Sean Heaney, senior manager of container research at Drewry Shipping Consultants, stating that MSC “seems better equipped for independent living than its partner.”

Update: Mounting Concern Over Delays in U.S. West Coast Labor Negotiations

It’s been nearly a year since contract negotiations began between the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA), and almost eight months of dockworkers along U.S. West Coast ports working without a contract. Despite ILWU and PMA’s insistence that talks are progressing and joint vow to prevent disruption, this protracted timeline is increasingly causing concern amongst shippers, who worry about the potential for a strike or lockout.

In an interview for FreightWaves’ Global Supply Chain Week, Peter Friedmann, executive director of the Agriculture Transportation Coalition expressed concerns over West Coast labor uncertainty.

“We’re seeing some investments being made at East and Gulf Coast ports due to one factor — the uncertainty of what’s going to happen,” said Friedmann. “Bit by bit this uncertainty continues. Investment decisions have to be made, capital is being raised, and it is going to be deployed where there’s less uncertainty. […] That means if [an investor] is putting a multimillion-dollar transload or cold storage facility in a port on the East Coast, that’s where the cargo is going to go. It takes years to get through the permitting and financing, so once those investments are made, that locks in a trade route or distribution network to that location.”

West Coast ports are already feeling the impact of prolonged negotiations, reporting low cargo volumes for the final three months of 2022, and will likely continue to do so until ILWU and PMA are able to reach an agreement. As Friedmann notes, carriers are shifting vessel capacity to the East Coast to meet rising demand, which not only negatively affects West Coast cargo volumes but also puts exporters looking to move goods such as soybeans, hay, almonds and meat to the Asia-Pacific region at a significant disadvantage.

In light of these challenges, members of Congress are looking for ways to protect exporters through legislative action. In June 2022, California Democrats introduced the American Port Access Privileges Act, which aims to establish a “secondary berthing” preference for container vessels that serve multiple U.S. ports, reward carriers that serve both importers and exporters and incentivize carriers to make second-legs voyages to West Coast ports.

report: Retailers Regain the Upper Hand This Contract Season

With contract season just days away, retailers are preparing to play hardball in an attempt to recoup costs after last year’s surge in rates. The Wall Street Journal reports that “some companies expect to cut ocean-freight rates by half or more,” which would enable them to reduce the cost of goods and, hopefully, encourage consumer spending.

As of February 9, the average contract cost of a shipping container from China to the U.S. West Coast was $2,618, according to transportation data firm Xeneta. This number is substantially lower than rates at this same time last year, when shipping volumes were surging, importers were scrambling for available capacity and terminal operators were working through a significant backlog of container ships off the coast of California.

Much has changed since then: Rising inflation has dampened consumer spending and firms have steadily depleted inventory backlogs. Both factors have led retailers to pull back on orders, which has weakened cargo volumes and demand for ocean carrier capacity. All of this has taken a serious toll on ocean carriers’ earnings — Maersk is forecasting an 80% drop in profits for 2023 — and gives firms the upper hand as they enter into contract negotiations.

Although retailers are still feeling financial pressure from high energy, labor and raw materials costs, should they succeed in securing lower contract rates, they’ll be able to offset some of those costs and balance prices.

forecast: Firms Seek Alternative Suppliers as Tensions Rise Between U.S. & China

It’s a story that’s captured the nation’s fascination and the intelligence community’s concern over the past few weeks: On January 28, a Chinese spy balloon first entered U.S. airspace near Alaska, before flying over Canada and the continental U.S. The balloon was again spotted over Montana on February 1, before making its way toward the East Coast, and was shot down over South Carolina on February 3.

Despite claims from the Chinese government that it was a weather balloon that veered off course, Secretary of State Anthony Blinken recently stated that the balloon was “clearly an attempt to surveil very sensitive military sites.” Since February 3, three additional unidentified objects have been spotted — and shot down — over Alaska and Lake Huron.

So, what does any of this have to do with logistics?

Well, according to some of the top retail trade associations, it’s a sign that it’s time for firms to start diversifying their supply chains and reducing their dependence on Chinese manufacturing.

“The ongoing tensions with the U.S.-China trade relationship continue to highlight the need for supply chain diversification,” said Jon Gold, vice president of supply chain and customs policy of the National Retail Federation, in a statement to CNBC. “From the tariffs to COVID-19 to additional challenges, retailers are looking for opportunities to diversify their sourcing to ensure they have resilient supply chains to meet consumer needs.”

As Gold notes, supply chain diversification and reshoring have been growing trends since the start of the COVID-19 pandemic — research from DHL and the NYU Stern School of Business shows that a considerable number of firms have moved their manufacturing facilities from China to Vietnam, India and the Philippines. But heightened tensions between the U.S. and China could lead to an accelerated shift.

Moving operations out of China is no easy feat given how integral Chinese manufacturing has become to the global supply chain; as American Apparel and Footwear Association CEO Steve Lamar notes, “selling into the Chinese market requires a certain amount of local presence.” With that said, major companies such as Apple have started to take their business elsewhere, weakening China’s hold. And now that the U.S. government is considering reprisal for Chinese surveillance, now may be the time for firms to expand their options.

Thank you for joining us for the very first Monthly Shipment of the new year; we can’t wait to see what else is in store for the logistics industry in 2023. As always, we encourage you to visit our blog or resource center for additional insights, or contact us directly to find out what the experts at Legacy can do for you.

Signing off — we’ll see you next month.

-

Tariff Update: Where things are heading next

The buzz around tariffs has settled down over the last few weeks. Progress is being made in many areas, so the purpose of today’s post is...

+ Read more -

Successful 3PL-Customer Relationship – 6 Cornerstones

Hiring a third-party logistics (3PL) provider is a strategic approach for businesses to increase their capacity without expanding their...

+ Read more -

Canadian Rail Strike? – What We Know So Far

On May 1st, CN (Canadian National Railway) and CPKC (Canadian Pacific Kansas City) rail workers voted overwhelmingly to authorize a strike...

+ Read more