Making Sense of Retail Logistics: Challenges, Trends & More

In our vast, yet tightly interconnected world, consumers are able to purchase products from halfway across the globe and have them on their doorstep within the matter of days. The global supply chain is the engine that makes this all possible and — for companies in the retail sector — retail logistics is the key to effectively managing the flow of goods from suppliers to consumers.

In this blog post, we’ll cover all things retail logistics: what it is, how it works, challenges, opportunities and more.

Table of Contents

- What is Retail Logistics?

- Common Retail Logistics Challenges Businesses Face [& How to Solve Them]

- 9 Retail Logistics Trends for 2022

- Trust Legacy for All Your Retail Logistics Needs

What is Retail Logistics?

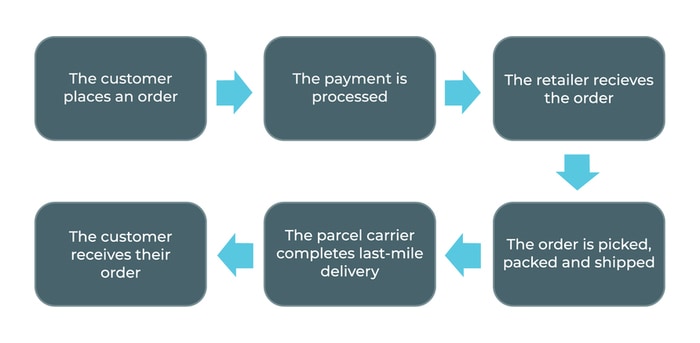

Simply put, retail logistics refers to all of the strategy, functions and processes needed to move merchandise from Point A (the source of supply) to Point B (the end consumer). Retail logistics can be divided into two halves, or categories: inbound logistics and outbound logistics.

Inbound logistics describes the process by which retailers source materials or finished goods and move them from the supplier to an internal destination, such as a warehouse, fulfillment center, manufacturing facility or retail store, in order to add them to inventory.

Outbound logistics, by comparison, describes the process by which retailers move product from an internal location — again, a warehouse, fulfillment center, manufacturing facility or retail store — to the end consumer. In a sense, outbound logistics picks up where inbound logistics leaves off.

When taken at face value, retail logistics may seem fairly straightforward; however, each component of the larger process requires careful consideration and meticulous planning.

For example, with retail warehousing, it isn’t enough for companies to indiscriminately place materials they’ve received on shelves. Retail logistics is a fast-paced process, and warehouses are typically high-traffic environments, so warehouses should be arranged in a way that facilitates logical inventory flow. Similarly, stock-keeping units (SKUs) must be strategically organized to enhance productivity and efficiency, with popular items easily accessible to warehouse workers.

Each of these elements must be reevaluated on a regular basis in order to assess their efficacy. This is why many retailers choose to invest in a warehouse management system (WMS) or to partner with a third-party logistics (3PL) provider with WMS capabilities in order to gain real-time visibility into inventory management and automate various warehouse workflows.

As you can see, there’s a great deal of complexity to warehousing — and that’s just one aspect of retail logistics. Further complicating things is the fact that most companies typically operate across multiple channels, not just in terms of how they sell their products, but also in how they run logistics.

For example, a retailer might manufacture certain products and, therefore, source raw materials for manufacturing from one supplier and finished goods from another. Or a company might use a combination of multiple different retail fulfillment models, choosing to fulfill certain orders in-house or from their own retail storefront, and others through a drop-shipper and/or 3PL partner. Or certain items need to be shipped to brick-and-mortar retail locations for final sale, while others are sent directly to the consumer — the list goes on.

Let’s explore some other challenges inherent to retail logistics.

Common Retail Logistics Challenges Businesses Face [& How to Solve Them]

We’ve already discussed a few obstacles to retail logistics — let’s look at some others, and potential ways to overcome them:

Rising Consumer Expectations: The modern consumer has become accustomed to certain conveniences, especially when it comes to shipping, and it directly impacts their purchasing decisions. According to data from ShipStation, 97% of consumers cite shipping cost as a priority when making purchasing decisions, while 92% cite shipping speed as a priority. Additional research confirms this. A study from the National Retail Federation (NRF) shows that 75% of consumers expect delivery to be free; however, 77% of consumers also say that they’re willing to pay more for next-day or same-day delivery.

We have Amazon to thank for this dramatic increase in expectation. The eCommerce giant first introduced two-day shipping over 15 years ago, and it quickly became an industry standard. Since then, Amazon has winnowed down its delivery window, forcing all other retailers to follow suit. If next-day and same-day delivery seem like high hurdles to clear, it’s because they are: In 2018 alone, Amazon spent $34 billion on retail fulfillment and $27.7 billion on shipping costs.

Few retailers can afford to spend that much on expedited shipping and, as a result, may not be able to promise same-day or next-day delivery — but the truth is, they might not need to. Reducing your delivery window by even a day can have a marked improvement on customer satisfaction; this can be achieved by making changes to your retail logistics procedure. Adopting lean practices within your warehouse, automating components of the fulfillment process, establishing pop-up warehousing and fulfillment centers close to your customer base and outsourcing components of fulfillment are all savvy ways to speed shipping while lowering costs.

In situations where expedited delivery isn’t an option, retailers can earn a lot of good will with customers by being upfront about when they can expect their orders to arrive and offering real-time order tracking. It’s also important to note that fast and free delivery isn’t the only way to satisfy consumers’ demands for convenience: Giving customers the option to buy online and either pick up curbside or in store and making the returns process simple and painless are also great ways to exceed expectations.

Lack of Inventory Visibility and Metrics: A lack of inventory visibility — both in terms of total number of SKUs and where inventory is located — can impede even the most robust retail fulfillment strategy. Fortunately, there are two fairly straightforward solutions to this retail logistics challenge.

First, it’s important that businesses monitor inventory metrics. From Inventory Carrying Costs and Perfect Order Percentage to Percentage of Orders Filled from Ideal Inventory Location to Inventory Turnover Rate, there are any number of metrics you can use to gain visibility into your inventory. Make sure that any metrics or key performance indicators (KPIs) you monitor align with your company’s customer, financial and strategic objectives in order to use your time efficiently and see the greatest ROI.

Second, develop an efficient retail fulfillment process using a WMS. WMS technology offers numerous benefits, including optimized workflow and process design, purchase order system integration and PO-, lot number-, serial number- and SKU-level tracking — it can even support inventory metrics through KPI development and custom reporting.

Retailers that achieve inventory visibility can use it as an accurate forecast of future demand and plan their supply chain activities accordingly, enabling them to create seamless omni-channel experiences for their customers.

Supply Chain Complexity and Disruption: As far as supply chains are concerned, with globalization comes complexity. Although expanding retail logistics operations to a global scale has enabled many companies to reduce costs, diversify product offerings, boost production efficiency and more, it’s also introduced more risk in the form of supply chain disruption.

According to data from McKinsey, “companies can now expect supply chain disruptions lasting a month or longer to occur every 3.7 years, and the most severe events take a major financial toll.” These disruptions can take many forms, from natural disasters to geopolitical tensions — even, as we’ve seen, global pandemics.

“Companies can now expect supply chain disruptions lasting a month or longer to occur every 3.7 years.”

-McKinsey

Though there is no simple solution to supply chain disruption, retailers can do themselves a favor by expanding their network even further. Though that might sound counterintuitive, given that intricate production networks contribute to complexity, they also build flexibility into the supply chain. For example, if a retailer were to source materials from China, India and Vietnam, and its Vietnamese supplier were to suddenly halt production for any reason, that retailer would still have two other viable sourcing options.

In the aftermath of the COVID-19 pandemic, we’ve seen a marked shift as retailers work to diversify their sourcing, with many embracing near-sourcing efforts. We’ve also seen a growing number of companies rededicate their focus to developing contingency plans in order to prevent future disruption. For insights into how to build a robust retail logistics contingency plan, check out our in-depth article on the subject.

High Costs: For many companies, the cost of retail logistics is baked directly into the price of their products. However, with major competitors offering items for sale at increasingly low prices, many retailers are under pressure to do the same, all without sacrificing any order fulfillment efficiency. Needless to say, it’s a real catch-22.

- Consolidate loads with light shippers to shift from less-than-truckload shipments to full-truckload shipments and enhance freight utilization

- Procure products from suppliers stationed closer to your primary customer base

- Establish fulfillment centers closer to your primary customer base

- Automate warehousing and logistics processes, such as data collection, picking and packing, inventory tracking and more

- Develop a stringent procedure for warehouse inventory organization and management

- Partner with a retail 3PL provider for warehousing, transportation, technology, inventory management and more

Labor Shortages: Labor shortages — especially those in the transportation sector — pose a real threat to retail logistics. After all, even if the demand is there, it doesn’t mean much if retailers are unable to get their hands on the supplies they need or get their products to end consumers.

Though the supply chain-wide labor shortage is certainly nothing new, the ongoing COVID-19 pandemic has exacerbated the situation, significantly reducing the available labor pool.

The labor shortage is also reaching an inflection point as Baby Boomers and even members of Gen X begin to retire, creating a vacuum in the workforce. According to a report published by the Association for Supply Chain Management, Millennials have stepped up to fill that gap, “growing and learning on the job in an era of lean, optimized, end to end supply chains” and demonstrating a unique talent for “leveraging technology and data to enhance efficiency.

However, the question remains whether this influx of Millennial talent — and Gen Z behind them — is enough to accommodate the needs of the supply chain industry. Per the report:

“…the demand for talent continues to outpace supply, while the increasingly complex nature of global supply chains requires a multitalented leader who possesses a vast swath of skills. It is tremendously challenging for a classroom to convey the knowledge an individual needs to thrive in an increasingly challenging setting.”

Based on this assessment, it appears as though the primary cause for the ongoing labor shortage is not disinterest or ineptitude from younger generations, but rather difficulty passing on critical skills. One way retailers can offset this — and, in the process, attract new talent — is by investing in continued education and employee development. From earning technical certifications to having new employees shadow experienced subject matter experts, companies can help bring younger workers up to speed on rigorous retail logistics requirements.

To cement these learnings, retailers can also develop employee incentive programs that reward new hires for demonstrating skills on the job. Such a program can be an attractive offer to candidates, bringing in more applications.

For companies that don’t have the resources or capacity to invest in ongoing education or incentive programs, partnering with a retail 3PL provider can be an excellent alternative. 3PLs offer a ready-made workforce to fill in any gaps in your existing team. They also have the means to invest in job skills development for their workers and typically hold multiple certifications demonstrating their capabilities, making them a smart addition to your retail logistics operation.

9 Retail Logistics Trends for 2022

We’ve covered some of the challenges inherent to retail logistics — now let’s talk about opportunities.

Global retail sales are projected to reach $26.7 trillion by 2022, a 6.6% increase from 2021. As has been the case throughout the COVID-19 pandemic — and even in the years preceding it — much of this sales volume can be attributed to eCommerce channels. We can expect a high volume of eCommerce sales to remain a fixture, as a growing number of businesses adopt an omni-channel retail logistics model, and new pure-play retailers enter the market.

Although eCommerce continues to grow at a rapid pace, it currently represents only 13.6% of U.S. retail sales (though it is projected to account for 26% by 2025). While eCommerce growth is certainly one major retail logistics trend for 2022, there are plenty more to discover. Let’s take a look:

- Earlier Peak Seasons: Christmas came early in 2020, with the NRF reporting that 42% of holiday shoppers started earlier than they normally would. Earlier peak seasons have been a consistent trend over the past decade, one that will continue to gain momentum in 2022 and beyond as digital shopping channels become more accessible to consumers. As peak season’s start date continues to creep up over the years, businesses will have to adapt their retail logistics strategies accordingly.

42% of holiday shoppers reported that they started their holiday shopping early in 2020.

Demand for Omni-channel Retail Experiences: The modern customer journey spans numerous touchpoints across multiple channels, both digital and physical. Retailers must adopt an omni-channel approach to retail logistics — for example, enabling shoppers to buy online and return in-store, or vice versa — in order to deliver a seamless experience as customers move from one channel to the next.

Embedded Integration Technology: From using radio-frequency identification tags to track the movement of shipments in real time to embedding Internet of Things-enabled sensors in packages to monitor their temperature and humidity, retailers are finding inventive ways to enhance the visibility and traceability of retail fulfillment.

7 Last Mile Delivery Trends You Won’t Want to Miss >>

Big Data Analytics: Given the vast wealth of data constantly being generated and circulated, businesses are in a prime position to leverage analytics engines to derive valuable insights from raw data. From examining warehouse performance to identify bottlenecks and forecasting future sales demand to analyzing traffic patterns for route optimization and conducting sentiment analysis on news reports to anticipate possible geopolitical conflicts, there are infinite opportunities to use Big Data analytics to enhance retail logistics strategy.

Collaborative Robots: Though human workers remain essential to retail logistics operations, companies have a real opportunity to boost retail warehousing and order fulfillment efficiency by investing in collaborative robots. As their name implies, these robots work alongside employees, organizing inventory, packaging orders and more. Collaborative robots are especially useful during peak season, as they can fill in gaps in a retailer’s workforce without the need to hire and onboard seasonal staff. Best of all, there are more options now than ever before to rent collaborative robots, making it easy for retailers to scale operations up or down as needed.

Autonomous Vehicles: Much like collaborative robots, recent advancements in self-driving automotive technology have the potential to help retailers supplement their existing workforce and offset labor shortage concerns. Although it’s still early days yet, some of the world’s largest retailers have already expressed interest in leveraging autonomous vehicles for last-mile delivery, with Walmart announcing a self-driving delivery pilot program and Amazon filing a patent for delivery robots.

Sustainability: “Sustainability” has become a buzzword in multiple industries as consumers become more aware of how their actions impact the world around them and make more conscious choices as a result. For retailers, sustainability takes more than just offering eco-friendly products and packaging (though that’s certainly a good place to start). It also requires the adoption of ethical and renewable practices at an operational level and collaborating with retail logistics partners who demonstrate a similar commitment to sustainability.

Supply Chain as a Service: As noted earlier in this article, supply chain networks are larger and more complex than ever before. Where once companies handled the entire retail logistics process in-house, they’re now more likely to partner with multiple different providers to outsource different components of the retail logistics process, including procurement, manufacturing, retail warehousing, retail fulfillment and more.

This business model, often referred to as Supply Chain as a Service (SCaaS), has become increasingly popular over the last decade or so due to the fact that it enables retailers to:

- Build flexibility into their supply chain

- Tap into a larger (and often more experienced) talent pool

- Scale operations up or down as needed

- Access the latest-and-greatest supply chain technologies

- Reduce operational overhead

- Gain a competitive advantage across different markets

“Once considered a novelty, blockchain is well on its way to becoming an essential retail logistics technology. Blockchain — a type of database that stores data in blocks that are chained together — is a central component of Bitcoin and other cryptocurrencies and has gained popularity for its decentralized, distributed and public nature. Blockchain can support a wide variety of retail logistics operations, including providing supply chain transparency, ensuring online payments security, verifying product authenticity, streamlining transactions between partners using smart contracts and more.

Trust Legacy for All Your Retail Logistics Needs

The global supply chain is evolving at a breakneck pace and, with it, how retailers handle logistics. From rising consumer expectations to the latest technological trends, there’s a lot that retailers need to stay on top of in order to maintain a competitive advantage, which is why it’s smart to partner with a full-service 3PL provider.

For nearly 40 years, Legacy Supply Chain has provided comprehensive services, including warehousing, distribution, fulfillment and transportation, for major retailers across North America. Our hard-earned expertise, vast network and state-of-the-art software solutions make us uniquely equipped to support retail logistics, so you can focus on adapting to the latest trends and building a truly dynamic supply chain.

Contact us today to find out what Legacy can do for you.

-

Legacy Achieves Platinum Status for Delivery Excellence From Amazon

When it comes to supply chain performance, the margin for error is razor thin. Customers expect orders to arrive quickly, accurately, and...

+ Read more -

IPS Corporation selects Legacy as 3PL Partner to drive Supply Chain Transformation

FRANKLIN, IN | September 10th, 2025 – Legacy SCS announced that it has been selected by IPS Corporation, a global leader in Water...

+ Read more -

How GForce Transformed Its Supply Chain Into a Powerful Growth Engine

When GForce Arms launched in 2020, the mission was simple but ambitious: deliver affordable, reliable firearms with the speed and...

+ Read more