Issue 19: Logistics Manager’s Index Celebrates 5-Year Anniversary

A Word from LEGACY

Hello, friends, and welcome once again to the Legacy Monthly Shipment, where logistics industry insiders gather to discuss the latest news and trends.

Persistent supply chain challenges mean holiday shopping season is beginning earlier than ever before, presenting shippers and carriers alike with new issues to contend with. Let’s look at the current state of logistics and early predictions for the rest of peak season in this month’s Market Update.

Market Update

Logistics Manager’s Index Celebrates 5-Year Anniversary

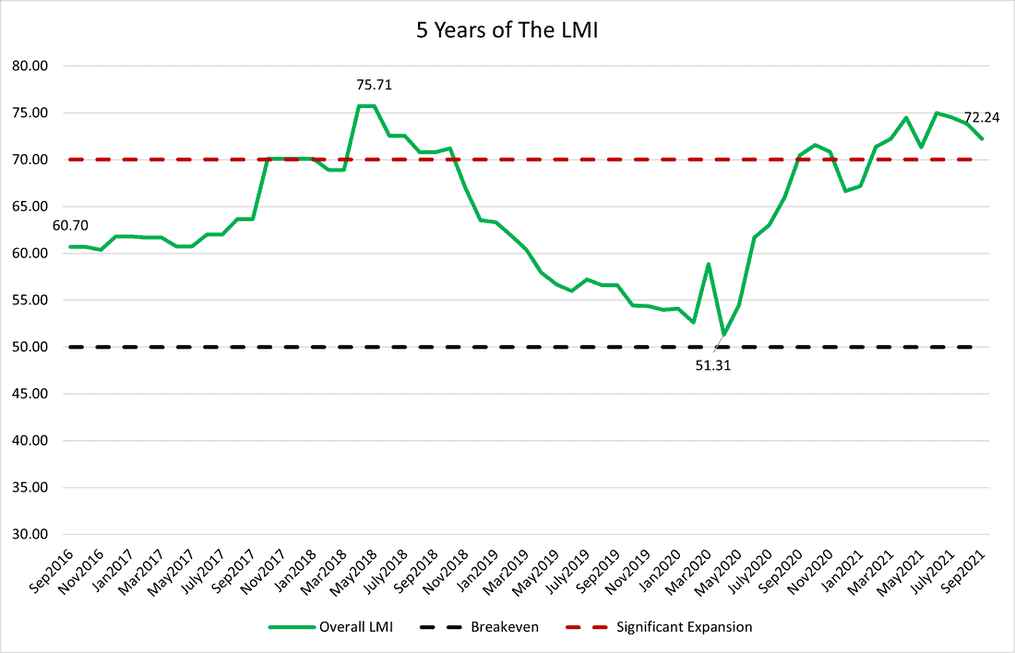

The September 2021 Logistics Manager’s Index (LMI) is finally here, officially marking the index’s five-year anniversary. In honor of the occasion, researchers included a five-year overview of LMI readings in this month’s report and highlighted key moments in the LMI’s history, including its first peak following the Trump tax cut of 2018, its lowest point at the outset of the COVID-19 pandemic and its recent boom period. As noted in the report, LMI readings have consistently remained high from April 2021 to present — the longest peak period in the history of the index — and are unlikely to drop off any time soon.

As for September 2021, the LMI was down 1.6 points from the prior month with a reading of 72.2. According to the official report:

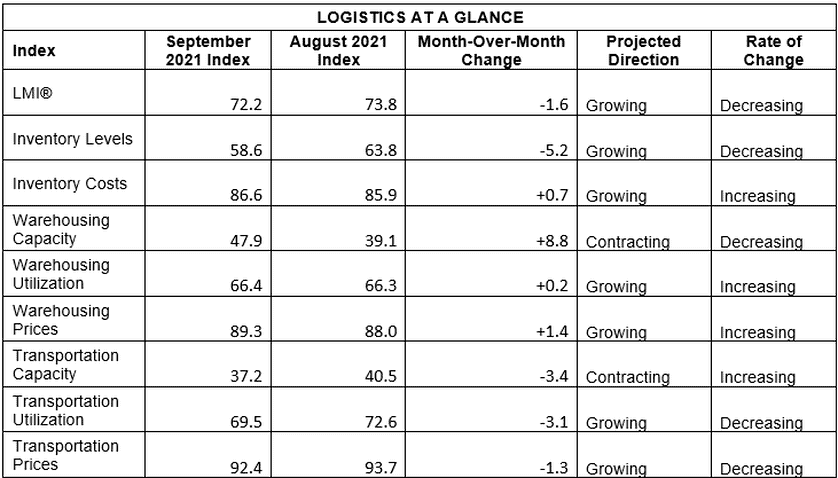

Growth is increasing at a decreasing rate for inventory levels, transportation capacity and transportation prices:

- Growth is increasing at an increasing rate for inventory costs, warehousing utilization, and warehousing prices; and

- Warehousing and transportation capacity are contracting.

Transportation Capacity was markedly low in this month’s report, at a reading of just 37.2 — down 3.4 points from August. LMI researchers largely attribute this number to port congestion, particularly in Southern California, which saw a record-breaking number of ships at anchor or drifting in San Pedro Bay during the month of September. This congestion has had serious downstream effects, including rising drayage fees, imbalances in trailer positioning for ground carriers and a high volume of dead head loads, all of which have contributed to the Transportation Price index’s 92.4 reading.

It’s a similar story for warehousing and storage. Warehousing Capacity remained low for the 13th month in a row with a reading of 47.9, while Warehousing Utilization and Warehouse Prices increased at respective readings of 66.4 and an all-time high of 89.3. With retailers scrambling to find storage, Inventory Levels have dropped 5.2 points, from 63.8 to 58.6. Based on this reading — as well as high consumer demand and slow replenishment times — LMI researchers anticipate that “Q4 supply chain issues look likely to impact goods across the spectrum, including Christmas Trees, gas in the U.K., and Nike sneakers.”

To see a full reading of the LMI, including scores across individual indices, please refer to the chart below.

Also in Today’s Shipment:

- Industry experts anticipate a permanent peak season in ocean freight market.

- The FMC announces two new initiatives concerning detention and demurrage.

- Vietnam factory shutdowns have brands telling consumers to start their holiday shopping early.

- Failure to reauthorize FAST Act elicits concern from industry insiders.

- Gene Seroka takes to the mic to reveal Port of LA’s congestion-fighting plan.

In the News

Supply Chain Woes Expected to Persist Well Into 2023

The sky-high rates and above average port congestion that have plagued the ocean freight market for the better part of two years are unlikely to go away any time soon. Though the effects of these supply chain woes have been felt far and wide, they were largely importers’ and exporters’ problem to deal with — that is, until they began to have a serious impact on inflation. Now, central bankers have started to take notice of the situation , with Federal Reserve Chairman Jerome Powell even stating that, “It is frustrating to see the bottlenecks and supply chain problems not getting better. In fact … [they are] apparently getting worse.”

To say that the situation is unprecedented would be an understatement. Early predictions about the state of the market as we head into 2021 have been repeatedly revised — as is the case with Maersk, which has updated its guidance three times this year — or discarded entirely. With new COVID-19 outbreaks being reported on an almost daily basis, it’s anyone’s guess when we’ll be free and clear of the market conditions that have sent importers and exporters into a spiral.

Rather than hope for the best, some industry insiders have chosen to simply face the facts. “I would say that shippers that don’t have enough inventory are going to sell out prior to Christmas because of all the delays,” said Nerijus Poskus, VP of global ocean freight at Flexport, adding “I think this chaos will last well into 2022. [Shippers] should expect that the whole of 2022 may be another peak season.”

Further complicating things are impending labor contract negotiations, longshore contract negotiations and 2022 annual contract negotiations. Assuming the industry’s forecast is correct and that supply chain woes will persist into 2023, all three will fall within the timeline and could contribute to further congestion and even higher rates.

At this point, the market’s best chances for stabilizing are if transport demand declines or transport supply grows to exceed shipping demand — both a bit of a long shot, given the circumstances. “I don’t see this ever returning to any semblance of normalcy again,” said Port of Los Angeles Executive Director Gene Seroka, noting that shippers and carriers alike will just have to adapt to the new normal. “We’ve got to learn to pivot, to scale up and down depending on seasonality and the flow of cargo. The learnings we take away from this episode will make us more resilient.”

Two New Initiatives Arise from FMC’s Ongoing Fact-Finding Investigation

Two New Initiatives Arise from FMC’s Ongoing Fact-Finding Investigation

This past summer, the Federal Maritime Commission (FMC) made public the preliminary findings of its Fact Finding No. 29 investigation, which examined international ocean transportation supply chain engagement. According to the FMC’s executive summary , Commissioner and Fact Finding Officer Rebecca Dye had reason to suspect that:

“…vessel-operating common carriers in alliances who call on the Port of New York and New Jersey or who call on the Port of Long Beach and the Port of Los Angeles may be employing practices and regulations that violate 46 U.S.C. § 41102(c).”

Commissioner Dye’s early findings prompted a Supplemental Order and, as of September 15, 2021, the unveiling of two new detention-and-demurrage-related initiatives. Per an official FMC press release, the first of these initiatives entails releasing a policy statement on “issues that affect the ability of shippers, truckers, and others to obtain reparations for conduct that violates the Shipping Act,” including detention and demurrage. This policy statement is intended to reinforce protections for shippers against carrier retaliation, as well as provide guidance on who is permitted to file a complaint with the FMC.

The second initiative will issue an Advance Notice of Proposed Rulemaking (ANPRM) — that is, a request for public comment on:

1. Whether the FMC should require ocean carriers to provide certain information about detention and demurrage billings; and

2. Whether the FMC should require ocean carriers to adhere to detention and demurrage best practices regarding timing.

These initiatives are just the latest outcomes of the Fact Finding 29 investigation; since its launch in 2020, the FMC has made at least six other announcements, including an official audit of the top nine ocean carriers and the solicitation of information on congestion surcharges from CMA CGM, Hapag-Lloyd, HMM, Matson, MSC, OOCL, SM Line and ZIM. This story is ongoing, so stay tuned for future updates.

COVID-19 Outbreaks in Vietnam Cause Holiday Season Complications

COVID-19 Outbreaks in Vietnam Cause Holiday Season Complications

The early days of the COVID-19 pandemic saw a major push from shippers to withdraw production out of China following a series of shutdowns and instead diversify their supply chains. Vietnam — already a popular manufacturing hub — saw increased interest during this time, which helped make it the top-performing Asian economy in 2020. All seemed well in Vietnam, which had proven extremely successful at curbing the spread of COVID-19 — that is, until the emergence of the delta variant.

As of April 2021, the number of domestic infections and deaths due to COVID-19 in Vietnam have skyrocketed, with containment efforts largely rendered ineffectual due to a combination of the delta variant’s unpredictable transmission pattern and the country’s slow vaccine rollout. The surge in case counts has prompted lockdown restrictions in Ho Chi Minh City, the nation’s largest city and the epicenter of Vietnamese manufacturing.

Vietnamese factory shutdowns have placed major retailers such as Nike — which makes 51% of its shoes in the country and has reportedly incurred 10 weeks of lost production — between the rock of inventory shortages and the hard place of fulfilling strong consumer demand. According to Nike’s Q1 earnings call, it now takes the company 80 days to move product from Southeast Asia to North America, compared to just 40 days pre-pandemic.

And Nike’s far from alone: Supply chain complications stemming from Vietnamese shutdowns are expected to have a serious impact on the holiday season for brands such as Adidas, PacSun, Ugg, Michael Kors, Hasbro and Columbia Sportswear. In light of these complications, many brands have decided to forego holiday discounts and have advised consumers to start their holiday shopping as soon as possible, anticipating shipping delays of up to four weeks.

The FAST Act Expires, What it Means

The FAST Act Expires, What it Means

As reported in last month’s Shipment, the fate of the Fixing America’s Surface Transportation Act (FAST Act) hung in the balance as negotiations around the Infrastructure Investment and Jobs Act stalled out. Well, the September 30 deadline has come and gone without any talks of reauthorization, meaning the FAST Act is no more — and not without consequence. The expiration of the FAST Act resulted in the furlough of some 3,700 Department of Transportation employees, prompting the Biden administration to extend transportation funding programs for a month.

With little real progress made concerning the infrastructure package — which includes a five-year surface transportation reauthorization bill — industry experts have expressed concern that lawmakers will continue to repeatedly pass extensions that act as short-term solutions rather than address underlying issues.

Jim Tymon, executive director of the American Association of State Highway and Transportation Officials (AASHTO), called the expiration of the FAST Act “unacceptable,” and said in an official statement that:

“While AASHTO appreciates addressing the lapse in federal highway, transit and highway safety programs caused by the failure to pass the bipartisan Infrastructure Investment and Jobs Act, short-term extensions are not a suitable way to govern. This particular extension doesn’t include any new funding for state departments of transportation until October 15, leaving them without support from their federal partners for weeks while they continue the work of moving people and goods through our communities.”

Port of LA Unveils New Plan to Combat Congestion

In a recent interview with Greg Miller for American Shipper, Gene Seroka, executive director for the Port of Los Angeles, shared the port’s new plan for battling continued congestion. Central to that plan? Increased data sharing, squeezing additional productivity out of available capacity, the addition of 1,000 longshore members and an aggressive training plan, to name a few key points.

Readers can hear Seroka’s statements in full by watching the video below.

That’s all for this month’s Shipment; we hope to see you again in November. In the meantime, why not check out our blog or resource center for even more tips, trends and insights? And don’t forget to let us know what stories you’d like to see covered in the next Shipment.

Until then, this is the Legacy team, signing off.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more -

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more