Recent International Cargo Shipping Rate Increases a Cause for Concern: Why You Should Be Using a 3PL Provider

Cargo Shipping Rate Increases Between Asia and the U.S. Leave Shippers with Few Alternatives

News of cargo rate increases comes as supply chain disruption continues on the U.S. West Coast. Shippers are avoiding the West Coast ports, both due to these port labor issues, and the fact that June–October is the peak season for these ports even without a labor dispute. This is pushing demand for capacity on vessels even higher than it would normally be, and is causing shippers to seek alternative ports wherever possible.

Although the West Coast labor disputes are a large contributor to the shuffling of ports, it is not the only region facing challenges. The U.S. East Coast is seeing heavy congestion and delays as contract negotiations remain unsettled between the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA). As shippers seek options to move cargo as peak season ramps up, alternate ports across the supply chain become stressed to a point where they become backlogged as well.

But the skyrocketing international shipping rate increases are the biggest cause for concern under current conditions.

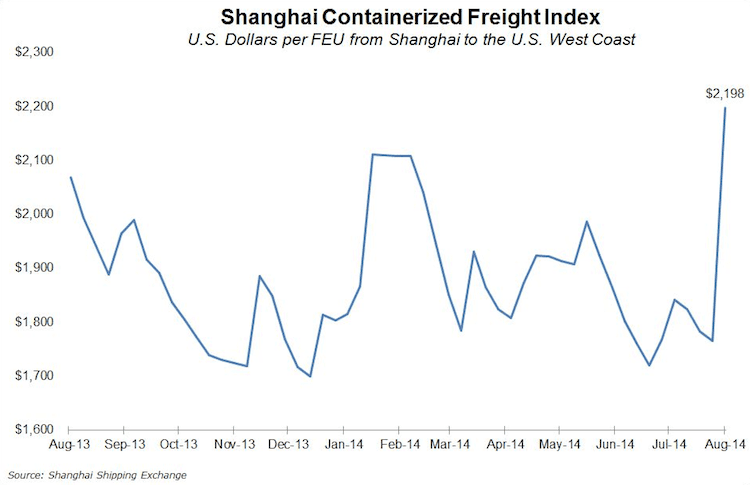

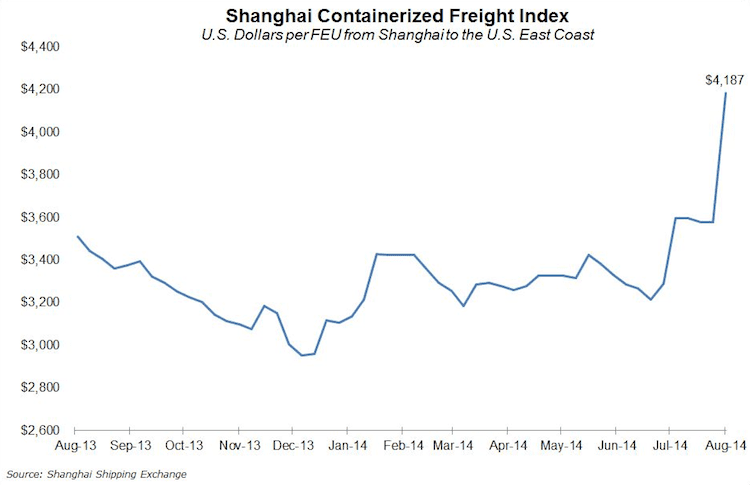

Shipping rates are increasing steadily on inbound freight to the U.S. With the July Peak Season Surcharge (PSS) still in place, there was an additional General Rate Increase (GRI) on August 1 of $600 for U.S. East Coast Ports, and upwards of $400 to U.S. West Coast Ports. September 1 is expected to bring with it yet another significant GRI of approximately $600 to all U.S. ports.

The 2 charts below illustrate the dramatic increase on inbound ocean transportation rates. The chart and statistics are taken from this recent JOC article.

Image from JOC.com

Image from JOC.com

What do these rates mean for beneficial cargo owners (BCOs) and Non-Vessel Operating Carriers (NVOCCs)?

For BCOs and NVOCCs, these supply disruptions have bigger implications than just cost. Peak season demand and labor issues have given steamship carriers the leverage to keep container prices at these high levels- but also given them the ability to control capacity. Carriers are able to be selective and only take bookings on their vessels for those shippers willing to pay premium market prices. As a result, shippers – even those with direct contracts – are seeing their bookings get bumped and thus delayed at port in Asia.

Rates will likely continue to maintain at current high levels for at least the next 6-8 weeks — unless shippers start collectively pulling bookings due to these extreme high prices. However, the likelihood of this happening is very low, and such a move would take many weeks to take effect.

How can a third-party logistics provider (3PL) help?

3PLs add value in these times of disruption by monitoring the market as it changes each day. In these extreme situations, the flexibility a 3PL partner normally offers is mitigated to some degree. However, a good 3PL partner will be able to consult, and advise of creative solutions to keep cargo moving through the supply chain.

At LEGACY Supply Chain Services, we have an experienced team of logistics experts.

“We make it a high priority to keep our customers informed of upcoming supply chain disruptions and potential rate increases,” says LEGACY’s VP Global Transportation Services Russ Romine. “We keep in close contact with our overseas partners, as well as origin and destination ports to quickly identify trends and recommend alternative options for our clients if necessary.”

Check out Legacy’s VP of Transportation discuss shipping dilemmas>>>

Contact us to learn how LEGACY’s global supply chain network can add value to your supply chain as your dedicated logistics provider.

Get Insights. Stay Ahead.

Get the latest news and insights via email on warehouse improvement, transportation optimization, labor strikes and international shipping rate changes.Popular Posts

Search Posts

-

2024 Q1 Freight Landscape: Trends, Challenges, and Predictions

As the first quarter of 2024 comes to an end, here are some observations over the past few months as well as predictions about the trucking...

+ Read more -

Baltimore Bridge Impact Assessment – Update

Following the recent Baltimore Bridge collapse and subsequent port closures, we want to keep our customers informed about the situation and...

+ Read more -

Global Momentum Builds for Charge on Global Shipping Sector’s CO2 Emissions

A growing coalition of 47 countries, including key players like the European Union, Canada, Japan, and various Pacific Island nations, is...

+ Read more